Mammoth Empire Holding Sdn Bhd (MEH), developer of Empire City Damansara, an RM5 billion project launched 2011, is making moves that will raise rM800 million, enable the paring down of debts, complete long-delayed projects and take the group to sound financial-footing by the middle of 2019.

The Edge reports that at the top of the list of measures is the sale of a 65-acre tract of land that was meant for Empire City Damansara 2 (ECD2) in Petaling Jaya, Selangor.

Located along Lebuhraya Damansara Puchong, it is horizontally across from the 28-acre ECD1 project.

Citing sources, the publication reports that the ECD2 land was divided and sold to two parties, a 45 acre tract went to a yet-to-be-announced joint venture (JV) between Exsim Development Sdn Bhd and Binastra Construction Sdn Bhd.

The remaining 20 acres has gone to property developer Aset Kayamas Group.

Two separate sources have been reported as saying that the two parties in the JV have a complicated collaboration. The JV is reportedly expected to be involved in a land purchase and completion as part of ECD1.

The JV is also said to be buying a 4.55-acre undeveloped land, in ECD1, originally planned for a Ritz Carlton to be developed on it.

Already having a development order for a 53-storey tower that will include 288 luxury guest rooms and suites.

MEH executive director Datuk Danny Cheah, when contacted, confirms MEH has sold the ECD2 land along with the plot in ECD1, but did declined to reveal their names.

"We are undertaking an exercise to have things in place so that by the middle of next year, we can start afresh, and embark on a new journey," Cheah says.

Neither of the JV partners would comment when contacted.

The publication reports that Aset Kayamas paid RM236 million for the 871,200 sq ft plot, or RM270.90 per sq ft.

As for the JV, the amount is not known, but sources cited by the publication say the deal may be worth between RM460 million and RM530 million. MEH purchased the land in 2011 for RM187.53 million.

For the 4.55 acres in ECD1, industry sources are cited as saying that with its development order, the land is worth RM90 million.

Asked about the debt of ECD1's developer Cosmopolitan Avenue Sdn Bhd, Cheah is quoted as saying "As at October, its total liabilities were only RM165 million."

Having taken an RM300 million loan from AMBank (M) Bhd three years ago for the Empire City Mall, the wholly owned subsidiary of MEH has now settled RM135 million of the amount.

"The sales proceeds will (also) be used to complete the mall, and for working capital," Cheah said. The mall is to be fully completed next year, he says.

MEH is also negotiating to sell to hotels in ECD1, the Autograph Boutique Hotel and the Marriot Hotel.

"We have not finalised the terms and conditions. Negotiations are still ongoing," said Cheah.

MEH is also interested in letting go of the McGuffin Hotel if it receives an attractive offer.

It is also in talks to sell Wolo Bukit Bintang, and has settled issues relating to the Empire Remix project.

"We will have the mall, a hotel block in ECD1, some RM100 million of commercial and office space in Empire Damansara and 10 acres of development land in Empire REsidence, (which) is good enough for us. All these assets will be free of encumbrances," he says.

MEH still plans to link ECD1 and ECD2, which will be called Sky Parade Garden.

"This will be completed in two stages - stage 1 by the end of next year, and stage 2 by 2020," says Cheah.

TOP PICKS BY EDGEPROP

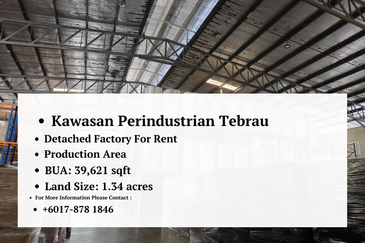

Kawasan Perindustrian Tebrau 3

Johor Bahru, Johor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Kinrara Residence

Bandar Kinrara Puchong, Selangor

Ambrosia @ Kinrara Residence

Puchong, Selangor

Tranquility Park @ East Ledang

East Ledang, Johor

Kawasan Perindustrian Pasir Gudang

Pasir Gudang, Johor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

Jalan Ceria 15

Iskandar Puteri (Nusajaya), Johor

Bangunan Duta Impian (The Embassy Suites)

Johor Bahru, Johor

Centra Residences @ Nasa City

Johor Bahru, Johor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)