While the Covid-19 pandemic has put a stop to almost all economic activities globally, except for certain industries are booming such as glove manufacturing, the industry property segment appears to be a silver-lining for the property market in Malaysia.

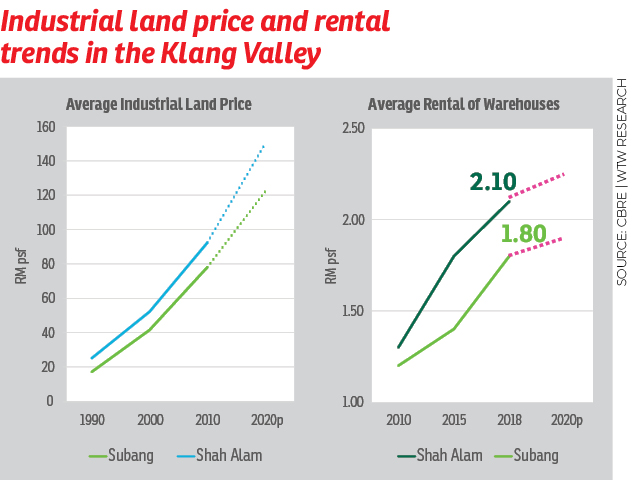

Despite a general weak property market, CBRE|WTW group managing director Foo Gee Jen observes that the average industrial land price for hot spots like Subang and Shah Alam are actually on thr rise, reflecting the increasing demand.

Read also

PKFZ: Opportunities to be discovered

“In fact, industrial land price in Subang and Shah Alam has increased more than double to the current RM120 to RM150 psf, from RM15 to RM30 psf back in the 1990s. We foresee the uptrend to continue,” Foo said during his presentation session in the 13th Malaysian Property Summit organised by the Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector Malaysia (PEPS) on Oct 13, 2020.

Meanwhile, the average rental of warehouses in Shah Alam and Subang also continued to rise in the past decade, from RM1.20 - RM1.40 psf to RM1.80 - RM2.10 psf in 2018.

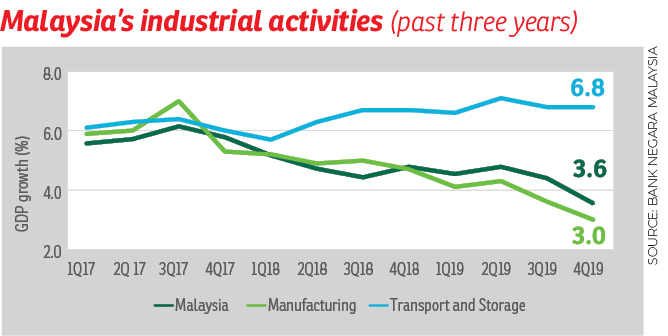

He attributes the rapid growth of the transport and storage sector to the rising demand of internet shopping. It has outperformed the average 5% Gross Domestic Product (GDP) at an average annual growth of 6.5% from 2017 to 2019.

Despite industrial property seeing a decline of 30% in transaction volume for the first half of 2020, the market demand is intact as there are still many enquiries for industrial properties in the Klang Valley, Johor and Penang areas, even during the MCO period, adds Foo.

“This could be partly due to Malaysia being one of the countries with the highest e-commerce penetration rate at 60% to 62% even before the pandemic. As the pandemic hit, the penetration rate is even higher and further drives the growth of the sector,” Foo explains.

The trend is evident in the recent mega warehouse investments in Malaysia, for example the setting up of the one million sq ft Ikea regional distribution and supply chain centre in Pulau Indah, as well as AREA Logistics’ warehouse with a built-up of 1.5 million sq ft in Ampang.

To further fuel the growth momentum, the government has introduced several projects or infrastructure developments to improve the connectivity and facilitate future industrial needs. These initiatives include the National Transport Policy, East Coast Rail Link, Serendah-Port Klang Rail Bypass and development of Carey Island.

Nevertheless, Foo believes more can be done to maximise the value of the sector to offer more to the country.

