Glomac Bhd (June 20, 78 sen)

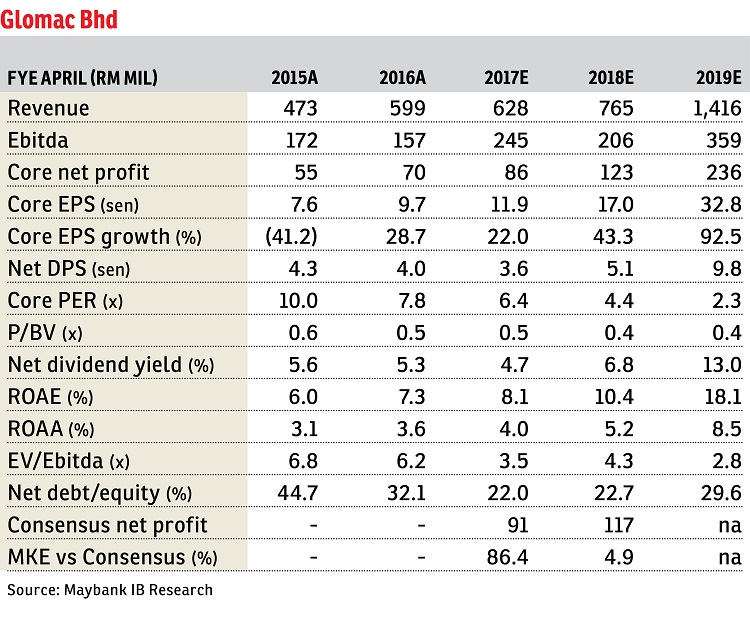

Maintain hold with an unchanged target price (TP) of 76 sen: Glomac Bhd’s financial year ended April 30, 2016 (FY16) year-on-year (y-o-y) core net profit growth of 28% came in as per our expectations but below consensus. A 40% y-o-y decline in property sales was also in line with our expectations. Despite a weak property market outlook, management has set a higher sales target of around RM630 million for FY17, supported by RM982 million new launches (excluding Centro V). We revise up our earnings forecasts by 2.3% to 13% post actual FY16 results. We maintain our 76 sen revalued net asset value (RNAV)-TP on an unchanged 60% discount to RNAV and “hold” rating.

Excluding RM10 million revaluation gain from the Glo Damansara mall, Glomac’s fourth quarter ended April 30, 2016 (4QFY16) core net profit declined by 60% y-o-y and 39% quarter-on-quarter to RM12 million, lifting FY16 core earnings to RM70 million, a 28% growth year-on-year, accounting for 97% and 82% of our and consensus FY16 estimates respectively. The weaker set of results was mainly due to provisions made for liquidated ascertained damages of RM32 million in 4QFY16. Glomac declared a final net dividend per share (NDPS) of two sen for FY16, bringing total NDPS for the year to four sen, which translates into 5.3% yield and was above our expectations.

Glomac’s FY16 property sales were weak at RM304 million, a decline of 40% y-o-y and 40% below management’s initial target (excluding Cheras land sale). The weaker sales were mainly due to the delay in new launches including the Centro V project worth RM240 million. In our view, its RM630 million sales target for FY17 is rather aggressive as we expect the macro headwinds and prolonged tighter lending measures to continue weighing on buyers’ sentiment. Our sales assumption is RM390 million, which is 38% below management’s target.

We revise up our FY17 and FY18 earnings forecasts by 13% and 2.3% respectively to factor in actual FY16 results and change in take-up assumptions. We maintain our TP pending further data on existing landbank from management. Unbilled sales were RM652 million, which is 1.1 times of our FY17 forecast property revenue. — Maybank IB Research, June 16

This article first appeared in The Edge Financial Daily, on June 21, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Pangsapuri Orchid View Luxury Apartment

Johor Bahru, Johor

TriTower Residence @ Johor Bahru Sentral

Johor Bahru, Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)