WITH ample supply of office space and human resource, Malaysia’s capital city of Kuala Lumpur is poised to be one of the more attractive destinations for multinational companies (MNCs) to outsource their operations, says international real estate services firm JLL.

JLL Malaysia managing director YY Lau says Kuala Lumpur remains attractive to MNCs looking to set up outsourcing centres.

“We have a highly educated workforce with a good command of English and other languages. Besides the rental of Malaysia’s office space is one of the lowest in the region,” she tells TheEdgeProperty.com.

“However, our wages may not be the lowest,” she adds.

Lau notes that while India and the Philippines may offer more competitive wages, Malaysia provides a niche market for certain outsourcing industries as the country has many young professionals, especially finance and accounting graduates.

“Other factors that encourage strong office space take-up over the medium term include the expected growth of co-working of office spaces, and the increased demand from other sectors like technology and infrastructure development,” she adds.

Co-working refers to shared offices by those self-employed or individuals working for different employers. Besides sharing the working space, the tenants also share facilities such as meeting rooms.

She says outsourcing services in Malaysia include customer call centres and shared services centres for IT companies, oil and gas companies and financial institutions.

A recent report by JLL titled “The Fourth Industrial Revolution: The Impact on Real Estate in Southeast Asia” published in June, discussed how technological advances are changing the way we work and how they are impacting office demand.

Based on the World Economic Forum (WEF) Jobs report, there will be fewer office and administrative jobs in high-income cities, but a gain in employment in emerging markets due to economic growth, outsourcing and the rise of the middle class.

The JLL report notes that outsourcing will be the main contributor to office demand in emerging markets while office net absorption in developed markets will be reduced.

Technological advances such as mobile internet, automation and cloud computing will further enhance companies’ ability to implement outsourcing, flexible working and co-working, says Lau.

Technological advances such as mobile internet, automation and cloud computing will further enhance companies’ ability to implement outsourcing, flexible working and co-working, says Lau.

They could outsource work to regions such as Southeast Asia (SEA) in the next five years and new locations could emerge, she adds.

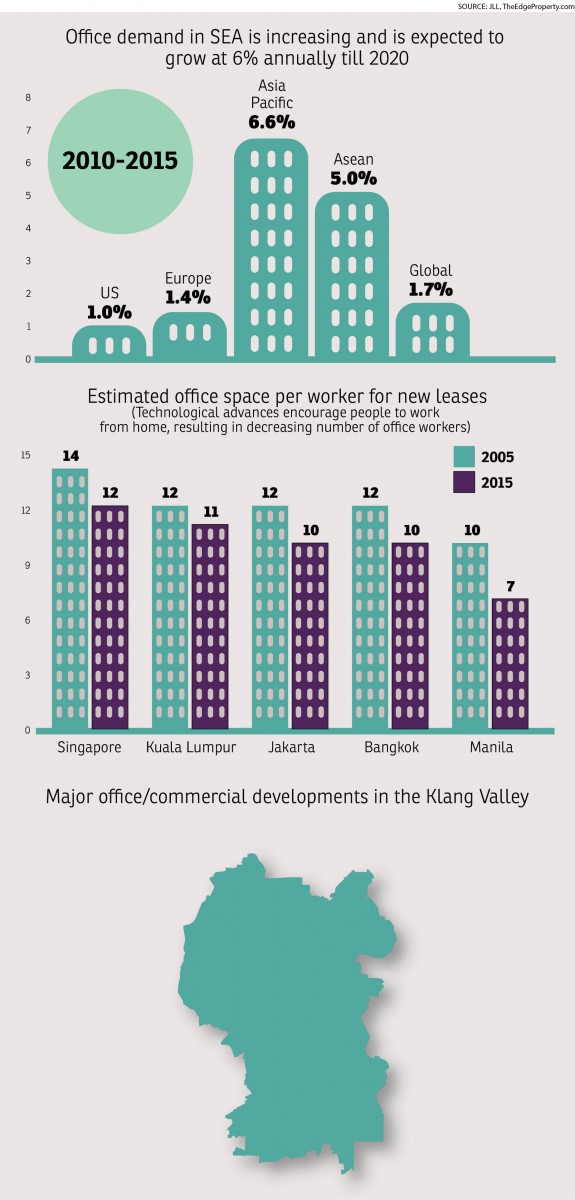

“While office demand growth globally has slowed after the global financial crisis, SEA has bucked the trend, with demand growing 20% faster,” the report notes.

JLL expects office demand in SEA to grow at 6% annually till 2020 amid an economic growth of 5% and rise of outsourcing. “We see strong growth in Manila and Kuala Lumpur. We expect demand for office space to be strong with growth at 6% per annum in Kuala Lumpur between 2016 and 2020”, it adds.

Although demand for offices from oil and gas companies could weaken due to low oil prices, JLL foresees that the financial services, technology and business services industries are likely to pick up the slack.

“We see large-scale developments going on in both the KL Central Business District (CBD) and decentralised areas,” Lau says.

She notes that decentralisation of office locations has taken place in recent years and tenants in the technology sector are looking at offices outside the KL city centre.

“This trend will continue over the next five years with improved connectivity and better infrastructure within the Klang Valley,” she explains.

Market remains challenging

The supply glut of office space in Kuala Lumpur, however, remains a concern. “The Kuala Lumpur office market continues to be challenging as there is a concern of oversupply,” Lau says.

She estimates that close to seven million sq ft of office space is expected to come onstream in the KL city centre in 2019 with the vacancy rate rising to over 20% from 2019 onwards.

Due to oversupply and uncertainties in the economy, rental growth over the medium term will be limited. However, she stresses that rental growth in different submarkets may differ.

For example in the prime fringe areas of Kuala Lumpur (KL Sentral, Mid Valley and Damansara Heights), rental growth in recent years has been strong compared to those in the city centre due to the decentralisation of office space.

“We expect this trend to continue over the medium term as infrastructure projects roll out and further provide better connectivity to fringe areas,” she adds.

This story first appeared in TheEdgeProperty.com pullout on Aug 5, 2016, which comes with The Edge Financial Daily every Friday. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Taming Jaya Industrial Park

Balakong, Selangor

Oakland Commercial Centre

Seremban, Negeri Sembilan

Isle of Botanica, Setia Eco Glades

Cyberjaya, Selangor

Isle of Botanica, Setia Eco Glades

Cyberjaya, Selangor

Trillium, Perdana Lakeview East

Cyberjaya, Selangor

Isle of Botanica, Setia Eco Glades

Cyberjaya, Selangor

Elmina Green Three @ City of Elmina

Sungai Buloh, Selangor