KUALA LUMPUR (July 16): CGS-CIMB Research said the conclusion of the Johor Bahru-Singapore Rail Transit System (JB-Singapore RTS) bilateral agreement in end-July may be a prelude to a likely favourable outcome at the KL-Singapore High-Speed Rail's (HSR) end-2020 review deadline.

CGS-CIMB Research analyst Sharizan Rosely said the main rationale of building the RTS is to ease traffic congestion at both the Causeway and the Second Link. The RM3.2 billion revised project cost for the cross-border rail transit line (RM4.9 billion original cost) is miniscule versus urban rail systems like LRT 3 (RM16.6 billion) and MRT 2 (RM31 billion).

“Our recent checks with various industry players led us to conclude that the civil works tender phase of the RM3.2 billion project is likely to be broken down into only a few packages compared to the LRT 3 and MRT 2 tenders, which rolled out ten to twelve work package contracts (WPC) spanning an average five to eight km for each package.

“Hypothetically, assuming 70% of the RTS’s RM3.2 billion cost, i.e. RM2.2 billion is civil works (including two terminus stations but excluding rolling stock and electrification/signalling works), dividing the RTS into five scopes works out to an average RM442 million value per WPC, and ten scopes works out to an average RM221 million value per WPC,” he said in a note July 15.

In terms of project structure and in order to maximise the benefit of the RTS project to smaller unlisted contractors, Sharizan said he would not rule out that the civil works tender submissions may require experienced rail contractors to form joint ventures with smaller players.

“Under this assumption, rail contractors under our coverage that may be keen to participate include IJM Corp Bhd, WCT Bhd, Sunway Bhd (via Sunway Construction), Muhibbah Engineering (M) Bhd, Malaysian Resources Corp Bhd and YTL Corp Bhd.

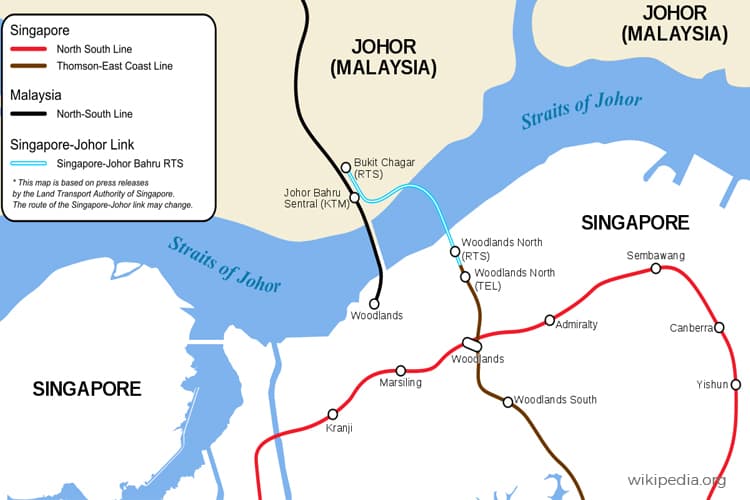

“We expect more clarity on the split of the RTS civil works between Malaysia and Singapore upon the formation of the Infra Co, and finalisation of the RTS alignment.

“For HSR, YTL Corp and MRCB remain our preferred picks, as both were previous winners of two sizeable HSR scopes in 2018 prior to cancellation,” Sharizan noted.

He reiterated a ‘neutral’ rating on the sector, adding that the upside risk includes inclusion of MRT 3 and HSR in the 12th Malaysian Plan.

Meanwhile, the downside risk is project delays.

The JB-Singapore RTS was approved and launched in 2018 but was reviewed by the previous government, which led to its deferment, similar to the KL-Singapore HSR project.

The relaunch of the RTS, which is targeted in November, would have positive implications for the sector’s job outlook post-movement control order (MCO), adding up to the RM4 billion total construction stimulus measures.

Stay safe. Keep updated on the latest news at www.EdgeProp.my

Click here for more property stories

Click here to see residential properties for sale in Kuala Lumpur.

TOP PICKS BY EDGEPROP

Residensi Bintang Shamelin ( Shamelin Star )

Cheras, Kuala Lumpur

University View Apartments (Bukit Beruang Bestari)

Bukit Beruang, Melaka

Puteri Palma Condominium @ IOI Resort City

Putrajaya, Putrajaya

Jalan Kemuning Permai 33/42

Shah Alam, Selangor

Bukit Kemuning Industrial Park

Shah Alam, Selangor