KUALA LUMPUR (Sept 2): Property developer Paramount Corporation Bhd (PCB) remained bullish on the prospects for the second half of the year despite a rocky first half due to the Covid-19 pandemic and the Movement Control Order (MCO).

“In a nutshell, for the first six months of the year, it’s a washout. But the good news is, as of Aug 31, we recorded sales of RM370 million and a high booking of RM490 million.

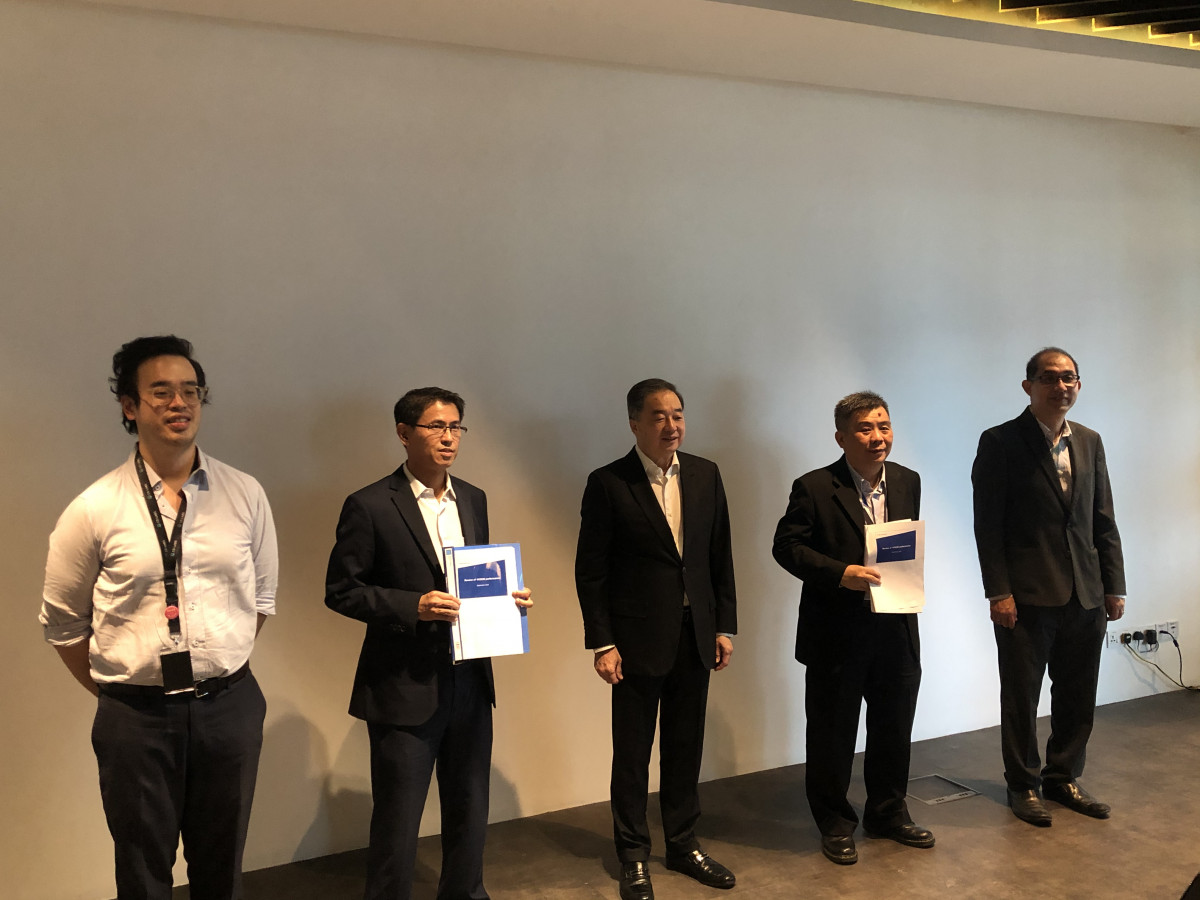

“Hence, we are quite surprised by the demand. Mainly, this is thanks to sales agents who are hard at work generating sales even during the MCO,” said PCB CEO Jeffrey Chew at a media briefing today.

He also highlighted that the current low interest rates are a major deciding factor for the homebuyers.

For 2H2020, Paramount is looking at RM640 million worth of residential property launches (121% higher than 1H2020) that include Greenwoods Salak Tinggi, Sepang; Berkeley Uptown, Klang; Sejati Lakeside, Cyberjaya and Bukit Banyan, Sungai Petani, Kedah.

For 4Q2020, the developer will be looking to launch the new Arinna high-rise development in Shah Alam equipped with smart features.

Future projects in the pipeline include a high rise development in the ‘Embassy Row’ off Jalan Ampang, KL; a transit oriented development in Section 14, PJ; a residential development in Damansara Jaya and the expansion of the Bukit Banyan township.

To recap, PCB had recorded RM193 million of sales for 1H2020. Majority of the sales were contributed by its landed residential developments - Sejati Lakeside (28%), Cyberjaya; Bukit Banyan (20%), Sungai Petani; Greenwood’s Salak Perdana (16%), Sepang, Selangor and the high-rise project Utropolis Batu Kawan (15%), Penang.

Meanwhile unbilled sales stood at RM873 million as of 2Q2020.

Profit before tax and revenue for the property division during 1H2020 stood at RM3.3 million and RM182 million respectively, down 94% and 46% year-on-year. This is attributed to lower construction activities and sales achieved due to the MCO.

Main contributors to 1H2020 revenue for the property division include Bukit Banyan (25%), Greenwoods Salak Perdana (24%) and Utropolis Batu Kawan (19%).

Average take-up rates for the properties stood at 72% for the period.

As for land acquisition, Chew noted that the current stand is Paramount will be looking at RM200 million to RM300 million of acquisition over the next six months to a year.

“We will be sticking to about RM500 million over the next five years from this year, focusing on Klang Valley and Penang,” he said.

As at June 30, 2020, Paramount had 505.1 acres of undeveloped land in the Klang Valley, Kedah and Penang.

EdgeProp Malaysia Virtual Property Expo 2020 (VPEX 2020) is happening now! Find out more exclusive projects and exciting deals here

Stay safe. Keep updated on the latest news at www.EdgeProp.my

Click here for more property stories

TOP PICKS BY EDGEPROP

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Bandar Rimbayu

Telok Panglima Garang, Selangor

Ridgewood Canary Garden @ Bandar Bestari

Klang, Selangor

Anjung Sari

Setia Alam/Alam Nusantara, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)