Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz in June 2021 announced a six-month loan moratorium under the RM150 billion PEMULIH stimulus package. Although the measure will not be interest-free, the minister noted that banks would waive compounded interests and penalty charges for borrowers who take up the loan moratorium.

Many who were looking forward to the reimplementation of the moratorium, like hoping for a raindrop in a drought, felt relieved when the announcement finally came.

The initiative to provide financial relief by deferring loan repayments for six months was initially viewed as commendable. However, upon scrutiny, it does not seem to achieve its underlying intent to help the rakyat who are struggling.

At the end of the moratorium period, borrowers have to service the deferred instalments plus other additional interests as the loan moratorium is not interest- free. It is simply a deferred payment scheme for six months, whereby additional interests are added to the amount.

Caught unaware in the first moratorium

In the first round of moratoriums in year 2020, many were caught off guard when at the end of the moratorium period, borrowers were slapped with additional interests over the six months of the blanket automatic moratorium, irrespective of whether they applied for it or not, or even if they continued to duly service the regular loan repayments.

It was later revealed that any loan repayments during the moratorium period were treated as “overpayments” and the amount was not used to reduce the number of loan instalments during the moratorium period. Automatically, the banks continued to charge interests on the cumulative loan repayments “suspended” during the six-month loan moratorium period, irrespective of “overpayments”. Furthermore, most banks required borrowers to apply for approvals for such “overpayments” to be offset against the principals.

Instead of an interest-free loan moratorium expected by laymen to benefit borrowers, the banks took advantage of the situation by charging another round of interest over and above the original loan sum which was deferred, hence worsening borrowers’ financial situations rather than alleviating their financial burdens.

A majority were not aware as banks did not provide any notifications or any options for the customers, leaving it entirely to an individual’s awareness while the banks stay secure behind the caveat emptor disclaimer.

The difference in the current moratorium this year is that it is not automatic and requires an opt-in instead. While this is commendable, the terms are not exactly clear especially with respect to interests charged and other applicable terms and conditions, all of which should have been made transparent from the onset. The banks should be put under obligation to duly inform borrowers in writing to enable them to make informed decisions.

One thing is certain though, similar to the 2020 moratorium, the 2021 one does not reduce borrowers’ lending costs as it is not interest-free. Hence, interests will continue to be charged during the moratorium period, and ultimately, borrowers will end up paying more to the banks when the moratorium period ends.

As put forth blatantly by a retired employee of Bank Negara Malaysia (BNM), whom we personally know, in referring to the loan moratorium: “In a lot of ways, the banking industry is similar to the gambling industry – the House will always win. Borrowers never stand a chance”.

While some of us have known this all along, it is no less shocking and heartbreaking to see how banks choose to treat their customers under the guise of helping them in their darkest hours, unless proven otherwise.

Is loan moratorium exploiting desperate borrowers?

In a recent talk on the loan moratorium issue, an ex-CEO of a bank clarified how there is no such thing as “a free lunch” when it comes to banks (including Islamic banks). He elaborated how the purported loan moratorium for hire purchase and mortgage loans will result in borrowers having to pay extra interests to the banks.

Stating the obvious, he advised distressed borrowers to think twice before opting in. He also commented that this time around, some banks have wised up and applied the extra interest charges to hire purchase loans too, unlike last year.

“What is the key takeaway from all of this?” I asked him. The reply was, during good times, banks will make profit out of their borrowers, and during bad times, banks will just make more profit out of their borrowers.

In HBA’s final analysis, it is advisable for borrowers to avoid taking the loan moratorium for housing loans if possible because they will end up worse than when they first started, with added interests to their extended loan periods.

Borrowers should ask their banks for a detailed computation or illustration to the extra interests they have to stomach if they were to opt into the six-month deferred payment scheme.

In clear numbers

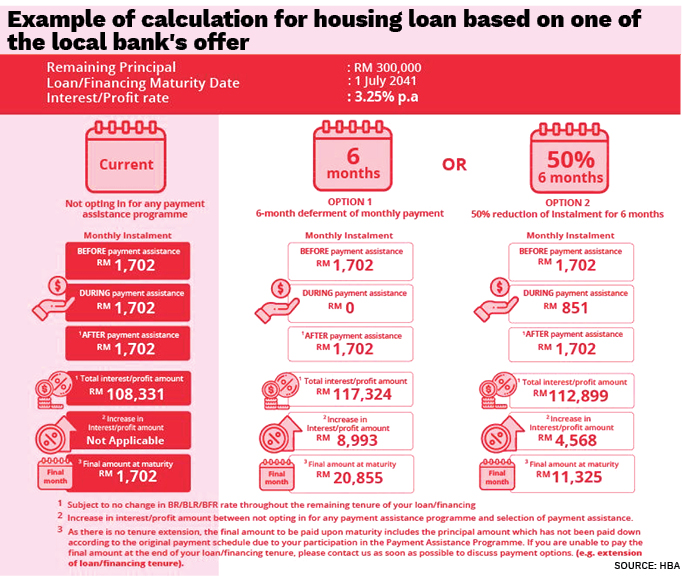

Latiff has a balance of RM300,000 in his housing loan with an effective interest of 3.25% per annum, translating to a monthly instalment payment of RM1,702. Assuming Latiff does not take the loan moratorium programme, his remaining interest to be paid for this housing loan is RM108,331.

