A note from the Editor-in-Chief

The current Covid-19 outbreak is unleashing havoc to economies across the globe. Uncertainty is the order of the day.

Frontline workers strive courageously to keep all of us safe. Business owners labour over cash flow issues. Employees worry about losing their jobs.

The reality: No one has an answer to the what, how and when of this Covid-19 pandemic that is threatening to bring world economies to their knees.

Stock markets have taken a knock. Industries are hitting the pause button; some already closing or downsizing.

Meanwhile, the government has extended lifelines through stimulus packages. Efforts can be expected to stimulate the much-needed economic activities.

In this context, is property investment then an irrelevant topic of discussion?

No one knows exactly what will unfold in the next few months or few years. What we do know is that now is a property buyers’ market. Prices are expected to dip, though thankfully this is cushioned in part by the moratorium on bank mortgages. Even before the pandemic hit, the value of Malaysia’s residential overhang has stood at close to RM20 billion and growing.

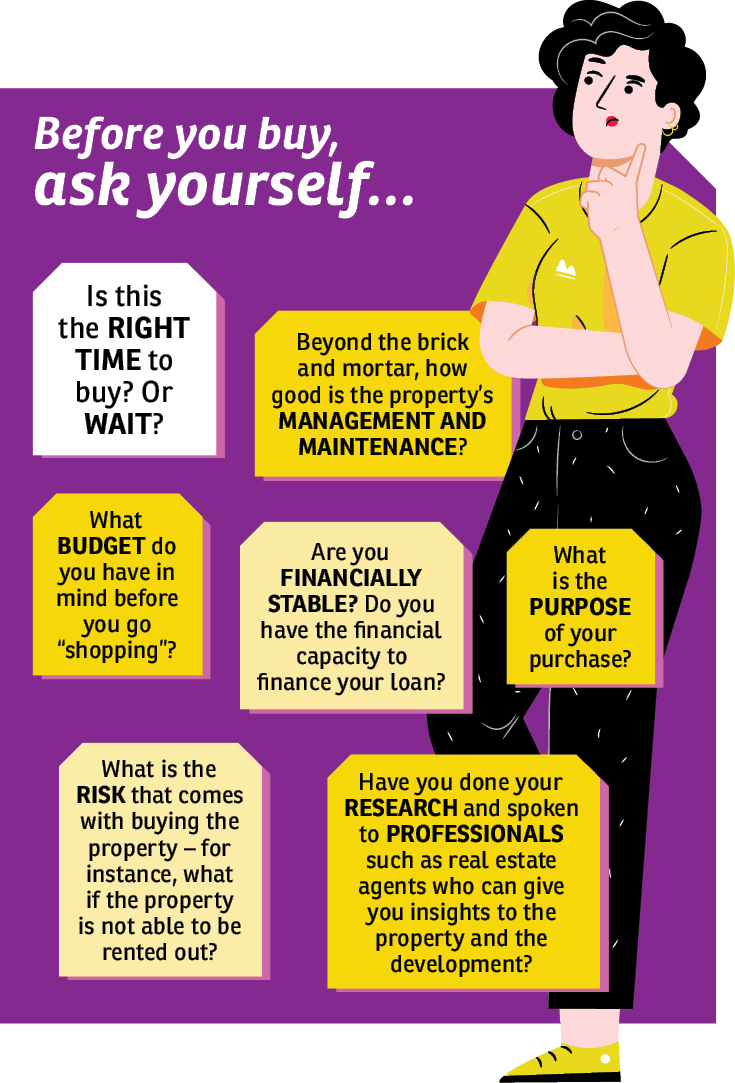

Be that as it may, there are always those out there who are confident about their job security, who have strong finances that are just sitting pretty in the bank and who have been waiting for the once-in-a-lifetime opportunity to invest in real estate. Is the Covid-19 pandemic such an opportunity? Even so, exactly where are we now in the curve? When is the right time to go into the market? The jury is definitely out on this.

The only certainty, however, is that every adversity offers an opportunity. Ultimately, every investor — big or small — needs to first establish the purpose of investment and his or her risk appetite.

Do your research. Stay close to the pulse of the market. Making informed investment decisions, without doubt, is key.

Good luck!

Au Foong Yee

Editor-in-chief and Managing Director,

EdgeProp Malaysia

With the current Covid-19 outbreak worsening the economic downturn in Malaysia, people in general are just not in the mood to spend, what more on buying property. Nevertheless, the current buyers’ market and low interest rate environment can be tempting.

