KUALA LUMPUR (Sept 21): FGV Holdings Bhd’s (FGV) largest shareholder, the Federal Land Development Authority (Felda), said it is counting on FGV to perform a thorough turnaround as soon as possible to improve both their financial standings.

Tan Sri Megat Zaharuddin Megat Mohd Nor, who has recently been appointed the agency’s new chairman, said Felda’s cash flow is so low now as to be “almost empty” and this urgently needs to be addressed.

He said Felda, which has a 33.7% stake in loss-making FGV, depends on the latter’s plantation segment as its main revenue source.

FGV is required to pay RM250 million annually to Felda for 20 years as part of a land lease agreement, together with 15% of operating profit from the sale of fresh fruit bunches (FFBs) harvested from the leased land. This, together with dividends, adds up to about a RM400 million annual contribution, he said.

“It should be higher. However, we know this will depend on the company’s productivity, as well as palm oil price and FFB yield. It is currently lower than the national average. So we need to ask them why.

“I had a look at their five-year turnaround plans and I told them it could be improved. FGV should prioritise their immediate issues,” Megat Zaharuddin said at his first media briefing yesterday since his appointment on July 27.

Nevertheless, he is optimistic about FGV reversing its fortunes, as the listed subsidiary has appointed a dedicated “turnaround manager” to lead the initiative.

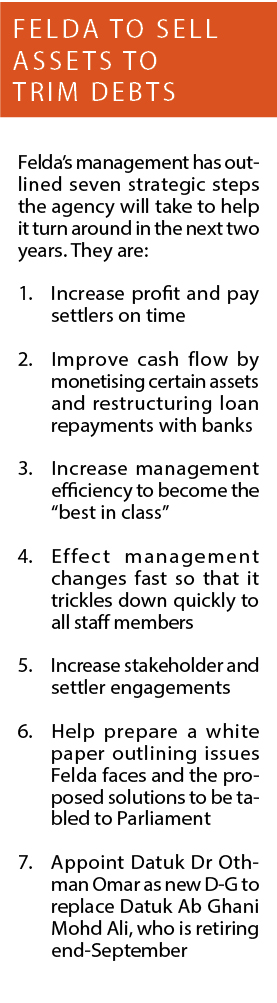

As for Felda, Megat Zaharuddin said the aim is to lower debt by some 19% to RM6.5 billion by year end, from RM8.03 billion as at June 30, 2018.

The agency plans to do this by restructuring its finances, which mainly involves mitigating loans by paying down the principal as well as asset monetisation through the disposal of properties and equities it owns.

The assets it intends to sell comprise hotels, hostels and apartments in London, Kuching and Kota Kinabalu that were bought at a cumulative price of RM2.2 billion, Megat Zaharuddin said.

“Some of those assets are not realising the value they were bought at. So we have to be careful to adopt the right kind of strategies and tactics to realise the highest value possible from those assets. This process of trying to improve the short-term cash flow through asset disposal as well as the right kind of borrowings will tide us over,” he said.

On its loans, Megat Zaharuddin said the agency has sought to restructure them with the banks. “By doing this, we hope to improve the short-term cash flow and hopefully turn Felda around in a minimum of two years,” he said, adding that previously due to low cash flow, Felda was not able to pay what should have been paid to settlers.

“Felda has taken a lot of loans from banks and it could not service the interest. The poor cash flow was also affected by slow to nil repayment of loans by Felda settlers that amounted to several hundreds of millions of ringgit. The government told Felda previously not to press settlers to pay back. So we had to review our financial position. I have conducted a few turnaround plans in my time, but I have to tell you this one is big. So you need to give us time,” he said.

Another factor which contributed to the cash flow problem was low palm oil prices, which resulted in lower revenue. As such, Felda will also be looking at improving its crop yield for the long term, he added.

He noted that though Felda’s productivity of 20 tonnes per hectare a year is higher than the national average of 18 tonnes per hectare, it is not the “best in class” compared with other companies which have reached 24 tonnes per hectare a year.

“Our challenge now is how to work with the settlers so that we can reach this Olympic target. If we can increase it by even one tonne a year, that are a lot of FFBs to yield and extra revenue for Felda. Those are the means by which we want to improve our overall cash flow,” he said. Felda has over 100,000 settlers.

Taking all the plans for the turnaround into account, Megat Zaharuddin said Felda will help prepare a white paper for the government based on the format given to the agency to have a complete picture of Felda’s current situation.

“We are following the template given by the government. They want us to include the problems that contributed to the poor financial situation in Felda. It could be poor planning, poor governance and execution, or malpractices. So we have to dig into things to uncover every aspect of what could possibly be the truth,” he said.

The white paper is expected to be tabled in Parliament in October.

Meanwhile, Megat Zaharuddin said Felda’s current director-general Datuk Ab Ghani Mohd Ali will be retiring in nine days after serving the agency for 37 years. He will be replaced by ex-Selangor State Development Authority chief executive officer Datuk Dr Othman Omar, from Oct 1.

FGV’s share price settled three sen or 1.94% lower yesterday to RM1.52, with a market capitalisation of RM5.55 billion. Last month, the company posted a net loss of RM21.9 million in the first six months of its financial year ending Dec 31, 2018, versus a net profit of RM38.96 million a year ago, as revenue fell 18% to RM3.44 billion from RM4.21 billion.

This article first appeared in The Edge Financial Daily, on Sept 21, 2018.

TOP PICKS BY EDGEPROP

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Jalan Taman Bukit Kinrara 1/8

Bandar Kinrara Puchong, Selangor

Savanna Executive Suites @ Southville City

Bangi, Selangor