Latiff needs to be made aware of the additional interest he will have to pay as a result of the loan moratorium, as it was reported that “normal interest will continue to accrue”. How is this “normal accrued interest” going to be calculated and what is the impact on Latiff’s monthly repayments?

Based on the website of a leading bank in Malaysia, the impact on Latiff applying for the loan moratorium is as follows:

By applying for the six-month loan moratorium, Latiff will incur additional interest charges of RM8,993 or approximately 8.3% over his original loan. This additional interest charge of 8.3% is excessive for just a loan moratorium of only six months. The banks must clearly explain this staggering rate!

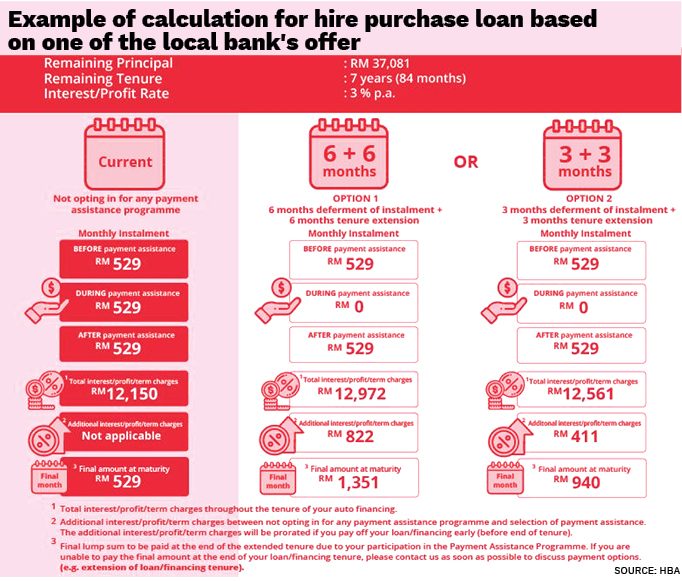

The bank has also illustrated the potential impact of the loan moratorium on a hire purchase loan with a monthly instalment of RM529 at a remaining principal amount of RM37,081, a remaining tenure of 84 months and an interest rate of 3.0% per annum.

By applying for the six-month loan moratorium for his hire purchase loan, Latiff will incur additional interest charges of RM822 or approximately 6.76% over his original loan. This additional interest charge of 6.76% is still excessive for just a loan moratorium of only six months and the banks must explain this exorbitance.

Banks must be transparent

The Finance Minister, as reported, believed that the domestic financial system will be able to manage the impact of the loan repayment deferments. “While the banks will be affected by the loan moratorium, I think they will be in a position to support it, given the strong capital buffers that they have”, he said.

Hence, may we humbly suggest that BNM and the banks consider the following?

The banks should be transparent and show their borrowers the computations/illustrative examples of the interest that will continue to accrue during the moratorium period like those on our credit card statements. It should be in easy-to-understand simplified figures in a table.

Tweak the loan moratorium scheme so that the moratorium period is really interest-free whereby there will be no interest charged, which means borrowers will pay the same amount of monthly repayments to the banks after the said period ends. It has a negligible impact on banks’ earnings but will alleviate the financial burden of borrowers.

Exercise some corporate social responsibility towards the eight million borrowers applying for the moratorium. Several banks are enjoying record profits despite the Covid-19 pandemic as evident from their first quarterly reports. Empathise with the fact that our fellow Malaysians are facing reduced or zero incomes while many businesses are facing drastically reduced cash flows with closures being a real threat.

Repackage the existing loans including rescheduling and restructuring the financing to suit the specific financial circumstances of borrowers in the current hard times without the need to provide supporting documents.

Conclusion

No matter what you call the borrowers, they are still your valued customers who have supported the banking industry in one way or another. While we understand the need for banks to cover its borrowing costs and generate satisfactory returns for their shareholders as they are commercial entities, it doesn’t seem morally right to us that they are allowed to make a fortune from borrowers/customers’ misfortune especially in this global pandemic.

To borrowers taking this moratorium exercise, HBA urges them to put the cash flow saved into good use and not to splurge on any unnecessary expenses as this is only a temporary measure. Bear in mind the monthly instalments at a higher cost must commence after the expiry of such a deferred payment exercise.

Datuk Chang Kim Loong is the Hon Secretary-general of the National House Buyers Association (HBA).

HBA can be contacted at:

Email: [email protected]

Website: www.hba.org.my

Tel: +6012 334 5676

This story first appeared in the EdgeProp.my E-weekly on July 16, 2021. You can access back issues here.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur