Last week, I presented the National House Buyers Association (HBA)’s: ‘tick where applicable” checklist to our newly minted Minister of Housing & Local Government, YB Datuk Seri Reezal Merican Naina Merican in my article published on Dec 11, 2021 entitled: ‘If I were the Housing Minister”

I have since received positive feedback from my fellow volunteers, friends of HBA, industry players, stakeholders, civil servants, politicians from both sides of the divide and housing developers (of the decent and responsible variety). I was reminded by them that there are other issues which are critical and should form part of the YB Minister’s agenda in the near future. Thus, I was inspired to continue my narrative in this Part 2 on areas which need revisiting.

If I were the Housing Minister, I would (in no particular order):

1. ‘Rein in’ and Regulate Liquidator’s conduct and fees

One of the amendments to the Housing Development (Control & Licensing) Act, 1966 (Act 118) (HDA) which took effect on June 1, 2015, namely Section 3 of the Interpretation extends the definition of 'housing developer' to include ‘a person or body appointed by a court of competent jurisdiction to be the provisional liquidator or liquidator for the housing developer’. The amendment to include a liquidator as a “housing developer” was intended to fill the void when a developer is wound up before completion of its duties.

As a result of the amendment, a liquidator will be subjected to the duties imposed by Act 118 and may be liable for breaching duties of a ‘de facto housing developer’. In theory, a liquidator should not be allowed to charge or impose any administrative fee when carrying out his duties (since he is assuming the affairs and responsibility of the defunct developer) contracted in the sale and purchase agreement. For example, functions such as updating the record of ownership and perfecting the transfer to a purchaser when a separate individual or separate title is issued is part and parcel of a developer’s duty, issuing written confirmation of particulars (for sub-sale) under the HDA.

The reality is that liquidators who are appointed to manage the affairs of a defunct developer are charging a purported administration fee of between 2% to 3% of the purchase price for these functions. There are no guidelines to regulate charges by liquidators. The purchaser has no choice in the appointment and is left to a game of chance. The purchaser is at the mercy of the appointed liquidator where each liquidator is like a ‘little Napoléon’ of that particular housing development. The irony is that Section 22D of the HDA clearly states that a fee of not exceeding RM50 may be imposed for a written confirmation of the record of the beneficial owner of the property in the housing development and consent for the assignment. Why then are liquidators granted special treatment by having their charges grossly inflated from RM50 to 2% to 3% of the purchase price?

I have, in fact, elaborated on this issue in my previous article: Liquidators making fortune from homebuyers' misfortune.

Was there a lacuna in the law that has been unearthed? Was there an “oversight” made by the drafters of the law resulting in laws not being able to be enforced and hence remained status quo or was it because the past Minister had forgotten to come up with the related ‘Regulations’?

2. Maintain “No” to DIBS for first-time house buyers

Every now and then, some quarters will accept developers’ mantra to re-introduce the Developers Interest Bearing Scheme (“DIBS”). It should be noted that Bank Negara Malaysia had prohibited and outlawed “any form of interest capitalisation scheme”.

DIBS or any other similarly “schemed” permutations cannot be allowed to re-surface because it risks creating a property bubble as prices are artificially increased and in turn, such increase creates a snowball effect of driving prices upwards creating an unrealistic demand. It indirectly encourages speculation as it creates an easy entry to purchase without taking into account the purchaser’s ability to sustain the loan through good and bad economic cycles.

Whatever the economic situation, the basic facts of DIBS are the same and made worse by the economic situation – it involves developer advancing the expenses of construction and other expenses which are to be collected later as debt from the purchaser with interest element factored in and therefore making the property more expensive.

False Market: The DIBS had created a false demand which in turn pushed up property prices making houses ‘seriously unaffordable’ to the average person.

3. The banishment of ‘oppressive En-Bloc strata sales’

It seems that the Ministry of Energy and Natural Resources was and currently is exploring new ways, including changes in legislation, under the pretext of facilitating strata property renewals or redevelopments in Malaysia. They wish to introduce an ‘en-bloc strata sale’ mechanism for stratified properties.

