KUALA LUMPUR (Nov 5): Budget 2019 was a surprisingly expansionary one by most measures, but one area in which the government carefully cut back was subsidies.

Although new measures, such as an RM100 monthly pass for public rail transportation and a special allocation for basic necessities in Sabah and Sarawak were introduced, several others — including petrol and electricity subsidies — have been scaled down and made more targeted.

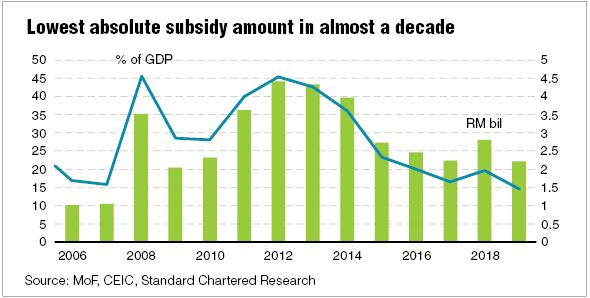

In fact, it is planning to spend a total of RM22.27 billion on subsidies and social assistance in 2019, down 20.6% from RM28.13 billion this year. Standard Chartered Global Research pointed out that this had been the lowest absolute amount of subsidies in almost a decade (see chart).

Economists viewed the rationalisation of these subsidies as not just more equitable for Malaysians but also a healthy economic move.

According to Lee Heng Guie, the executive director and economist of the Socio-Economic Research Centre (SERC), the measures underscore the government’s commitment to reform subsidies while also easing the cost of living for the bottom 40% of income earners (B40).

“The government cannot be giving everyone blanket subsidies; this (rationalisation) is fairer,” said Lee, adding that limited resources should be reserved for the most deserving.

UOB Global Economics & Markets Research senior economist Julia Goh concurred, saying that the targeted subsidies are “in line with the Pakatan Harapan manifesto and also the government’s stance of prudent spending”.

“The cash aid has been adjusted to be more conditional on the number of children in the family, [which] I think is quite fair,” she said.

The Cost of Living Aid or Bantuan Sara Hidup (BSH) now includes a top-up of RM120 per child under the age of 18 in families for up to four children, unless the child is disabled, for which no age limit applies.

In total, some RM5 billion has been allocated for BSH, which is expected to benefit 4.1 million Malaysian households compared with some RM6.12 billion for over 7.08 million applicants under the 1Malaysia’s People Aid (BR1M) in the previous budget.

Still a boost to consumption

To get more bang for the buck, the subsidies are granted to low-income earners, who tend to have a higher propensity to spend for each extra ringgit they get. Hence, the smaller amount of subsidies is believed, to some extent, being able to fuel private consumption as the nation’s economic growth engine in 2019.

“Any support given to the B40 will result in almost a complete pass-through to consumption,” said Professor Dr Yeah Kim Leng, a professor of economics at Sunway University Business School.

He opined that the support given for the B40 in terms of subsidies will be helpful in sustaining the present “above trend” of high domestic consumer spending.

“This is the key in sustaining economic growth [and] shielding the economy from a more volatile external environment,” Yeah said.

Another boost to consumption next year is likely to be the RM50 hike in the minimum wage nationwide to RM1,100. Though it may appear to be insignificant, the gradual hike will and benefit some 700,000 employees and translate into greater consumer spending, said Yeah.

On top of that, the RM1 billion bonus for civil servants and tax refunds totalling RM37 billion are expected to provide a boost to private consumption, said UOB’s Goh.

“The RM37 billion refunds (of the goods and services tax as well as the income tax) would help to spur spending and ease the cash flow for companies. As such, private-sector spending will continue to anchor the economy at [a] 6.4% growth in 2019,” she said.

Goh’s forecast is slightly lower than the finance ministry’s expectation that private consumption will grow 6.8% in 2019, though both come under the expected 7.2% growth expected for this year.

Still, the expected marginally stronger economic growth of 4.9% next year (4.8% in 2018) is likely to rely even more heavily on private spending.

This is because public expenditure will shrink further by 5.4% next year, compared with 1.8% this year, while import growth is forecast to outpace export growth next year.

Ultimately, it is the strengthening of income levels and not higher cost of living aid that should be focused on, said SERC’s Lee.

“Cash handouts should not become a permanent way of addressing [the rising] cost of living,” Lee said.

On this front, he believes the government has also done well, pointing at measures in Budget 2019 that are aimed at improving skill training, employability and worker productivity.

While the proposed rationalisation of subsidies is indeed a laudable effort for the government, finer details have yet to be made available for the mechanisms of handouts, such as for the petrol subsidy.

What could be the key challenge facing the government now is the implementation of plans that it has mapped out in Budget 2019. And this is what the voters observe as well.

This article first appeared in The Edge Financial Daily, on Nov 5, 2018.

TOP PICKS BY EDGEPROP

De Cendana Apartment

Setia Alam/Alam Nusantara, Selangor

Bandar Baru Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur

Tropicana Aman Bayan Residences

Telok Panglima Garang, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)