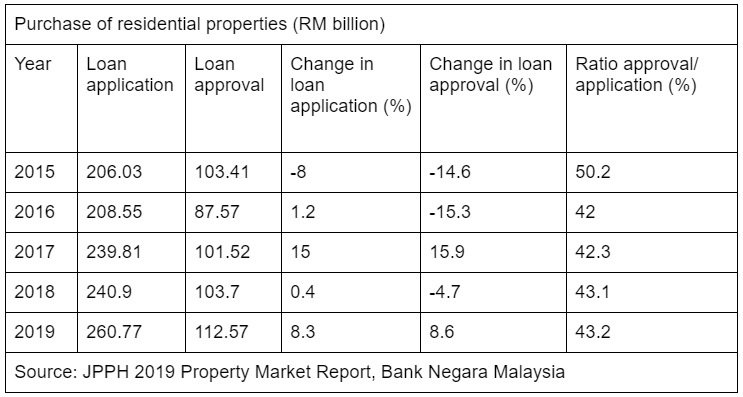

PETALING JAYA (April 30): Aggressive marketing campaigns by property developers coupled with the government’s measures lifted homebuying sentiments among Malaysians last year, resulting in increases in the amount of total loan applications and total loan approvals for the purchase of residential property by 8.3% and 8.6% respectively.

Read also

KL residential transactions up 1.1% in 2019

Primary market sales improved amid fewer new launches

Sharp rise in Selangor serviced apartment overhang

MAH: Scheduled hotel openings for this year postponed

Demand for warehouses up but industrial overhang continues to rise

Johor residential property transactions grew in 2019

Serviced apartment prices under pressure as supply surges

Penang reduced serviced apartment overhang by 50% in 2019

Meanwhile, for non-residential property, the amount of loan applications and loan approvals increased by 0.6% and 4.0% respectively.

According to the 2019 Property Market Report released by the Valuation and Property Services Department (JPPH) yesterday, the ratio of loan approvals for the purchase of residential property and non-residential property stood at 43.2% and 37.5% in 2019 versus 43.1% and 36.3% in 2018.

JPPH noted that the property market's performance last year was boosted by various incentives by the government:

● Home Ownership Campaign (HOC) which started from January 2019 till end-2019;

● Two-year stamp duty exemption (from 2019 to end-2020) on instrument of transfer for homes priced up to RM300,000;

● Allocation of RM1.5 billion for the construction of affordable homes.

● The RM1 billion Fund for Affordable Home by Bank Negara Malaysia, to assist first time homebuyers to purchase properties priced up to RM300,000 at a lower interest rate of 3.5%;

● Youth Housing Scheme by Bank Simpanan Nasional (BSN), to provide home loan guarantees via Cagamas and RM200 monthly financial assistance for the first two years;

● The reduction in the Overnight Policy Rate (OPR)

EdgeProp Malaysia will be hosting a virtual Fireside Chat titled "The Malaysian property market picked up in 2019! Could this be its last hurrah?" through Facebook Live on May 1 at 2pm.

Join us for more insights from Rehda president Datuk Soam Heng Choon, Rehda vice-president and Selangor branch chairman Zulkifly Garib and Rehda Johor branch chairman Datuk Steve Chong Yoon on the market outlook post-MCO!

Stay calm. Stay at home. Keep updated on the latest news at www.EdgeProp.my #stayathome #flattenthecurve

TOP PICKS BY EDGEPROP

Bandar Puteri Puchong

Bandar Puteri Puchong, Selangor

Semenyih Lake Country Club

Semenyih, Selangor