HBA is opposed to the entire idea as we are of the opinion that it is a mere facade to hide the true intention of overriding or eroding a host of other legislations currently in place to safeguard the fundamental rights of property owners. The said legislations include Land Acquisition Act 1960, the National Land Code, the Federal Constitution (right to own property), Strata Management Act, 2013 and Strata Titles Act 1985.

4. Private Lease Scheme (PLS) ~ ‘scheming’ the naive & unwary buyers

The Ministry of Energy and Natural Resources was seeking to amend the National Land Code, 1965 (NLC) by the introduction of a new proposed Chapter identified as ‘Register of Private Lease’.

In a nutshell, future home buyers may find themselves “renting” in perpetuity if the proposed private lease scheme makes its way into the NLC. The new chapter into NLC, would allow landowners (private corporations) to lease out their freehold land for development under a Private Lease Scheme (PLS).

Note that the term “leasehold property” is commonly used in Malaysia and refers to a State lease. This type of leasehold land is owned by State authorities, who have a moral obligation to renew the lease upon expiry.

In a PLS, the land for development is a freehold property and is owned by a private corporation. The land owner or private corporation will lease the land to a developer for a period of say, 30 years or 60 years or 99 years with the rights given to the developer to develop and construct landed/ stratified properties for sale to the public. The pertinent question is what is being sold to the public?

Under PLS, the sale and purchase agreement signed by the purchaser and the developer is not for the sale of the property, but for the sale of a lease over the landed or strata parcel. This effectively makes the purchaser a lessee of the property, and not the owner of the property, as assumed by most buyers in general. The current NLC does not allow for leases to be created for more than one person but the proposed PLS will contradict this provision.

The scheme also will result in land ownership in perpetuity as private landowners would have a monopoly on merely ‘renting’ out lands where landed/ stratified properties are built and they will have the absolute right upon the expiry of the said 30 years or 60 years or 99 years not to renew or continue with the lease. It will be subjected to terms and conditions (normally) favourable to the landowner making it their prerogative.

Most property purchasers are unaware of the implications of purchasing under a PLS and would assume that they are buying a leasehold property under the State government, which is not the case. It is disastrous to equate PLS to leasehold land. A lot of people are bound to miss the “forest for the trees” by buying a property under PLS, thinking that it is a state lease property. We believe that this new class of real estate ownership should be rejected: it differs from our existing culture of titled system of ownership. There is no safeguard of ownership to buyers and HBA objects to such deceiving schemes.

Read the following published articles on the rationale of our objections:

Unfortunately, the die is cast for certain developments in Johor who have used PLS though the laws are not in place. To minimize the damage done, there should be special legislations for certain gazetted economic zones like Medini, Johore with proper safeguards for the buyers. It cannot be allowed to be applied nationwide as it would ‘open a new can of worms’.

This PLS scheme issue is currently the subject of a court case at the Court of Appeal stage where HBA team of pro bono lawyers are involved. The Ministry of Energy and Natural Resources has since halted the idea of a new proposed Chapter identified as ‘Register of Private Lease’.

5. Delete Housing Development Regulation (HDR) 11(3) - EOT abuse

At the stroke of a pen, compensation payable to a group of aggrieved house buyers are taken away by the then Minister and his Controller of Housing (past past government fault)

Between 2014 to July 2019, a total of 536 projects were granted ‘extensions of time’ (EOT) from the Minister and his Controller of Housing, which prohibited house buyers from seeking compensation in the case that their house completion is delayed. A house buyer typically can get compensation of 10% of the purchase price, if the developers exceed the mandatory 36-month timeframe.

The then Minister and his Controller of Housing obliged them under HDRegulation 11 (3) by granting housing developers an EOT (some between 6 month to 24 months). With the EOT, compensation for late delivery is waived. Is it right for the Minister to exercise this discretion in stealth as home buyers are usually not consulted prior to such applications for EOT, without any valid basis and obviously, at the disadvantage of home buyers?

