SINGAPORE (July 27): CDL Hospitality Trusts (CDLHT) is mulling to diversify its investment strategy besides hospitality assets to include rental housing, co-living, student accommodation and senior housing, reported The Edge Singapore on July 26.

“The managers believe that the revision of CDLHT’s principal investment strategy will provide CDLHT with better growth by increasing the diversification of its portfolio, enhancing income stability,” CDLHT said in a statement.

The trust manager added that the broader strategy will rein in more investment opportunities, in line with their key financial objectives to maximise rate of returns and make regular distributions.

As at Dec 31, 2020, CDLHT has assets under management worth S$2.9 billion (about RM9 billion).

CDLHT owns 18 properties, comprising six hotels and a retail mall in Singapore; with additional hotels in Australia, New Zealand, Japan, United Kingdom, Germany, Italy and Maldives.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

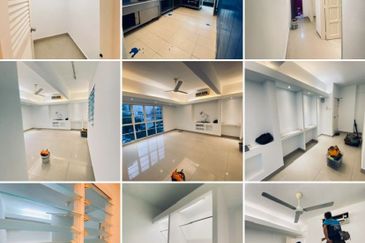

Amberside Country Garden @ Danga Bay

Johor Bahru, Johor

Baypoint @ Country Garden Danga Bay

Johor Bahru, Johor