At the EdgeProp.my Facebook LIVE Fireside Chat titled ‘Undervalued Properties: Opportunities or Risk?’which took place last Friday April 10, several EdgeProp.my’s Pro Agents gave their views on the current market environment and some advice for property buyers.

Read also

Check out these below-market residential properties in the Klang Valley and Greater KL

The online event received more than 10,000 views. Selected questions from viewers were answered by the guests namely Propnex principal and chief operating officer Evon Heng, Kith & Kin Realty co-founder Freeman Woo, Rescom Realty & PEHAM (Persatuan Perunding Hartanah Muslim) Exco team leader Mohd Faizal Mohd Ismail and Propstar Realty senior real estate negotiator Kevin Teh. The chat was moderated by EdgeProp Malaysia editor-in-chief and managing director Au Foong Yee.

“We are living in interesting times, a time that is beyond our wildest imagination. Just look at the current economic and investment landscape. Bank Negara Malaysia expects GDP growth in 2020 to range from -2% to 0.5%. World Bank has recently revised its projected growth for Malaysia from 4.5% to -0.1%,” said Au, kicking off the session.

Missed the Fireside Chat? View it here.

She recalled that during the global financial crisis in 2008, despite negative GDP growth, house prices in Malaysia continued to rise steadily.

“Before you think about popping the champagne, getting out of the current economic woes is a lot trickier. Why? Because it involves a life-threatening health crisis that is affecting people all across the globe. Will the Malaysian housing market crash? Is it going to be total gloom? Or are we staring at a once-in-a-lifetime investment opportunity?”

Is it a good time to buy?

Propnex’s Heng highlighted that property owners are becoming more realistic in their pricing during tough times and are more willing to reduce their asking prices. She defines undervalued properties as properties with asking prices of at least 10% below bank valuation, are in a good location, units that are easy to secure tenants and offer decent rental yield of around 4.5%.

“The Covid-19 pandemic has impacted every sector but it has opened up good investment opportunities as property owners are looking to cash out to conserve cash for their businesses. Now is the time for serious buyers — those who have done their studies, understood their budget and risk appetite, and most importantly, identified their preferred locations — to seriously consider making their buying decisions,” said Heng.

Meanwhile, Rescom Realty’s Faizal, who specialises in Bangi, Semenyih and Nilai properties, said prices for landed homes are now “juicy” compared with prices in 2018 and 2019.

When will prices hit bottom? What if prices go lower after this?

While many anticipate property prices to come down in light of the uncertainties brought on mainly by the Covid-19 pandemic, no one would be able to predict exactly when housing prices will bottom.

“We will never know when prices have hit rock bottom. The more important question an interested buyer should ask is: why am I buying the property in the first place?” offered Kith & Kin’s Woo.

“Don’t buy because of the property price. Always know why you are buying and the purpose of the purchase. Understand that and your financial status first before looking for a property, said Woo, citing for instance, investors looking for rental returns.

“In Malaysia, we are lucky to gain rental returns for properties which will hold the market value of the property. When the rental yield reaches 5-6%, those who are cash-rich will look at buying and investing in these properties to diversify their savings,” he added.

Heng concurred, saying that if one is looking to buy a property for own stay, that property which you have an eye on in the market may not always be available.

“If it is so nice, it will not be there always waiting for you. We can never know when prices will bottom. The longer you wait, the more likely the good deals will be going off. Every property has its uniqueness, and once it goes off the market, you may not get it back.”

Faizal reckoned that property prices are unlikely to change much immediately after the Movement Control Order imposed since March 18 until April 28, due to the six-month loan moratorium which has been introduced by the government effective April 1.

“Property owners will be able to sustain their holding power due to the moratorium. But after September, we will begin to see some changes,” said Faizal.

Nevertheless, he believes that for first-time homebuyers, the best time to buy a property is “always now”.

“If you want to buy a property and are waiting for the best time, it is now. If you keep waiting for the market to touch bottom, you may just miss the right home,” he shared, and added that a first-time homebuyer should never hope for property prices to go down to buy a home.

“In any case, generally, many landed homes on the secondary market have lower asking prices now compared to a few months ago. You should take the opportunity now to really find a home that suits you,” he shared.

As for investors, Propstar’s Teh reminded them that property is a long-term investment and they must expect to wait for their returns on investment. He said there are a number of interested property investors out there looking for a good deal before the MCO and he expects those with deep pockets to continue shopping for bargains post-MCO.

“If it’s for your own stay, you should not really care whether the market is going up or down.

“However, when it comes to your subsequent purchases for investing, the question to ask is: ‘can you wait?’ If you can’t, then buy, provided you are financially stable,” he said.

Looking beyond the property price

In conclusion, EdgeProp.my’s Au highlighted that buying a property especially for a first-time homebuyer, is one of the single biggest and most important decision one makes in his or her life, hence it is also a very personal decision close to one’s heart.

“If a listing on the market that a person is eyeing is no longer for sale, why should he or she be upset? Then it hit me that people buy because of the familiarity it offers. Maybe it is near to a school or your work place. And if the listing is gone, you may not find a similar listing like this again,” said Au.

“Even if there are other listings in the market in the same development, it may not be the one which you really like in the first place, perhaps for the view or the layout or the floor level, for instance,” chipped in Propstar’s Teh.

Hence, a discerning buyer should not just look at the price of the property alone.

“Instead, they should do their research, talk to the professional real estate agents who can advise them, look beyond the brick and mortar of the property such as its property management and the investment potential including the location, facilities and amenities of the property,” said Au.

Although no one knows when the Malaysian housing market will bottom, all agreed that it is a good time now to look out for buying opportunities.

“It is too early to know whether the market has bottomed, but my guess is that it hasn’t. The reality is people are losing their jobs. When it comes to tenancies, we can expect vacancies.

“The bottom will come, we don’t know when. Are there risks? Yes, of course there are risks. We have to ask ourselves, can we take on that risk before we make this major decision of signing on the dotted line,” she stressed.

Property management impacts the value of the property

The quality of a property’s maintenance and management could play a decisive role in determining the property’s value, said Kith and Kin Realty co-founder Freeman Woo at the EdgeProp.my Facebook LIVE Fireside Chat titled ‘Undervalued Properties: Opportunities or Risk?’on April 10.

Speaking from experience, Woo said property management is a major consideration for buyers when they are choosing a property. “For instance, on first impression when walking into a premises, the quality of the management can be observed. Even from the look of the security guards when you first enter the property, you can know whether it is managed well,” said Woo.

He added that in the current market where negative sentiments abound and properties may be hard to sell, any value-add could mean a lot.

In deciding whether to buy a property, Woo advised buyers to use the “PPLC” rule which stands for the ‘purpose’ of buying; the ‘price’, the ‘location’ and the ‘condition’ of the property, both of the individual unit and the common property.

The loan moratorium and the property seller

The six-month moratorium on all bank loans from April 1 will benefit most mortgage holders but for investor-owners who are looking to cash out, it may not be such a good idea for them to opt for the loan repayment deferment.

This is because the sale transaction process for secondary properties takes around three to four months to conclude for fully redeemed secondary properties, while for properties that are still serving loan repayments, the transaction may take around six months to complete.

“Time is an opportunity cost especially for those who only have a very short repayment period left and looking to sell. They should list their property in the market and continue to pay their instalments,” said Propnex principal and chief operating officer Evon Heng.

“For sellers looking to realise their investment, the earlier they could sell off their property, the earlier they could get the money to reinvest,” she noted.

Propstar Realty senior real estate negotiator Kevin Teh concurred, saying that if those who intend to sell decided to take the deferment and waited until September to list their property, they would have wasted a lot of time to get their property sold.

Even if you could get the buyer immediately after the Movement Control Order, the seller will still need to wait till early next year to get their profit,” he said.

Both Heng and Teh were speaking at the EdgeProp.my Facebook LIVE Fireside Chat titled ‘Undervalued Properties: Opportunities or Risk?’on April 10.

Stay calm. Stay at home. Keep updated on the latest news at www.EdgeProp.my #stayathome #flattenthecurve

This story first appeared in the EdgeProp.my pullout on April 17, 2020. You can access back issues here.

TOP PICKS BY EDGEPROP

Tenderfields @ Eco Majestic

Semenyih, Selangor

Isle of Botanica, Setia Eco Glades

Cyberjaya, Selangor

The Maisons, Perdana Lakeview East

Cyberjaya, Selangor

Taman Wawasan, Pusat Bandar Puchong

Puchong, Selangor

Bandar Sungai Long

Bandar Sungai Long, Selangor

Ridgeview Residences @ Kajang

Kajang, Selangor