In the decision of the Federal Court on Nov 26, 2019 in Ang Ming Lee & Ors v Menteri Kesejahteraan Bandar, Perumahan dan Kerajaan Tempatan & Anor and other appeals (2020) 1 CLJ 162, the Apex Court has effectively put to rest the unbridled attempts by the then Housing Minister/s and those under their charge to extend the ‘handover dateline’ from the mandatory 36 months to 48/ 54/ 60 months. The lengthy litigation were undertaken by HBA team of pro bono lawyers and was a victory for all house buyers,

We have been alerted that there are recent objectives to circumvent the Federal Court decision by invoking a different provision in the Housing legislation to replicate the same action. Is it a ‘Resurrection of EOT: Old Wine in New Bottles?’. Perhaps, the house buyers need to make another trip to the Courts to rectify the injustice via a civil suit with a prayer pertaining to the act of ‘Contempt of Court’ against whoever invokes the ‘Resurrection of EOTs’.

What is happening to the Housing Ministry? The Ministry is supposed to be the authority that many an aggrieved house buyer turns to in times of developer defiant of the law, the Ministry house buyers rely on for protection and for all the desperately needed interventions and assistance when a housing project is delayed or abandoned.

This gross abuse of power should be checked under the new Minister’s watch. Any decision which deprives the home buyers of their rights and entitlement should be exercised transparently, strictly and with open communications.

6. Time to 'upgrade' the archaic Uniform Building By-Laws (UBBL) and bring it to the 21st century

UBBL should be up for a holistic review instead of in an ‘ad hoc’ manner, amending and/ or adding a few clauses and chapters here and there.

Having been drafted in the mid 1970s' to regulate building design standards, implementation and construction based on their British counterpart of the same era, it will be about half a century old come 2020. UBBL is a piece of 'archaic' secondary legislation long overdue for a major overhaul.

The By-Laws were struggling to cope with the rapid development of the building industry that took place since the 1980s', let alone able to cater for the 21st century where the building industry has undergone massive changes and transformation.

During this period, they were found ill equipped to deal with new development and demand of the industry with its deficiencies, inadequacies, antiqueness were too apparent for all to see and experience. Some parts of the fire fighting provisions were revamped in the 2010s' but clearly the overall effort was not satisfactory.

A major revamp is required to put the Building Codes / Regulations in perspective / context of the 21st Century building methodology. .

The assumption is that since better building technology has enabled higher buildings, it should translate to better, more “sophisticated”, environmentally sustainable and “smart” buildings. The sad reality is that there are tremendous numbers of defects found even in newly constructed buildings. Water leakage has been the most common nightmare for any building occupants. The situation is worsened by green house and urbanization effects that bring about heavier and more frequent precipitation, and stronger wind. There should be a holistic review in prevention of dampness. More waterproofing and damp proofing measures are needed.

The UBBL should cater to a new generation of buildings – performance based?

7. Formulae to control house prices

If the government can control the prices of essential goods such as rice, sugar, cooking oil and other daily essentials, it should also be able to control prices of houses, more so for the affordable housing category.

Currently, the prices of raw building materials such as cement, sand and steel are regulated by the government. The same goes for professional fees of consultants. such as architects, lawyers, engineers and surveyors are also regulated and processing fees standardised. The price of a piece of land could also be set by the National Property Information Centre (NAPIC).

If the pricing for so many items and services can be regulated, there is no excuse not to regulate certain sectors of the housing industry which affect the majority of the nation.

Price controls might be necessary to allow people, especially the middle- and lower-income groups, to own their own homes. HBA suggest that the government cap the profit margins of property developers constructing “affordable” houses. This would accordingly lead to a price reduction by those involved in the building of such homes, including sub-contractors, suppliers and vendors,

8. Reduce the 'Cost of Doing Business' to bring down the house prices

The ‘Compliance Costs’ for development such as land premium for land conversion; development charges; submission fee and upfront deposits to local authorities (planning department, building department, engineering department, landscape department, etc), cost incurred for SiFus, and other statutory contributions should be reduced. Developers will factor Compliance Cost into their sale price. If these Compliance Cost could be reduced or waived (where unnecessary), the price of house should also correspondingly come down (provided the developers doesn’t up their profit margin) pun intended.

Cost of laying the last mile of public utilities such as electricity, water, etc to be borne by respective utility companies (TNB, SYABAS, TELEKOM etc) and not the housing developers who obviously will factor into their sales price.

9. Making 'Qlassic Standards' mandatory

Construction Industry Development Board Malaysia (CIDB) has been promoting Quality Assessment System in Construction (QLASSIC) for quality standards in the housing industry some decades ago. It is somewhat similar to the ‘SIRIM’ endorsement in electrical appliances that we have in our kitchen.

