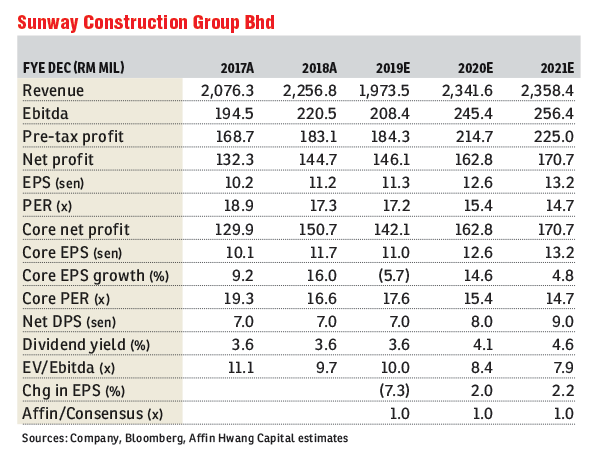

Sunway Construction Group Bhd (Aug 20, RM2.05)

Maintain buy with a higher target price (TP) of RM2.25: Sunway Construction Group Bhd’s (SunCon) net profit of RM64 million or -10% year-on-year (y-o-y) for the first half of financial year 2019 (1HFY19) comprised only 42% to 44% of market consensus and our 2019 forecasts of RM147 million to RM153 million. Its revenue plunged 18% y-o-y to RM880 million for 1HFY19 due to slow construction progress billings and lower revenue from its precast concrete operation (-4% y-o-y).

A reduced scope of work and contract value for the Klang Valley’s Mass Rapid Transit Line 2 and Light Rail Transit Line 3 (LRT3) projects contributed to the lower revenue. There were also low progress billings for the LRT3 and some building projects due to design changes.

Its profit before tax (PBT) declined 8% y-o-y to RM81 million for 1HFY19, entirely contributed by its construction division (-3% y-o-y) as its precast concrete division only managed to break even.

The precast concrete segment’s weak performance — compared with a PBT of RM5.8 million for 1HFY18 — was due to lower profit margins for legacy contracts that will mostly complete in the third quarter of 2019. The construction PBT margin improved to 10% in 1HFY19 compared with 8.3% in 1HFY18 due to a better profit margin on the finalisation of accounts for a completed project.

SunCon clinched RM1.54 billion worth of new contracts year to date, including the RM310 million Petronas Leadership Centre project secured recently. Its remaining order book increased to RM5.8 billion currently, equivalent to 2.6 times FY18 revenue, from RM5.2 billion as at end-2018. SunCon has submitted tenders for road or railway projects in India, piling projects in Singapore, hospitals for Sunway and domestic large-scale solar 3 projects.

We raised our 2020 revalued net asset valuation (RNAV) per share estimate to RM2.50 from RM2.49 previously, to reflect a higher net cash at end-1HFY19. Based on the same 10% discount to RNAV, we raised our TP to RM2.25 from RM2.24 and maintained our “buy” call. A key risk is a slow awarding of new public-sector projects. — Affin Hwang Capital, Aug 19

This article first appeared in The Edge Financial Daily, on Aug 21, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

RIMBUN KIARA @ SEREMBAN 2

Seremban, Negeri Sembilan

Bandar Tun Hussein Onn

Batu 9th Cheras, Selangor

Pandan Villa Condominium

Pandan Indah, Selangor

Bandar Damai Perdana

Bandar Damai Perdana, Selangor

Laman Anggerik, Nilai Impian

Nilai, Negeri Sembilan

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur