Although market sentiment is generally bearish owing to the Covid-19 pandemic and economic slowdown, Malaysia has been able to fend off the worst thus far, thanks to its strong fundamentals and the government’s efforts to bolster the economy.

The World Bank stated on July 19 that Malaysia is riding out the current severe global economic downturn comparatively better than many economies.

Winston Churchill’s quote: “Don’t waste a good crisis” is often heard during such times. Indeed, many investors are on the lookout for opportunities and good deals in a gloomy market, including property investors.

For first-time homebuyers and up-graders, this downturn could also be an opportune time to buy, especially from property developers due to the many incentives offered by the government and the industry itself.

Lower entry cost

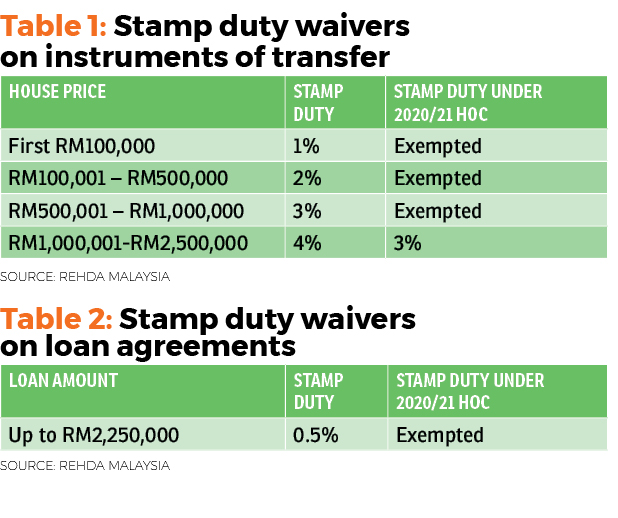

Among the incentives for homebuyers are those given under the Home Ownership Campaign (HOC). Due to the effectiveness of the national HOC in 2019, the government has reintroduced the HOC in June 2020 for residential property purchases on the primary market.

The 2020/21 HOC provides stamp duty waivers on instruments of transfer and on loan agreements for Sale and Purchase Agreements signed from June 1, 2020 to May 31, 2021 for homes priced between RM300,001 to RM2.5 million before discount (see tables 1 and 2). The properties under the campaign are also subject to at least a 10% discount given by developers.

Malaysian Institute of Estate Agents (MIEA) president elect and S.K. Brothers Realty (M) Sdn Bhd general manager Chan Ai Cheng notes that apart from the HOC incentives, many developers are also providing additional discounts, rebates, easy ownership schemes such as lower deposits or upfront payments, and even loan installment subsidies. All these could be of great help in easing the burden of buying a property in times of uncertainty.

Chan says in order to push sales during the downturn, property developers are currently offering more incentives than ever before, hence buying from the primary market could bring more benefits than buying from the secondary market at this moment.

“Many new developments are also coming up with features, concepts and specifications that meet the needs of the current market, she adds.

Property consultancy Landserve Sdn Bhd managing director Chen King Hoaw concurs as the discounts, rebate and tax waivers could translate into huge savings for homebuyers and lower upfront payments for property purchases.

“The lower upfront payments will make it easier for buyers to secure a home as long as they are able to get a bank loan,” says Chen.

Low interest rate

The reduction in the Overnight Policy Rate (OPR) also means lower monthly interest rates on home loans. Bank Negara Malaysia announced its latest OPR cut on July 7, 2020 to 1.75%. It was the fourth consecutive cut since the beginning of the year. The latest OPR is even lower than the 2% OPR imposed during the 2008/09 Global Financial Crises.

Besides the many incentives and the low-interest rate environment, another benefit of buying a property in the current downturn is that consumers are spoilt for choice when it comes to picking their dream home.

According to property consulting firm Firdaus and Associates Property Professionals Sdn Bhd founder and managing director Firdaus Musa, there are currently plenty of good options for new home buyers that are in strategic locations, especially stratified properties.

The economic slowdown and the Covid-19 pandemic will not last forever thus buying a property as a long-term investment and the numerous incentives on offer and the low-interest rate environment certainly makes it very attractive to buy a property now.

Outlook for residential market

The property agents and consultants are certain that demand for residential properties will remain strong considering the fact that Malaysia’s population is still growing at a steady rate. “No matter what the market condition is, we all need a roof over our heads. In fact, we have seen more enquiries from buyers and tenants recently,” MIEA’s Chan shares.

She believes that after the Covid-19 pandemic is contained, the economy would start to pick up and property prices will definitely grow.

Firdaus concurs and says that the most popular housing segment Malaysians would go for are properties priced below RM500,000 with two or three bedrooms.

“Thanks to constant market demand, long-term price growth would be more of a gradual increment whilst rental would be stable,” he adds.

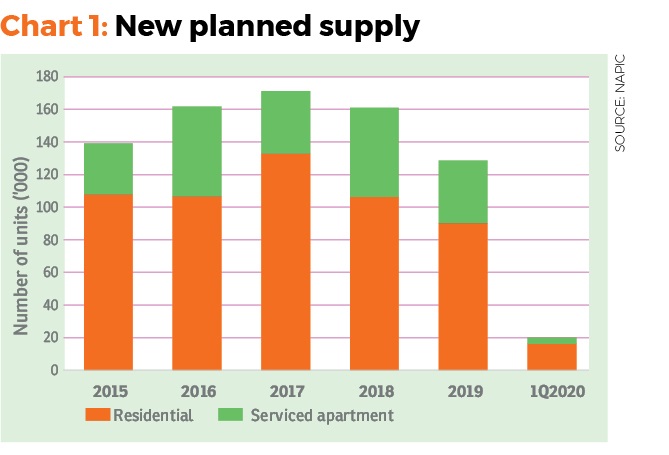

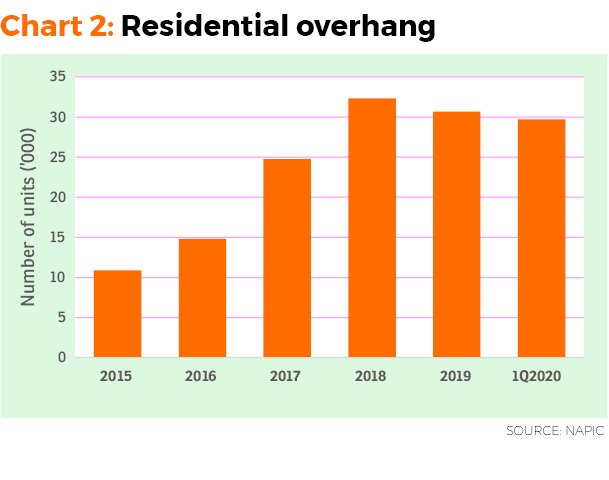

Landserve’s Chen points out that although the growth momentum of property sales in 1Q2020 was hampered by the Covid-19 pandemic, data has revealed some positive market indicators, especially regarding the future supply and overhang of residential properties.

According to data released by the National Property Information Centre (NAPIC), the number of residential units that have started construction and that are newly planned in 1Q2020 has dipped 15.8% and 4.1% respectively, from a year ago.

Residential property overhang had fallen 9.8% y-o-y while the number of unsold residential units under construction dropped 12.4%. Unsold and not constructed residential units declined 16.9%.

Although the overhang in serviced apartments surged 30.2% in 1Q2020, those that have started construction and newly planned ones have dipped 57.3% and 36.5% respectively. Unsold under construction and unsold not constructed serviced apartment units have also decreased by 11.2% and 32.1% respectively.

Sustaining value

Chen highlighted that prospective buyers must be aware that for property prices to be sustainable over the long term, not only is location important, the management and maintenance of the property are also crucial.

“While prices of new and well-located residential properties are expected to remain stable, as more residential units and serviced apartments are completed, there may be downward pressure on rents of poorly managed residential properties especially strata properties. For prices and rents to sustain, proper maintenance and management are critical,” he says.

Strategies

MIEA’s Chan opines that waiting for prices to fall before making a purchase may not be the best investment strategy going forward, as prices may hold strong or continue to rise depending on location or property type.

“A better way would be to determine an acceptable price range based on recent transacted data. These data are easy to get such as from EdgeProp.my’s property portal.

“Don’t wait to buy property, buy property and then wait, so goes the saying,” she shares, adding that the innate quality of property investment is that it is a good hedge against inflation.

“Property investment is a mid- to long-term investment. For those who are looking for the ‘flip’ type of property investment, opportunities for such an investment in the near term are few and far between. Hence, take the long-term view as property prices will increase over time considering inflation is certain to occur in future,” Chan says.

In the current uncertain economy where unemployment rate is rising, if a home buyer feels his or her employment or income source is unstable, they may opt for a Rent-To-Own (RTO) scheme when buying a property, she suggests.

Choose the right developer

Meanwhile, Firdaus reminds prospective home buyers that in uncertain times, it is crucial to purchase properties from established developers with good track records.

“Apart from location, accessibility, security and practical layouts that make up some of the important features of a property that could determine the success of one’s property investment, investors and homebuyers also need to be aware of issues that could arise after purchasing the property,” he says.

Among the “after-purchase issues” that could arise, he cites, are defects after completion and management of common properties.

“They need to choose a responsible developer who will be around long after the keys are handed over and who can resolve the defects well, for instance,” stresses Firdaus.

Stay safe. Keep updated on the latest news at www.EdgeProp.my

This story first appeared in the EdgeProp.my e-Pub on Aug 7, 2020. You can access back issues here.

TOP PICKS BY EDGEPROP

Canal Gardens, Kota Kemuning

Kota Kemuning, Selangor

Periwinkle @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Bandar Puteri Puchong

Bandar Puteri Puchong, Selangor

Pangsapuri Seroja Bukit Jelutong

Shah Alam, Selangor

TriTower Residence @ Johor Bahru Sentral

Johor Bahru, Johor