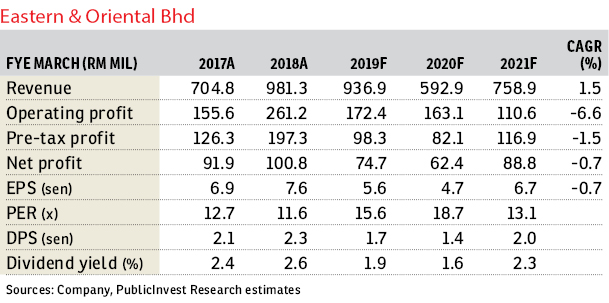

Eastern & Oriental Bhd (Feb 25, 88.5 sen)

Maintain neutral with a target price (TP) of RM1: Eastern & Oriental’s (E&O) third quarter of financial year 2019 (3QFY19) swung into a loss of RM8.8 million primarily due to the provision of RM44.5 million one-off land holding costs and RM11.6 million foreign exchange.

Stripping out these one-offs and revaluation gain of about RM1 million, its net profit for 9MFY19 is estimated to be at RM79 million, making up 87% and 92% of our and consensus full-year estimates.

*E&O posts 3Q net loss on forex loss, holding cost

This is mainly due to better cost management in the reclamation works for Seri Tanjung Pinang 2A (STP2A) and lower operating costs in the hospitality divisions.

The reclamation works for STP2A are progressing well with 97% completion today (based on two metres above sea level) and on track for completion by year-end and the first launch by mid-2020.

No dividend was declared for this quarter. We adjust our FY19-21 earnings by -18%/+22%/+12% after accounting for these one-off items in FY19 and changes in margin assumptions for FY20 and FY21.

The group’s property sales rose to RM251 million compared with RM236 million a year ago. We understand that its sales campaign “E&O Luxury Living” to reduce inventory has been successful in clearing its inventories.

The unbilled sales were lower at RM282.4 million in 3QFY19 (vis-à-vis RM856 million a year ago) in the absence of new projects with new property sales mainly coming from projects in Penang.

The group targets to launch several new projects totalling approximately RM1.5 billion in the next 24 months which, among others, include 503 units of serviced apartments at the intersection of Jalan Conlay and Jalan Kia Peng — E&O’s second joint-venture project with the subsidiary of Japanese conglomerate Mitsui Fudosan — with an estimated gross development value (GDV) of RM900 million, The Peak residential development in Damansara Heights (GDV of RM278 million) and the maiden launch of a condominium project at STP2.

The initial phase of STP2A is said to have a GDV of approximately RM380 million comprising 400 units of serviced apartments (600-1,200 sq ft) and 16-20 retail lots. — PublicInvest Research, Feb 25

This article first appeared in The Edge Financial Daily, on Feb 26, 2019.

TOP PICKS BY EDGEPROP

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Rawang Integrated Industrial Parks

Rawang, Selangor

Eastern Heritage, Setia Eco Glades

Cyberjaya, Selangor

Pandan Villa Condominium

Pandan Indah, Selangor

Bandar Tun Hussein Onn

Batu 9th Cheras, Selangor

Bandar Damai Perdana

Bandar Damai Perdana, Selangor