PETALING JAYA (Sept 29): Sime Darby Property (SD Property) and Asia Pacific logistics specialist LOGOS Property Group Ltd have formed a joint venture company to establish a fund management platform to invest and develop “built-to-suit to lease or sell” industrial and logistic assets in Malaysia.

SD Property’s wholly-owned subsidiary Sime Darby Property (Capital Holdings) Pte Ltd and LOGOS Property's wholly-owned subsidiary LOGOS SE Asia Pte Ltd have today inked a shareholders’ agreement today, to form a joint venture company named Industrial Joint Venture (Holdings) Pte Ltd. The JV company will establish a fund management platform to manage funds for the logistics sector and to offer development services

Under the agreement, SD Property will hold 51% of equity of the JV company, while LOGOS hold the remaining 49%.

The collaboration aims to raise US$200 million (about RM850 million) in seed money from accredited and institutional investors to finance the planned development of industrial property at Bukit Raja in Klang, Selangor.

The JV company will focus on ‘build-to-suit to lease or sell’ assets, primarily for clients in the logistics sector.

To this end, SD Property has allocated a 177-acre site within its Bandar Bukit Raja township in Klang, Selangor to spearhead this initiative. Bandar Bukit Raja was selected to leverage its strength as an established industrial township given its strategic connectivity to essential infrastructure in the Klang Valley.

LOGOS Property’s experience in providing sustainable, integrated logistics solutions with green building certification will be replicated at these facilities, with the implementation of the latest in warehouse/logistics automation and construction technology.

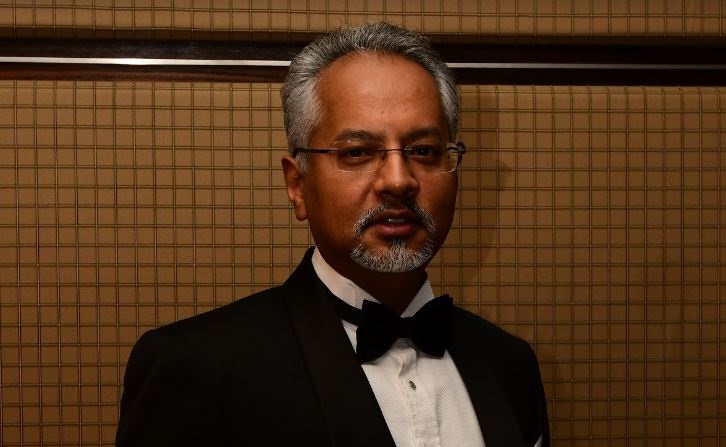

In a virtual media briefing today, managing director of SD Property Datuk Azmir Merican said the joint venture with LOGOS is timely as the industrial and logistic segments are becoming increasingly important since the pandemic.

“The global demand for e-commerce is very strong (especially prevailed during the pandemic) and we feel it is a very strong pivot for Sime Darby Property to look seriously into the industrial property segment as well as to diversify our real estate company,” he said, adding that the joint venture is also a strategy for a wider recurring income base by 2025.

Azmir added that in the past year, growth in e-commerce propelled by the COVID-19 pandemic has led to shortage of quality warehouses to cater for businesses to expand. This has elevated the demand for better logistics products, infrastructure, and efficiency in supply chain management.

“The prime products we will offer through the fund management platform are earmarked to support the local and regional e-commerce networks, as the developments will be strategically located with easy access to major expressways and connectivity to ports and airports,” he said.

LOGOS Property’s head of Malaysia David Aboud noted that the reason for selecting Bandar Bukit Raya is for its strategic location and connectivity to essential infrastructure of highways, ports and airports via the West Coast Expressway.

“The Asia Pacific logistic sector has been undergoing major growth over the past number of years underpinned by an increase in e-commerce, manufacturing and the diversification to decentralised supply chains,” he said.

Aboud added that in Malaysia, this is resulting in a significant increase in demand from multinational and domestic customers for high-quality logistics space, which is currently not being well serviced by the majority of available stock in the market.

Especially with Covid-19, the importance of logistic and industrial segments were increasingly obvious as demand for better logistic products, infrastructure and efficiency in supply chain management became detrimental, he said.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Wira Heights, Bandar Sungai Long

Kajang, Selangor

Casabayu Townhouse @ Cybersouth

Dengkil, Selangor

Casabayu Townhouse @ Cybersouth

Dengkil, Selangor

Reef Of Tropics, Setia Eco Glades

Cyberjaya, Selangor

Residency Aurora @ Selangor Cyber Valley

Cyberjaya, Selangor

Charms of Nusantara, Setia Eco Glades

Cyberjaya, Selangor

Liu Li Garden, Setia Eco Glades

Cyberjaya, Selangor