REAL estate investors usually have two main considerations — rental yields and capital appreciation.

However, in recent times, rental yields among non-landed residences in many places in the Klang Valley have been affected by rising house prices and supply.

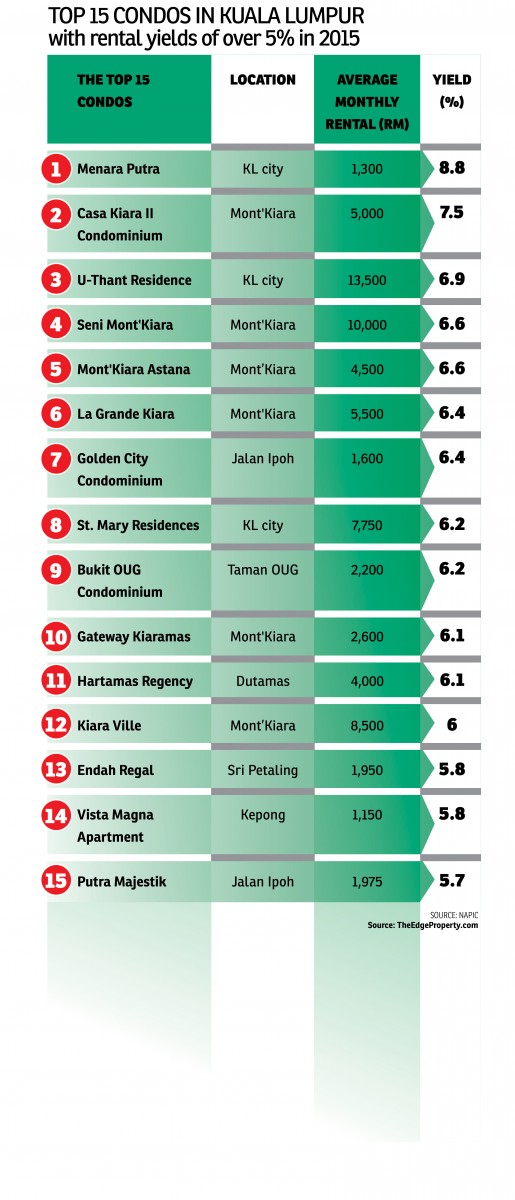

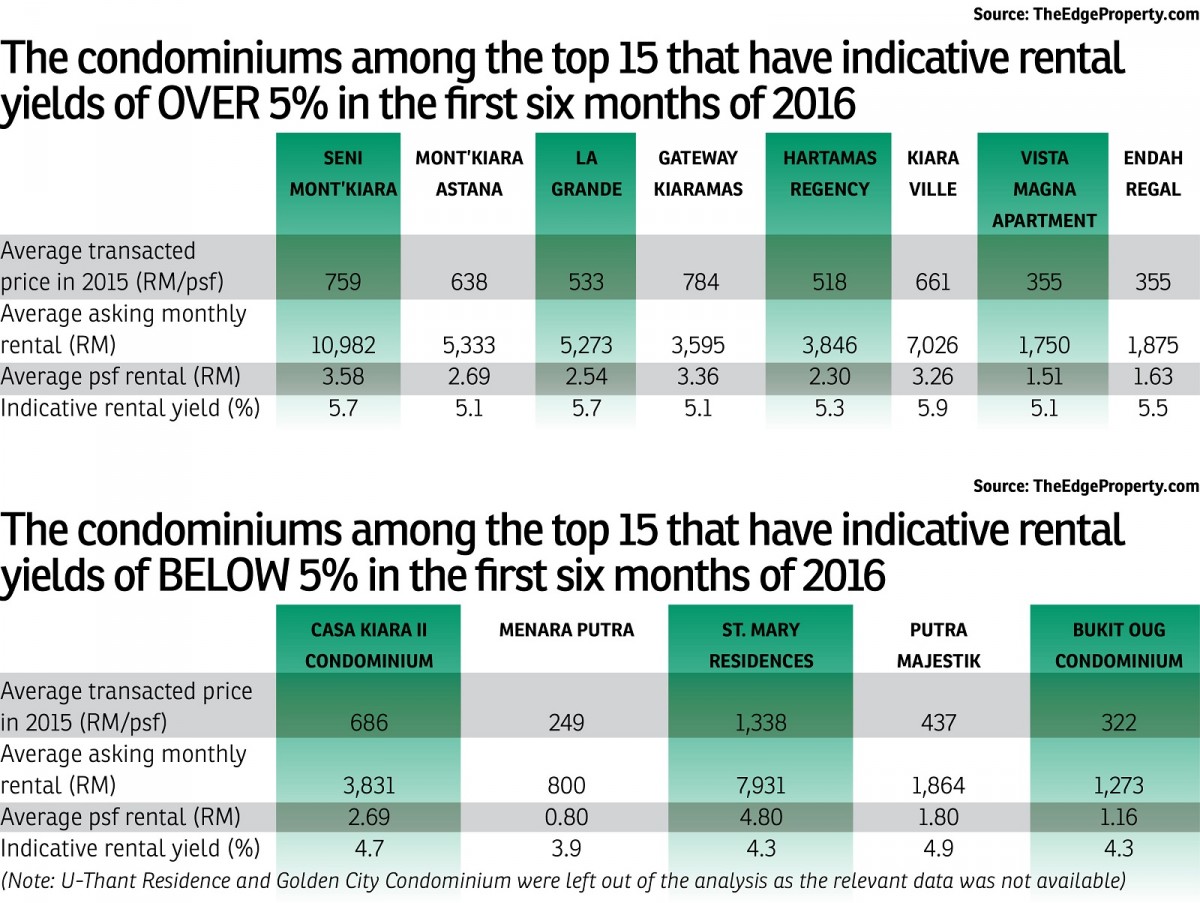

Some areas that enjoyed high capital appreciation have seen weaker rental yield — some even lower than fixed deposit rates. Nevertheless, there are many non-landed residences that enjoy yields of more than 5%. Data collated by the National Property Information Centre (Napic) showed that there were 46 condominiums in Kuala Lumpur that had enjoyed gross rental yields of over 5% in 2015.

From Napic’s list, TheEdgeProperty.com shortlisted the top 15 condos with the highest yields recorded last year. They ranged from a low of 5.7% to as high as 8.8%.

Among the top 15 were condos in Kuala Lumpur City Centre, Mont’Kiara, Jalan Ipoh, Dutamas, Kepong and Sri Petaling.

Among the top 15 were condos in Kuala Lumpur City Centre, Mont’Kiara, Jalan Ipoh, Dutamas, Kepong and Sri Petaling.

The five best performing projects were Menara Putra (rental yield of 8.8%), Casa Kiara II (7.5%), U-Thant Residence (6.9%), Seni Mont’Kiara (6.6%) and Mont’Kiara Astana (6.6%).

Zerin Properties head of research and consultancy Roja Rani Applanaidu says, “These condos are hugely popular with foreigners and expatriates especially those within Mont’Kiara or Hartamas due to their strategic location and proximity to international schools,” she tells TheEdgeProperty.com.

Factors contributing to the strong rentals are the various condos’ strategic locations within or close to Kuala Lumpur City Centre with excellent accessibility to commercial and financial hubs as well as amenities such as schools, eateries, malls, hospitals and others.

