The Industrialised Building System (IBS) is the term used to represent the prefabrication concept in Malaysia. It is a construction technique where components are manufactured in a controlled environment, before they are transported, and then assembled into structures with minimal site work.

The use of IBS is said to bring advantages such as reduction of unskilled workers, less wastage, less volume of building materials, increased site cleanliness and better quality control — compared to the conventional construction which consists of a reinforced concrete frame and bricks, beams, columns, walls and roofs that are cast in-situ using timber framework. The latter requires many wet trades on-site and is often regarded as labour intensive, less productive and requiring lengthy durations.

The adoption of IBS has always been seen as an initiative to increase productivity in the construction industry. In the recently announced Budget 2021, the tax incentive given to manufacturers of IBS components — so as to further improve technology adoption in the construction sector through usage of IBS — has been extended.

Companies that produce at least three basic components of IBS or IBS systems that use at least three basic IBS components are eligible for the incentive tax allowance of 60% on qualifying capital expenditure incurred within five years, which can be set off against 70% of statutory income for each year of assessment. The application of such incentive is made effective from Jan 1 2021 to Dec 31, 2025 through the Malaysian Investment Development Authority (MIDA).

Even though IBS has been promoted by the government and championed by the Construction Industry Development Board (CIDB) ever since it was first introduced to the Malaysian construction industry in 1966, its take-up rate is not as high as expected. This is due mainly to the cost factor along with the availability of cheap foreign labour.

Higher cost than conventional construction

At present, the use of IBS can result in an additional cost of 6% to 10% more than the conventional construction, which is deemed economically inappropriate for developers in their projects.

The outbreak of Covid-19 is said to have presented an opportunity for a higher adoption of IBS, as the cost of conventional construction could be higher than before, following the shortage of foreign labour and the ever-rising material cost.

Even so, developers are still not motivated to see IBS for building construction in the near future. This is because the pandemic has simultaneously dampened the housing industry across the board, where the supply of houses is foreseen to reduce tremendously in response to the market slowdown.

Considering that consistency in terms of volume, continuity, and repetitiveness is a must to ensure economic viability in IBS construction, private developers would still prefer conventional construction (i.e. formwork system) over IBS, from the perspective of sheer cost and market size.

Mismatch of incentives

Though there are no lack of incentives to encourage the use of IBS throughout these years, the response from the industry players is still lukewarm. This is because there is a mismatch of incentives between the one offered by the government and the one expected by the developers.

The given incentives are mainly “supply-side” in nature, aimed to enhance the supply capacity of the IBS ecosystem. They are either insignificant to offset the additional construction cost of using IBS (i.e. levy exemption given by CIDB), or only targeted on manufacturers at the downstream of the supply chain (i.e. incentive tax allowance given by MIDA), which cannot effectively address the major impediment faced by developers in adopting IBS — cost.

The government should understand that developers, among the wide range of industry stakeholders, hold very important positions in ensuring the success of IBS adoption, as they are the project owners that determine the process of property developments. In fact, developers are the major contributors to the building construction projects in the country.

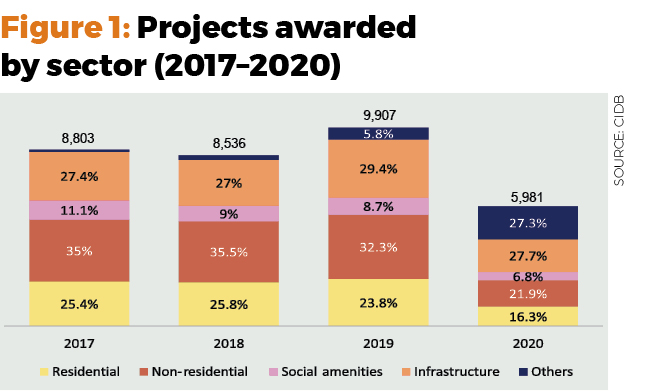

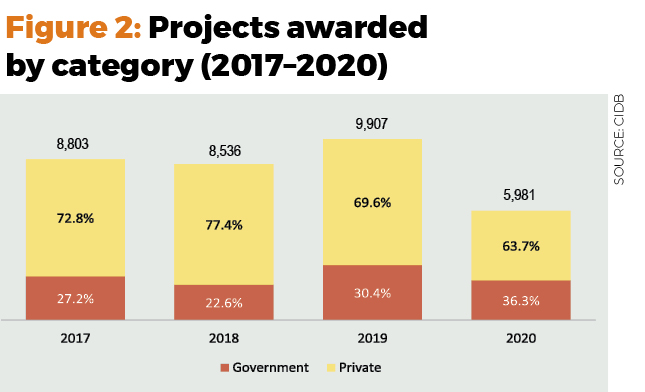

For instance, about 70% of the construction projects in the country are initiated by the private sector every year (Figure 1); and most often, these projects are under the category of residential and commercial developments (Figure 2). If more of the developers from the upstream of the supply chain are incentivised to use IBS, higher demand will be generated, and hence, gear towards a more energised IBS ecosystem in the country.

