IGB Real Estate Investment Trust (Oct 24, RM1.97)

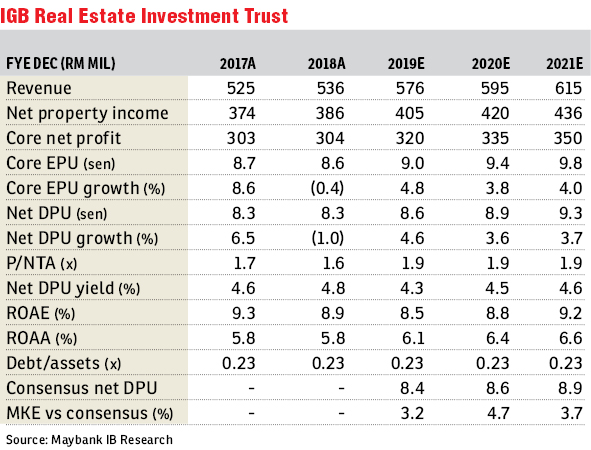

Maintain hold with a higher target price (TP) of RM2: IGB Real Estate Investment Trust’s (REIT) third quarter of financial year 2019 (3QFY19) earnings and third interim gross distribution per unit (DPU) of 2.31 sen (nine months [9M] of FY19: 6.97 sen) were within our expectations with 9MFY19 earnings at 77%/76% of our/consensus full-year estimates. We nudge up our earnings forecasts by 2-3% and our dividend discount model-based TP by 15 sen to RM2 after realigning with a lower beta assumption of 0.5 time (x). We maintain “hold” on balanced risk-reward (+2% total return). IGB REIT could be rerated once there is better visibility of its next major retail asset acquisition. Its FY20 estimated net DPU yield is 4.6%. We prefer YTL Hospitality REIT (“buy”; TP: RM1.50).

3QFY19 net profit was RM79.8 million (+5% year-on-year [y-o-y]; +2% quarter-on-quarter), taking 9MFY19 earnings to RM240.6 million (+5% y-o-y). The improved 3QFY19 y-o-y bottom line was mainly due to higher rental income from positive rental reversions and sustained high occupancy rates (about 100% committed tenancies at both malls). Furthermore, 3QFY19 earnings were also lifted by lower operating expenses (-1% y-o-y), which boosted the net profit income margin to 73.9% (+1.7 percentage points y-o-y) for 3QFY19.

We continue to favour near-term organic rental income growth from Mid Valley Megamall and The Gardens Mall due to their prominent locations with wide catchments and high footfall traffic. This would support our decent near-term DPU growth forecasts amid the ongoing mall oversupply and heightened competition in the Klang Valley.

IGB REIT’s key growth catalyst is likely to come from sizeable retail asset acquisitions, namely Mid Valley Southkey in Johor Bahru (a joint venture between IGB REIT’s parent IGB Bhd [“not rated”] and Selia Pantai Sdn Bhd), which was opened in April 2019. However, we believe potential acquisition of the asset is not likely until at least after one tenancy cycle of approximately three years (earliest by FY22). Hence, we have not factored in any new assets into our forecasts. Also, asset purchases would be supported by its low-end 3QFY19 gross gearing of 0.23x.

There are several risk factors for our earnings estimates, TP and rating for IGB REIT. Changes in rental rates, occupancy rates and operating expenses may lead to lower earnings for IGB REIT. A third of IGB REIT’s net lettable area is due for lease renewal in 2019, while all debt is on fixed rates. — Maybank IB Research, Oct 24

This article first appeared in The Edge Financial Daily, on Oct 25, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Seri Mutiara Apartments, Bandar Baru Seri Alam

Masai, Johor

Havona Residence @ Taman Mount Austin

Johor Bahru, Johor

Taman Nusa Bestari, Skudai

Iskandar Puteri, Johor

SKS Habitat Apartment, Larkin

Johor Bahru, Johor

Sky Loft Premium Suites, Bukit Indah

Johor Bahru, Johor