“Proximity to public transportations particularly rail stations (such as the Light Rail Transit (LRT), the KTM Komuter, and future Mass Rapid Transit (MRT) stations) is a key factor that contributes to high rental demand,” she adds.

JLL Malaysia country head YY Lau concurs that Mont’Kiara, for instance, is a relatively good place to live in as the properties are architecturally and aesthetically pleasing while incorporating greenery, spacious communal areas and lifestyle elements.

“Mont’Kiara is one of the most sought-after locations for both locals and expatriates. It has many good international schools and international F&B outlets that are suitable for expatriate families,” she explains.

She notes that the capital appreciation of properties in Mont’Kiara has been relatively slow over the past three quarters.

“One has to be selective so as not to end up with falling capital values even though yields may look good. Yields may be good during boom time, but may be affected during downturns,” she reminds.

“One has to be selective so as not to end up with falling capital values even though yields may look good. Yields may be good during boom time, but may be affected during downturns,” she reminds.

For buyers who are looking for rental yield, besides the potential yield numbers, they will also need to look at maintenance cost as that could affect the net rental yield.

“Investors would need to remove the outgoings such as the maintenance cost which tends to be higher for high-end properties. This could bring yields down closer to 5% and below,” she adds.

Lau notes that rentals have been easing in Mont’Kiara and areas surrounding Kuala Lumpur City Centre due to the contraction in the oil and gas (O&G) industry as a result of cuts in jobs for semi-skilled and skilled workers, including expatriates.

“Landlords are willing to rent out units at a lower rate to ease cash flow, rather than have their units unoccupied,” she adds.

Mont’Kiara stays popular

Among the top 15 condos that have enjoyed the highest gross rental yields, six of them are located in Mont’Kiara, three in Kuala Lumpur City Centre and two in Jalan Ipoh.

MIP Properties senior negotiator Freeman Woo says Mont’Kiara is still one of the most popular locations for tenants with above average budgets, especially expatriates.

“Vacant units in good locations such as those close to schools or with good access to main roads will normally take about one month to get a tenant,” he adds.

“I have received quite a number of rental enquiries in recent months. Many expatriates are looking for long-term accommodation in Mont’Kiara as there are a few international schools in the vicinity,” says the real estate negotiator who specialises in Mont’Kiara.

He notes that Mont’Kiara is an enclave of luxury condos, with a good liveable environment and within close proximity to the city centre which has attracted many expatriates to stay here and form their own community, especially those from Japan and South Korea.

Woo notes that monthly rentals could start from RM2,000 (for older unfurnished condos) to RM20,000 for a luxury penthouse.

Newer condos with private lifts such as 28 Mont’Kiara can offer a partly furnished unit with a built-up size of 2,535 sq ft for a rental of around RM7,000 to RM7,500 a month.

“For a smaller 1,600 sq ft unit in other condos, such as Casa Kiara or Kiara Ville, the monthly rental ranges from RM4,500 to RM5,500 depending on how well the unit is maintained,” he explains.

Accessibility matters

Apart from Mont’Kiara, One Sunterra Properties Sdn Bhd head of agency Terence Yap notes that locations on the fringes of Kuala Lumpur City Centre are generating interest from the middle class working population as these locations are well connected and easily accessible via major roads and highways as well as LRT stations.

“These areas close to Kuala Lumpur City Centre are the preferred locations among investors given their premium addresses. Even within KLCC, prices have declined and some owners are looking to cash out, hence making yields attractive,” he explains.

Yap also likes KL Sentral for its comprehensive masterplan comprising residential, commercial, leisure and an integrated transport terminal.

“KL Sentral is also home to prominent multinationals such as Shell, Google and Facebook, making the residential developments here a sought-after address for the working population in KL Sentral itself,” he adds.

Taman Desa in Old Klang Road is Yap’s next pick due to its strategic location between Kuala Lumpur and Petaling Jaya.

“Its location is also close to major existing landmarks such as Mid Valley City, KL Eco City and Bangsar South as well as upcoming developments such as Bandar Malaysia and the High Speed Rail (HSR) terminal,” he explains.

Zerin’s Roja chooses non-landed homes in Kuala Lumpur City Centre, Bangsar, Damansara Heights, Sentul and KL Sentral for their positive rental yield potential.

“These areas are established neighbourhoods and highly popular with locals and expatriates for their excellent locations, proximity to public transportations, commercial and financial hubs as well as conveniences such as F&B outlets, schools, entertainment areas and healthcare centres,” she explains.

Some pressure on yield growth

Property consultants and agents concur that the current sluggish economy and high property prices may cap rental yield growth in the medium term.

Yap says rentals and yields are not expected to rise in Kuala Lumpur if the economy continues to weaken as it may affect employment rates.

Roja notes that in terms of rental performance, condos in locations near to public transportations and commercial and financial hubs will continue to record high rental rates and yields.

“For instance, condos within Jalan Ipoh, Dutamas, Kepong and Sri Petaling enjoyed good rental yields because of their relatively lower or affordable prices which could generate comparatively higher yields,” she adds.

Meanwhile, Lau from JLL expects rental yield growth to be flat due to economic uncertainties.

“Apart from loss of jobs due to the downturn in the O&G industry, there are also job cuts in the financial industry. Unemployment is rising and business confidence remains weak,” she explains.

However, she adds that mature neighbourhoods like Bangsar, Damansara and Petaling Jaya, which have shown capital appreciation in the past, will continue to retain their occupancy rates although yields may no longer be as attractive as before.

“Land scarcity has increased the development cost of future projects. This puts pressure on rental yields as property prices keep escalating,” she concludes.

This story first appeared in TheEdgeProperty.com pullout on July 29, 2016, which comes with The Edge Financial Daily every Friday. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Royal Strand @ Country Garden Danga Bay

Johor Bahru, Johor

Citrine Hub Residences, Sunway Iskandar

Iskandar Puteri (Nusajaya), Johor