Gamuda Bhd (July 29, RM4.82)

Maintain buy with an unchanged target price (TP) of RM5.47: Naim-Gamuda joint venture (JV) (a JV with Naim Engineering Sdn Bhd) was awarded a Pan Borneo highway construction package from Lebuhraya Borneo Utara Sdn Bhd which is the project delivery partner for the highway. The Naim-Gamuda JV is 70% controlled by Naim Engineering Sdn Bhd and 30% by Gamuda Bhd.

We reckon that the contract involves heavy geotechnics such as piling, earthworks, paving and road furniture for the duration of 51 months. The construction package is from Pantu to Batang Skrang with a distance of about 117km within the Sri Aman district, southwest of Sarawak.

The contract was within our job replenishment assumptions with the order book increased by +6.0% from RM8.3 billion to RM8.7 billion. We are reassured that the project key execution risks would be mitigated due to Gamuda’s strong expertise and track record in highway and expressway construction (example: Penchala Link, Kerinchi Link, Kesas highway and Lebuhraya Damansara-Puchong) and coupled with Naim’s in-depth knowledge of the local topography and geotechnics.

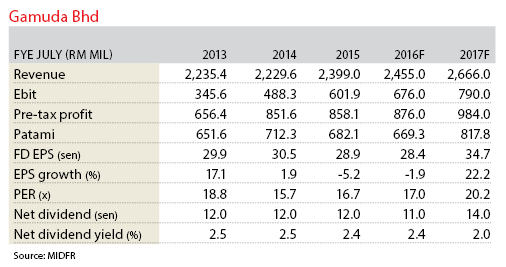

We make no changes to our financial year ending July 31, 2016 (FY16) and FY17 earnings forecasts. The award is within our expectations and we have imputed the 30% shareholdings in the JV company on the back of 10% marginal assumptions for the job as the soil condition is not as challenging as the coastal location.

We maintain our “buy” recommendation with an unchanged TP of RM5.47 per share based on FY17 sum-of-parts valuation on the back of prospective price earnings ratio (PER) of 18 times which is on the higher end of our big cap construction 14 times to 19 times PER range.

We reckon that the construction cost per km of RM13.41 million is fair due to the soil condition of southwest Sarawak which is alluvial with luxuriant vegetation, within the reasonable range of the average total construction cost of RM13.39 million per km for Pan Borneo Highway, and the construction of a parallel carriageway simultaneously.

It is also worthwhile to note that Gamuda’s experienced management has consistently delivered above-average (10-y) net margin of 17.7% and return on equity of 17.9% versus its peers in KL Construction Index of 6.5% and 9.0% respectively. Consequently, we are expecting Gamuda’s order book to increase by another +10% by 4QFY16 to be underpinned by strategic changes in its tender strategy, that is to say from bidding for total project package (such as light rail transit, LRT3 project) to bid for subcontracting packages (such as Gemas-Johor Double Track). — MIDF Research, July 29

This article first appeared in The Edge Financial Daily, on Aug 1, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Pangsapuri Orchid View Luxury Apartment

Johor Bahru, Johor

TriTower Residence @ Johor Bahru Sentral

Johor Bahru, Johor