Construction sector

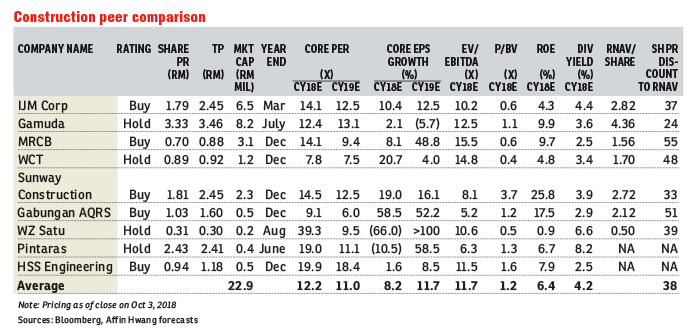

Maintain neutral: The outlook for the construction sector remains challenging as the federal government is reviewing ongoing infrastructure projects to reduce costs by 20%-33%. Projects that could be affected include the Klang Valley mass rapid transit Line 2 (MRT2) and light rail transit Line 3 (LRT3), Pan Borneo Highway (PBH) and Gemas-Johor Baru Electrified Double Tracking (EDT). There are opportunities in state government projects in Penang and Sarawak. Top “buys” are IJM Corp Bhd, Sunway Construction Group Bhd (SunCon) and HSS Engineers Bhd.

We gather that the MRT2 project could see a 25% reduction in cost to RM24 billion from an initial estimate of RM32 billion. The MMC Gamuda joint venture (JV) will be the most affected as it is the main contractor for the underground section and the project delivery partner (PDP) for the above-ground section of the MRT2. Other listed contractors that could be affected due to ongoing work on above-ground packages secured include Ahmad Zaki Resources Bhd, Gadang Holdings Bhd, George Kent (M) Bhd, IJM Corp, Malaysian Resources Corp Bhd (MRCB), MTD ACPI Engineering Bhd, Mudajaya Group Bhd, SunCon, TRC Synergy Bhd, TSR Capital Bhd and WCT Holdings Bhd. Since the cost reductions will come from the reduction in the scope of work, we believe only the contract values will be reduced while profit margins should be preserved.

We gather that the LRT3 construction cost could be slashed to RM9 billion to RM10 billion from an initial estimate of RM15 billion to RM16 billion. The MRCB-George Kent JV will be most affected as the PDP for the project. We maintain our forecasts for MRCB as we believe we were conservative in our contract value assumption at RM9 billion for the LRT3 despite the previous escalation in cost. Other contractors affected include Gabungan AQRS Bhd, IJM Corp, SunCon and WCT.

The Penang and Sarawak state governments are looking to improve road and public transport infrastructure in their respective states. The Sarawak state government plans to complete the upgrading of the Coastal Highway and trunk roads at an estimated cost of RM11 billion. Project pre-qualification bids have been called. Potential Sarawak beneficiaries are Cahya Mata Sarawak and Hock Seng Lee. The Penang Transport Master Plan is pending approval by federal government authorities to be implemented and public feedback collection is ongoing. The Pan Island Link 1 (PIL1) highway and George Town-Bayan Lepas Airport LRT is estimated to cost RM16 billion. The Gamuda-led SRS Consortium is the PDP for the project.

We reiterate our “neutral” call on the construction sector as we remain cautious on the sector due to the risk of order-book reductions with potential cost cuts for infrastructure projects. However, we believe the concerns are reflected in current share prices. Our top “buys” are IJM (large-cap), SunCon (mid-cap) and HSS (small-cap). The key upside risk is an acceleration in public infrastructure spending and the key downside risk is further cuts in spending. — Affin Hwang Capital Research, Oct 4

This article first appeared in The Edge Financial Daily, on Oct 5, 2018.

TOP PICKS BY EDGEPROP

Kawasan Perindustrian Mount Austin

Johor Bahru, Johor

Havona Residence @ Taman Mount Austin

Johor Bahru, Johor

Havona Residence @ Taman Mount Austin

Johor Bahru, Johor

Havona Residence @ Taman Mount Austin

Johor Bahru, Johor

Taman Mount Austin Commercial

Johor Bahru, Johor

Section 13 (Seksyen 13)

Petaling Jaya, Selangor

Havona Residence @ Taman Mount Austin

Johor Bahru, Johor