Currently, buyers have to face with shoddy workmanship and sub-standard materials that are prevalent in the housing market without any recognised standards to measure quality. Perhaps, a study should be made with a view to make Qlassic quality standards mandatory.

Read my published article entitled: Defects turning new house owners' delight to dismay

10. Fine tune Bumiputra Discounts

HBA has previously proposed the abolition of Bumiputera discounts for luxury properties.

Imagine a luxury home costs RM3 million and a 7% Bumiputera discount is RM210,000. That money can be used to build three low-cost apartment units worth RM70,000 each for poorer Bumiputeras

Developers were profit-oriented and forcing them to give discounts would see them raising the prices of other properties to make sure that their profit margins were met. This would invariably result in a higher cost of home ownership for non-Bumiputeras. On top of the abolition of Bumiputera discounts for luxury properties, there should also be a cap on the maximum number of properties Bumiputeras can buy at a discount. If there was no cap, more affluent Bumiputeras could buy several homes under RM1 million at discounted prices, depriving other less privileged Bumiputeras. If there is no cap, the richer Bumiputeras can buy multiple properties at lower prices and resell them for a quick buck. That is why HBA proposes that Bumiputera discounts be limited to 2 properties per person, to prevent abuse. Bumiputera discounts should be limited to private residences, and not commercial properties.

The manifesto, themed “With BN for A Greater Malaysia”, also promises to end the policy of Bumiputera lot discounts for property valued at RM1 million and above

Read my published article entitled: Timely release mechanism of bumiputera lots will reduce price of property

11. Transparent data sharing with related agencies

The Minister should have the following property data/s available for the public to access with a ‘click of a button’:

-

those still in the drawing board;

-

under construction and incoming supply; and

-

available stock already completed

By price range within each State; breakdown to district and municipality

By make and types eg, single or double storey landed or stratified properties

By location, location & location

NAPIC has a portal for data/s sharing between KPKT – DOSM (statistics) which shows the average income of the district and towns. The integrated system called HIMS (Housing Integrated Management System) is supposed to be available by the end of 2021. This system would enable the rakyat to make informed and correct decisions when purchasing or renting.

There should also be sharing data on abandoned housing projects both private and government related.

12. Rid of Speculators, bogus house buyers & Investors Club

The situation has been getting worse with the self-glorified “Investors Club” mushrooming in the housing market.

The ‘modus operandi’ of the operators of such a club is to negotiate as block purchasers with cash-strapped developers and bargain for a pre-launch block discount of, say, 25% off the sales price. The operators then circulate amongst their members for a “bargain” early-bird discount of 15%, thus making themselves a 10% clean profit. The members of the Investors Club will subsequently dispose of their “product” upon delivery of vacant possession at a further profit.

Seminars like “How to become a billionaire” and “Invest in properties without deposits” will trigger young adults into thinking of shortcuts toward great riches.

This is to alert the Government that this issue was prevalent, some 3 years ago and is making a comeback.

HBA fully understands and appreciate the vital role played by the Ministry of Housing & Local Government and housing industry in the fabric of the nation’s social and economic development. This is one industry and Ministry that is the most closely connected to the nation heartbeat. A roof over one’s head is one of the most basic needs of life next to food, water and air. That is why HBA strongly feels that more should be done to improve and overcome the prevalent weaknesses afflicting the housing Ministry and industry.

I reiterate that I am not the Housing Minister and do not desire to be one. This article was written to articulate my aspirations for a better Malaysia.

HBA could be contacted at: Email: [email protected]

Website: www.hba.org.my

Tel: +6012 334 5676

TOP PICKS BY EDGEPROP

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

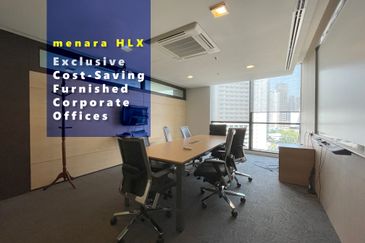

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Bandar Rimbayu

Telok Panglima Garang, Selangor

Ridgewood Canary Garden @ Bandar Bestari

Klang, Selangor

Anjung Sari

Setia Alam/Alam Nusantara, Selangor