KUALA LUMPUR (June 12): Marzunisham Omar was today named as a deputy governor of Bank Negara Malaysia (BNM) for a three-year term, effective June 15.

BNM said in a statement that the appointment was approved by the finance minister.

Marzunisham joined BNM in 1993 and has 27 years of experience across various functions of central banking, ranging from economic and monetary policy, financial sector regulation and development, financial inclusion and organisational development.

He holds a Master’s degree and a Bachelor's degree in Economics from the University of Cambridge, United Kingdom.

As deputy governor, BNM said Marzunisham will oversee the full breadth of the bank’s corporate management, which includes currency and finance, digital and technology, human capital and corporate services.

He will also be the deputy governor in-charge of the Financial Intelligence and Enforcement Department.

It added that Marzunisham will be a member of BNM’s board of directors and continue to serve on various committees of the central bank. These include the Management Committee, Monetary Policy Committee, Financial Stability Committee, Reserve Management Committee and Risk Management Committee. He will also be the chair of the National Coordination Committee to Counter Money Laundering (NCC).

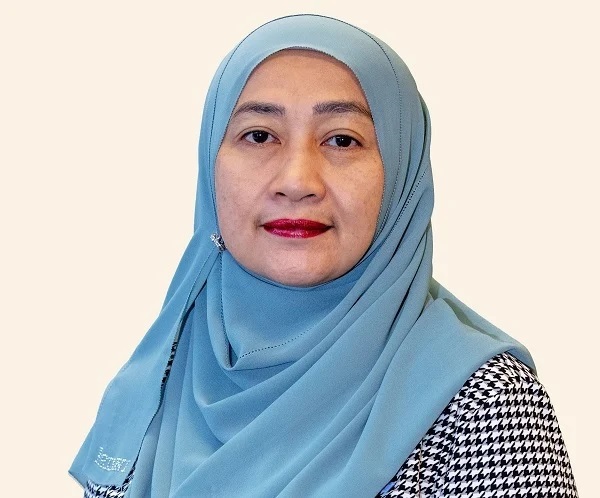

BNM also announced the appointment of Dr Norhana Endut as an assistant governor of the central bank.

She will be responsible for the Economics, Monetary Policy, Data Management and Statistics Departments as well as International Departments.

Prior to her appointment, Norhana served in the Economics and Monetary Policy Departments.

She holds a PhD and a Master’s degree in Economics from Washington University in St Louis, the US and a Bachelor’s degree in Economics from the University of Warwick, UK.

Stay safe. Keep updated on the latest news at www.EdgeProp.my

TOP PICKS BY EDGEPROP

Andana Condominium @ D'Alpinia

Puchong South, Selangor

Pangsapuri Angsana, Bandar Mahkota Cheras

Cheras, Selangor

South Brooks @ Desa ParkCity

Desa ParkCity, Kuala Lumpur

Paloma @ Tropicana Metropark

Subang Jaya, Selangor