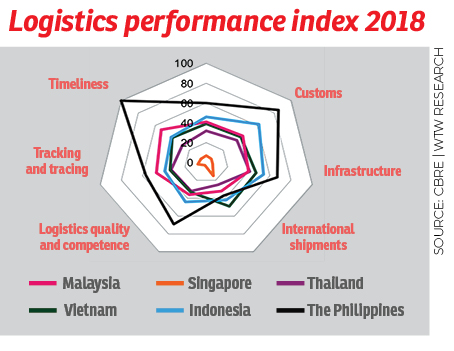

Citing the Logistics Performance Index 2018 by World Bank, Foo highlighted that Malaysia was ranked 41st, far behind Singapore (7th), Thailand (32nd) and Vietnam (39th).

Malaysia also allocated a lower national budget of less than 5% to enhance the country’s infrastructure in 2017, while neighbouring countries such as Indonesia, Thailand and the Philippines each committed over 20%.

“We may be in a better position in terms of hard infrastructure but we should now focus more on the soft infrastructure, such as logistics tracking and tracing, as well as training the professionals,” Foo shares.

Nonetheless, he believes the industrial property sector is still a promising one in the current uncertain times. “Though the rental outlook is neutral in the short to middle term, the prime areas and modern facilities will stand firm on the higher side of market rental.”

Moving forward, Foo says the industry players should also relook at the warehousing practice, from “Just In Time” inventory to larger inventory to mitigate unpredictable supply chain disruption caused by abrupt lockdowns.

Rising demand

Being in the industry for over 10 years, CID Realtors Sdn Bhd’s team leader of industrial division Norman Soo affirms that the industrial property market in the Klang Valley is not showing any sign of slowing down.

“In fact, there have been more enquiries in the past few months, even though we can only focus on the local buyer or tenant now as the oversea investors couldn’t fly over to Malaysia for viewing. The problem is, we do not have enough supply to offer. Majority of the tenants or buyers are looking to buy in Port Klang or Shah Alam,” he tells EdgeProp.my.

Although industrial property transactions have slowed down in October, Soo didn’t see this as a big issue as the year-end is normally the low season.

“I believe the transaction volume and price will continue to grow in the short to medium term, supported by the rising demand for warehouses and limited market supply,” he shares.

He also points out that generally, the industrial property price has continued to grow despite the pandemic environment.

“There were cases asking for higher selling prices than pre-pandemic times and they were still sold, specially in hot spots like Port Klang. The market has not been dampened by the pandemic,” Soo notes, adding that 80% of the buyers were from the manufacturing and logistics business sector.

Meanwhile, senior negotiator of The Roof Realty Sdn Bhd Sonia Soh shares a different view on the industrial property.

“Industrial property prices have come down a little but it is not significant. It is mostly because the owner is more open to negotiate on the selling price, and asking rental and leasing terms. However, I agree that generally, the market has stronger interest and much more enquiries on industrial properties than other property segments due to supply being much less than demand,” she comments.

Most of the industrial property transactions handled by Soh were rental deals from a variety of business sector owners such as timber, manufacturing and warehouse.

“There are more business owners looking for warehouse space since the pandemic hit. They prefer convenient locations such as Port Klang and Shah Alam. However, it is not easy to match a buyer or landlord and a seller or tenants due to limited supply,” she offers.

CID Realtors’ Soo concurs with Soh, adding that the price is not the biggest consideration for tenants and buyers, but the match-making for seller and buyer, to fulfill buyer’s (or tenant’s) needs for the right location and right size.

“For example, there are people who are enquiring about the Port Klang Free Zone, eyeing the tax benefits, but unlike other parts of Port Klang, PKFZ’s plots are only available for rent, and furthermore, it is 100% taken up,” Soh says.

He also shares that industrial properties, which are generally owned by corporations that have better holding power than individual investors, would not let go of good property easily.

“Besides facilitating their business operations, a well- located industrial property also provides the prospect of capital appreciation in the future. Therefore, an industrial property in the right size and right location is always a recession-proof segment,” he concludes.

This story first appeared in the EdgeProp.my e-Pub on Oct 16, 2020. You can access back issues here.

Get the latest news @ www.EdgeProp.my

TOP PICKS BY EDGEPROP

Duduk Huni @ Eco Ardence

Setia Alam/Alam Nusantara, Selangor

Taman Sengkang @ Pasir Panjang

Port Dickson, Negeri Sembilan

Apartment Putra 1 (Pangsapuri Putra 1)

Kajang, Selangor

Astana Alam Apartment

Bandar Puncak Alam, Selangor