S P Setia Bhd (July 25, RM2.05)

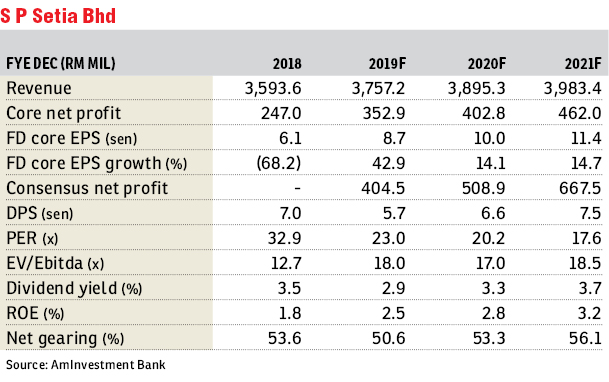

Maintain buy with an unchanged fair value (FV) of RM2.39: We have made no changes to our financial year ending Dec 31, 2019 (FY19) to FY21 numbers.

We met S P Setia Bhd’s management for updates during a recent meeting. Despite the lacklustre property market in Malaysia, the company believes demand remains strong for owner-occupied landed residential properties in established townships.

The company’s most recent launches, Phase A1 of Setia Safiro and Phase 1 of Setia Mayuri, were sold out during their launches this month.

Meanwhile, the launch of Clarino double-storey terraced houses priced from RM649,000 in the mature township of Alam Impian in March 2019 achieved a strong take-up rate of 98% within a month.

S P Setia plans to launch projects with a gross development value (GDV) worth approximately RM6.8 billion in FY19, focusing mainly in the Klang Valley and Johor.

The company has maintained its sales target of RM5.65 billion for FY19.

To recap, S P Setia launched projects worth RM339 million in GDV in the first financial quarter ended March 31, 2019 (1QFY19), comprising mainly landed residential properties.

The company recorded new sales of RM718 million in 1QFY19, whereby 94% was derived from local projects.

As for the 40% stake in its joint-venture Battersea project, demand for residential units has been encouraging with sales of £120 million (RM616.28 million) over the past 12 months.

Phase 2 (residential), comprising 255 units of apartments, has a GDV of approximately RM3.8 billion and is expected to be completed by the end of 2020.

Revenue profit recognition is expected from 4QFY20. So far, more than 90% of Phase 2 residential properties have been sold.

FY19 earnings will be driven by higher sales due to the stamp duty waiver, inventory clearing efforts and lower interest expenses as a result of repayment of borrowings from the sale of Battersea Phase 2 commercial assets.

We have maintained our FY19 to FY21 net profit forecasts at RM352.9 million, RM402.8 million and RM462 million respectively. Our FV is unchanged at RM2.39 per share.

We believe the outlook for S P Setia remains stable, premised on strong unbilled sales of RM10.95 billion and overseas contributions from 2020. — AmInvestment Bank, July 25

This article first appeared in The Edge Financial Daily, on July 26, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Endah Ria

Bandar Baru Sri Petaling, Kuala Lumpur

Springville Residence

Seri Kembangan, Selangor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

SkyLuxe On The Park @ Bukit Jalil

Bukit Jalil, Kuala Lumpur