Sime Darby Property Bhd (Dec 20, 95.5 sen)

Buy with a largely unchanged target price (TP) of RM1.26: The consortium comprising Sime Darby Property Bhd, S P Setia Bhd and Employees Provident Fund (EPF) — each holding a stake of 40%, 40% and 20% respectively — has finally sealed the deal with PNB-Kwasa International 2, a joint venture of Permodalan Nasional Bhd (PNB) and EPF, to sell Battersea Power Station phase 2’s (BPS2) commercial spaces for £1.58 billion (RM8.37 billion). The sale is expected to be completed by the first quarter of 2019 (1Q19) while construction of BPS2 is slated to be completed in end-2020.

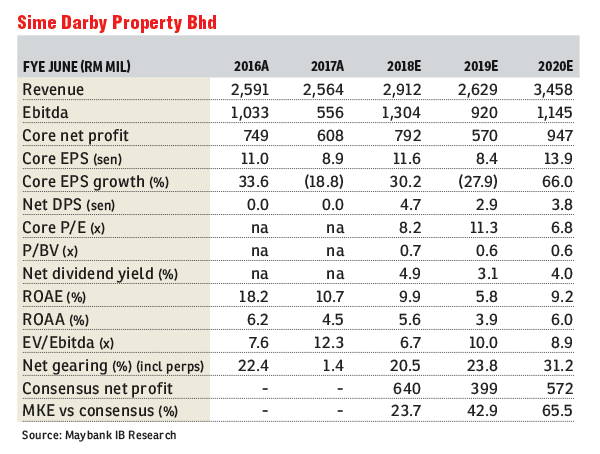

We raise our financial year 2020 (FY20) earnings forecasts by 5% on a higher pre-tax margin. Our revalued net asset value (RNAV)-based TP is largely unchanged at RM1.26 (+one sen).

The consortium has finally formalised the sale by entering into a sales and purchase agreement (SPA) with PNB-Kwasa International 2 (joint venture company [JV Co]) to dispose of seven subsidiaries which own the commercial spaces under the BPS2 for £1.58 billion. The JV Co is 65% and 35% owned by PNB and EPF respectively.

The salient terms of the SPA are:

i) an initial completion payment equal to commercial costs to date of BPS2 as at the completion of the sale;

ii) subsequent payments on a progressive manner based on construction works. The total of (i) and (ii) shall not exceed a maximum cost funding commitment (CFC) of RM1.4 billion;

iii) difference between the sale price and maximum CFC will be offset by the cost of rental guarantee paid to the JV Co (5% yield for five years post completion of BPS2 or £79.2 million per annum); and

iv) an adjustment mechanism is applicable after the end of the fifth year post completion of BPS2 based on BPS2’s net operating income versus the rental guarantee. This allows the consortium to share the upside in rental growth, if any. The sale price will be adjusted down accordingly, if otherwise.

Currently, BPS2’s commercial spaces are 50% pre-leased while the construction works of BPS2 are 30% completed. We adjust our FY20 earnings forecast by 5% to factor in a higher pre-tax margin assumption of 11% (from 8%) for BPS2 commercial spaces. Our RNAV estimation is largely unchanged at RM2.79 (+one sen); our TP is pegged at 0.45 times price to RNAV. — Maybank IB Research, Dec 18

This article first appeared in The Edge Financial Daily, on Dec 21, 2018.

TOP PICKS BY EDGEPROP

Mayfair Residences @ Pavilion Embassy

Keramat, Kuala Lumpur

Semenyih Lake Country Club

Semenyih, Selangor