PETALING JAYA (June 17): The one-month long full lockdown (FMCO) is expected to affect the property sales and developers’ earnings in the second quarter this year, but Maybank Investment Bank Research believed that property sales will be picking up again once movement restrictions are lifted .

Malaysia's property sector is poised for recovery this year, thanks to the historically low interest rates and pent-up demand, research house's analyst Wong Wei Sum said in a research note today.

Although construction works for some projects are allowed to continue during FMCO, other challenges such as stricter SOPs and shortage of raw materials (leading to price increase) appear to plague the property industry during FMCO.

"These have led to slower construction works. Sales wise, the signing of SPAs have been postponed until FMCO is lifted; hence, we expect a quarter-on-quarter (q-o-q) decline in 2Q21 sales," noted Wong.

On the bright side, she said that the statistics by the National Property Information Centre (Napic) for 1Q21 continued to show positive signs.

Property sales (residential; in value) have recovered 26% year-on-year (y-o-y) but declined 6% q-o-q due to MCO2.0 imposed in early January this year.

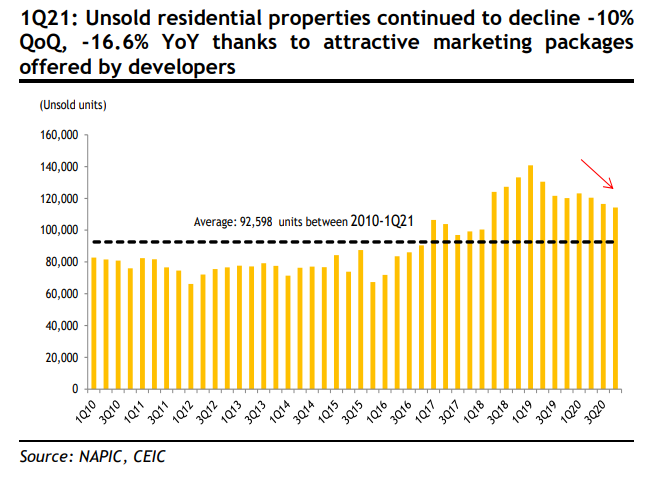

While unsold stocks (residential) continued to improve, by 10% q-o-q and 17% y-o-y (in units) in 1Q21, due to attractive rebates and discounts given by developers amid a low interest rate environment.

"Based on our conversations with developers, sales achieved under the Home Ownership Campaign (HOC) 2020 from June 1, 2020 to May 31, 2021 were better than HOC 2019 (pre-Covid 19)," said Wong.

Meanwhile, in the same report, she maintained a "neutral" call on the property sector, with share prices of property developers largely priced in the positives. "Nevertheless, these positives appear to have been largely priced in and our coverage stocks now offer limited upside to their target prices (TPs)," said Wong.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

Taman Wawasan, Pusat Bandar Puchong

Puchong, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Avenham Garden @ Eco Grandeur

Bandar Puncak Alam, Selangor

Bandar Baru Kuala Selangor

Kuala Selangor, Selangor

Jalan Cakera Purnama 12/19

Bandar Puncak Alam, Selangor