MRCB-Quill Real Estate Investment Trust (Aug 3, RM1.24)

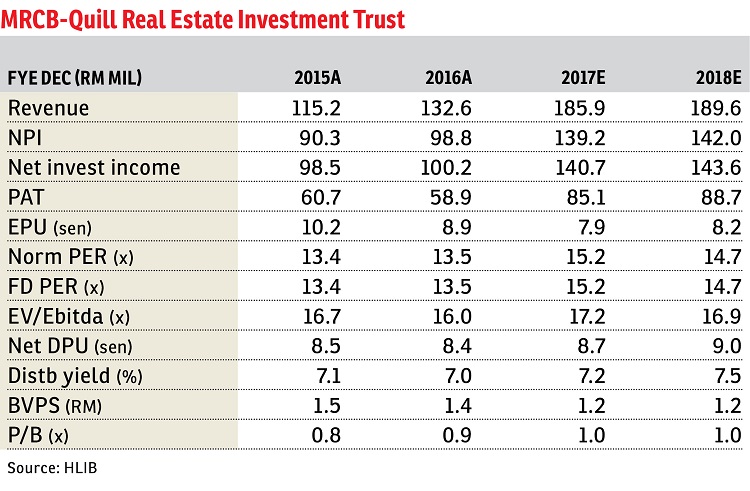

Maintain buy recommendation with an unchanged target price (TP) of RM1.34: MRCB-Quill Real Estate Investment Trust’s (MQREIT) first six months of financial year 2016 ended June 30, 2016 (6MFY16) gross revenue of RM65.2 million, which represented a 28.4% growth year-on-year (y-o-y), was translated into a normalised net profit of RM30.6 million, a 39.7% growth y-o-y, accounting for 51.9% and 53.4% of our and the consensus forecasts respectively.

MQREIT declared a dividend of 4.23 sen for the first half of FY16 ended June 30, 2016 (1HFY16), compared with 4.1 sen for 1HFY15, going ex on Aug 16, 2016, representing an annualised yield of 7.05% at a payout ratio of about 91.4%.

Highlights included a resilient revenue growth of 28.4% y-o-y in 1HFY16, due to additional income from Platinum Sentral and step-up rent adjustments, while its bottom line grew higher by 39.7%, given lower repair and maintenance costs this year, mitigated by higher financial costs due to loan drawdowns for acquisition. The overall occupancy rate was healthy at 97.2%, with an 87% renewal rate achieved for lease expiry in 1HFY16. Major asset enhancement initiatives planned for this year involve energy saving and carbon footprint reduction at both Quill Building 1-DHL and Quill Building 4-DHL. Despite an overall lacklustre office market, we are less concerned about office spaces owned by MQREIT, given its high occupancy rates and long lease terms. Besides, its net lettable area expiry is well spread, with about 13% and 26% expiring in FY17 and FY18 respectively. Following the acquisition of Menara Shell, its asset size now stands at RM2.27 billion.

With additional income from Menara Shell from FY17, management will be able to achieve a greater scale and raise the payout, with proposed partial payment of management via units.

Consequently, distributable income will be lifted. The potential yield-accretive asset injection is expected to be funded via placement exercises with an equity/debt ratio of about 65:35. The gearing ratio is expected to improve to around 40% from 42% post exercise.

Among the risks are a high gearing compared with the industry average, and a slower rental reversion rate for the office market. Positives include a huge pipeline of asset injections from MRCB, Quill and the Employees Provident Fund, and resilient earnings with sustainable distribution per unit.

We maintain our “buy” recommendation with an unchanged TP of RM1.34, based on a targeted yield of 6.5%, which is two standard deviations below the one-year historical average yield spread of MQREIT and 10-year government bonds. — Hong Leong Investment Bank Research, Aug 3

Try out one of our super tools, the rental yield calculator, here.

This article first appeared in The Edge Financial Daily, on Aug 4, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

De Tropicana Condominium

Kuchai Lama, Kuala Lumpur

Eco Botanic

Iskandar Puteri (Nusajaya), Johor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

Hijayu 3D Alwinix & Alconix Community Park

Seremban, Negeri Sembilan