Having said that, developers are not homogeneous in nature. They are in different types, scales, and even have different business models and operation strategies. Consequently, the role, involvement, as well as the willingness and commitment of developers in the IBS construction are also very different from each other. The government should be well aware of their diversities and incentivise them accordingly.

Not all developers are like SP Setia, Gamuda, IJM, Sunway or MRCB that possess in-house IBS manufacturing capacity and are able to provide full-fledged IBS engineering services. Due to their massive financial structure, these developers can take part in the whole IBS supply chain, ranging from being a planner, designer, contractor, manufacturer, as well as other trades along the IBS supply chain.

Also, there are various forward-integrated product manufacturers (such as Kimlun) or contractors (such as LBS and Seri Pajam) who turn into developers. These developers are capable of providing IBS construction services.

Direct incentives to builders

In this case, direct incentives that can either help sustain their mass volume production or upskill their IBS manufacturing facilities, such as tax holiday; as well as lowering their production cost through duty import exemptions for machinery, equipment, and technology, are most welcomed.

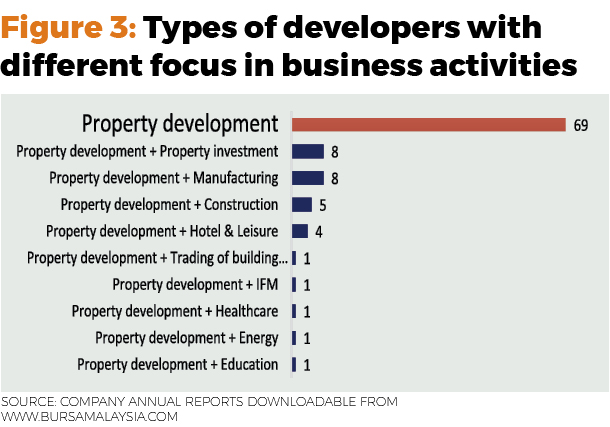

Most often, developers in Malaysia are only involved in property development and investment, while outsourcing their building and construction works to third parties. For example, as of Nov 2020, there are 69 out of 99 public-listed property companies on the main market of the Kuala Lumpur Stock Exchange that are practising property development as their core business (Figure 3).

This type of developers is normally referred to as “pure developers”, and generally obey the following development process: purchase a tract of land or join venture with the land owner, determine the marketing of the property, engage consultants to develop the building design and programme, obtain the necessary public approval and financing, engage contractors to build the structures, and ultimately rent it out or sell it.

Given that financial viability is important for them to kick-start a project, and that they will always strive to keep the construction cost down in order to offset the ever-rising cost of doing business posed by artificial regulatory barriers; any attempts from the government that could help them to mitigate the additional cost of using IBS are more than preferable.

Non-cash incentives to consider

For example, measures that focus on improving the project development process, such as the provision of fast lane approval for IBS projects or eliminating onerous building requirements, will go a long way to both advancing development cost and meeting the existing housing demands on a timely basis. Also, any “non-cash incentives” such as higher plot ratio for affordable housing projects that adopt IBS construction or the reduction of compliance cost, are definitely seen more attractive and motivated, as they are deemed benefiting the developers directly.

In view of the importance of “demand-side” incentives in generating higher demand for IBS among private developers — coupled with the fact that these “demand-side” incentives are beyond the jurisdiction of CIDB or MIDA, and can only be accomplished by including the Ministry of Housing and Local Government, state governments and local authorities — establishing a functional IBS ecosystem is no longer an issue within the construction industry alone, but a part of a bigger ecosystem — the property industry ecosystem.

This story first appeared in the EdgeProp.my e-Pub on Nov 20, 2020. You can access back issues here.

Get the latest news @ www.EdgeProp.my

TOP PICKS BY EDGEPROP

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor