KUALA LUMPUR (May 26): IOI Properties Group Bhd’s net profit for the third quarter ended March 31, 2022 (3QFY22) plunged 66.59% year-on-year to RM59.72 million from RM178.75 million partly because of property development costs written down.

However, quarterly revenue in 3QFY22 grew 27.44% to RM737.79 million from RM578.95 million in 3QFY21 mainly attributable to better performance contributed from all business segments.

“Excluding property development costs written down of RM111 million and net foreign currency translation gain on foreign denominated borrowings and deposits, the group’s underlying profit before taxation (PBT) of RM324.6 million for the current year quarter is RM42.9 million or 15% higher than the preceding year corresponding quarter of RM281.7 million.

“However, the underlying PBT is partly offset by higher share of associate’s profit in the preceding year corresponding quarter arising from the sale of land. In the current year quarter, the group recognised property development costs written down of RM111 million attributable to the launched development project in IOI International Parkhouse, Xiang’an,” said IOI Properties.

The property development segment’s revenue grew to RM605.9 million from RM485.2 million mainly attributable to higher progress works from ongoing development and higher number of vacant possession of the completed projects as the construction activities of the past quarters have been disrupted by lockdown in Malaysia.

The property investment segment recorded revenue of RM99.7 million, higher than the RM72.5 million a year ago amid the commencement of recurring leasing income from IOI Mall, Xiamen and lower rent rebate given to tenants following the improvement in mall traffic in Malaysia operations.

Revenue in the hospitality and leisure segment increased to RM30 million from RM19.1 million mainly due to robust domestic demand pursuant to the relaxation of travel restrictions.

Amidst the challenges in Malaysia, proactive measures have been taken to drive sales of its mid priced range of products by leveraging on the group’s digital marketing capabilities and aggressive campaigns.

In response to the current challenges arising from the strict operating procedures and movement controls implemented by the China government which has affected its mall operations in Xiamen, the group will adopt an active and pragmatic tenant retention strategy to maintain occupancy rates.

Meanwhile, the completed residential developments of IOI Palm City and IOI Palm International Parkhouse in Xiamen, China will continue to contribute towards IOI Properties’ financial performance.

“Across the border, the group’s new acquisition of a mixed-use development site in Singapore, comprising residential and hotel components in the Marina Bay area, complements its existing developments in the Lion City. Since the acquisition, the group is in the midst of planning the development of the land. At IOI Central Boulevard Towers, leasing activities have received strong response from reputable multinational companies. This is in anticipation of its expected completion in 2023.

“We foresee robust recovery of all sectors of the economy as we reopen our borders and transition into the endemic phase. Therefore, we expect an increase in consumer confidence nationwide that will generate a steady rise of demand within the property market,” added the group’s chief executive officer Datuk Voon Tin Yow in a separate statement.

IOI Properties shares closed down one sen or 0.98% at RM1.01, valuing the group at RM5.56 billion.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

Desa ParkCity (The Breezeway Garden Condo)

Desa ParkCity, Kuala Lumpur

BANDAR AINSDALE FASA 3B (TENANG)

Seremban, Negeri Sembilan

Hijayu 1, Bandar Sri Sendayan

Siliau, Negeri Sembilan

Taman Senawang Perdana

Seremban, Negeri Sembilan

Taman Bukit Senawang Perdana

Seremban, Negeri Sembilan

Taman Bukit Senawang Perdana

Seremban, Negeri Sembilan

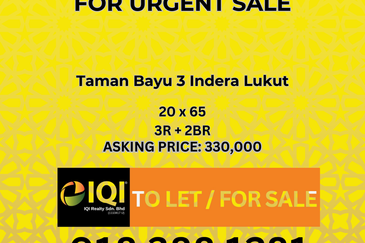

TAMAN BAYU INDERA, LUKUT

Port Dickson, Negeri Sembilan