- BNM governor Tan Sri Nor Shamsiah Mohd Yunus: For OPR (overnight policy rate) to go back to the pre-pandemic level of 3.0%, we are at 2.25%, so that would mean that OPR would have to increase by 75bps (basis points). We have said that any adjustment and recalibration to monetary policy will be done in a gradual and measured manner

KUALA LUMPUR (Aug 12): Bank Negara Malaysia is not likely to take an aggressive stance in normalising its monetary policy to the pre-pandemic level as it would risk disrupting the ongoing economic recovery.

“For OPR (overnight policy rate) to go back to the pre-pandemic level of 3.0%, we are at 2.25%, so that would mean that OPR would have to increase by 75bps (basis points). We have said that any adjustment and recalibration to monetary policy will be done in a gradual and measured manner.

“So changing OPR by 75bps this year will not be in line with that,” central bank governor Tan Sri Nor Shamsiah Mohd Yunus (pictured) told reporters at the 2Q GDP briefing on Friday (Aug 12).

Nor Shamsiah said Bank Negara’s Monetary Policy Committee (MPC) will continue to assess the situation, which is very fluid globally, especially with ongoing uncertainties in terms of commodities prices.

Asked whether the central bank would stick to a pace of 25bps hike in OPR every time the MPC meets for the remainder of this year, Nor Shamsiah said “increases of 50bps, and what not, will not be consistent with our gradual and measured manner”.

“We need to do it in a gradual and measured manner so that we continue to be on the recovery course and tackling any possible demand pressures that may add to the high inflation and cost environment that we have currently,” she said.

In terms of whether a rising interest rate environment would increase the government’s debt servicing charges, the governor said as long as Putrajaya is committed to its fiscal consolidation plan, such burden is likely to be alleviated overtime.

“The government is committed to fiscal consolidation, so it will be tabling its financial responsibility act soon as what was announced in the national budget.

“As the economy recovers, that would provide an opportunity for the government to continue on its fiscal consolidation course. So, moving forward it will result in lower debt servicing charges for the government,” she explained.

The MPC has increased OPR twice this year, 25bps each time, raising the benchmark interest rate to 2.25% from its historical low of 1.75%.

TOP PICKS BY EDGEPROP

Palmiera @ Kinrara Residence

Puchong, Selangor

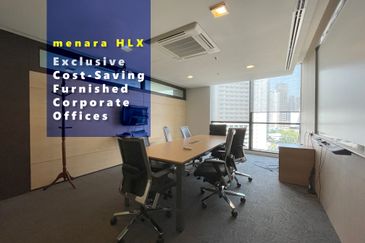

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Laman Anggerik, Nilai Impian

Nilai, Negeri Sembilan

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)