KUALA LUMPUR (Nov 4): Investors are probably watching closely every move YNH Property Bhd’s board makes, given the company’s inexplicably high valuations relative to its peers against the backdrop of a lacklustre year for property counters.

Last week, the property developer told The Edge Financial Daily it is finally moving ahead with its parcel of land atop Genting Highlands, next to Resorts World Genting, that it had bought in 2008 for RM16.05 million.

The project, featuring three blocks of serviced apartments worth RM700 million in gross development value (GDV), will be launched within the next year and start contributing to the group’s top line, said YNH general manager James Ngio.

“We are going to [first] develop five acres (2.02ha) of the 100 acres [we own there]. It is going to be mostly residential, and our target market will very much be investors and [those seeking] holiday homes,” Ngio said.

The Genting project makes up nearly half of the RM1.5 billion GDV in upcoming launches YNH has planned for the coming year, although the group is aiming to officially launch its RM700 million residential project dubbed Solasta in Dutamas, Kuala Lumpur before end-2019 if possible.

The high-rise project, each with an 800 to 900 sq ft build-up area, will be priced at an average of RM600,000 to appeal to young executives and first home buyers.

Other than these two projects, YNH will continue to build 500 residential units and 100 commercial shop lots at the Seri Manjung township in Perak, carrying a GDV of RM100 million, according to Ngio.

“For next year, [our] main revenue generator will be the Kiara 163 serviced apartments [in Mont’Kiara] as well as the two upcoming projects, Solasta and [the one] in Genting.

“The Kiara 163 serviced apartments are expected to be completed by the end of next year, and revenue recognition from this project will be the main revenue contributor for the coming quarters. The Genting and Solasta projects are going to last us for another three to four years,” he added.

The six-acre mixed development project in Mont’Kiara was first launched in 2016. According to Ngio, the serviced apartments, launched later in the first quarter of 2018, is currently 70% sold.

It is reasonable for investors to cast a wary eye towards the group’s future plans. After all, there are high hopes, given that YNH’s share price has more than doubled since April to now trade at 67 times its 12-month historical price-earnings ratio and 1.48 times its net asset value, based on its closing price of RM2.58 last Friday.

Furthermore, many are still awaiting updates on the Menara YNH mixed development project the group proposed on a prime three-acre parcel along Jalan Sultan Ismail, Kuala Lumpur, about 10 years ago. YNH bought the piece of land during the 1997/1998 financial crisis, according to Ngio.

He explained that the group delayed the project as it “wants to maximise the value” given that it is among the last remaining plots of prime land in Kuala Lumpur’s city centre.

“We have the necessary approvals to develop the land and the current plan is for a mixed development project with an estimated GDV of about RM4 billion. We have factored in a higher plot ratio, which increased the GDV to its current value (from RM2.3 billion estimated in 2018).

“We will launch the project when the time is right,” said Ngio without elaborating further on the timeline.

The general manager remains positive about YNH’s existing land bank and upcoming projects, adding that the group has unbilled sales of RM600 million and is consistently working on strengthening its balance sheet.

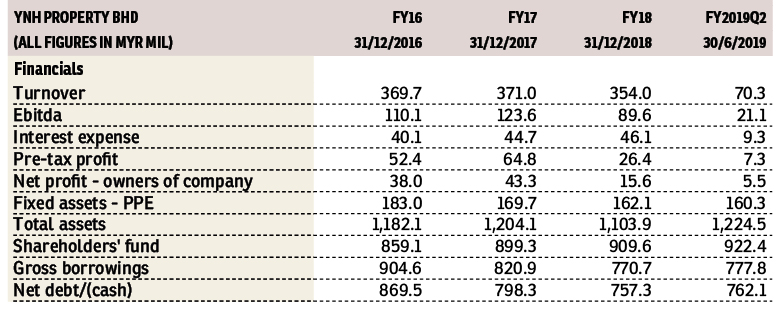

As at June 30, YNH has cash and equivalents of RM15.7 million while total debt stood at RM777.8 million, Bloomberg data shows.

Ngio said that the group may set up a real estate investment trust to monetise assets such as 163 Retail Park and Aeon Seri Manjung, adding however that the plan is still in a preliminary stage.

In terms of earnings, the developer’s net profit for the six-month period ended June 30, 2019 (6MFY19) grew 54.4% to RM12.8 million from RM8.29 million on lower cost of sales and operating expenses. However, its revenue dropped 18.4% to RM145.08 million, from RM177.78 million for the same period last year.

This came as YNH recognised profit from completed projects, namely Kiara 163, a small office versatile office development, and Sfera Residency condominium in Seri Kembangan.

For FY18, YNH’s net profit halved to RM15.6 million compared with RM32.46 million for FY17. The developer attributed the lower earnings to slower progress in project development and resulted in lower profit recognised.

It will be interesting to watch whether the kick-start of the project in Genting Highlands will put YNH on growth path to justify its current high valuation.

This article first appeared in The Edge Financial Daily, on Nov 4, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Endah Ria

Bandar Baru Sri Petaling, Kuala Lumpur

Springville Residence

Seri Kembangan, Selangor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

SkyLuxe On The Park @ Bukit Jalil

Bukit Jalil, Kuala Lumpur