KUALA LUMPUR (Aug 8): Matrix Concepts Holdings Bhd, which was one of the small- to mid-capitalisation property developers that have been offering a decent dividend payout ratio (DPR) — at least 40% of its net profit — recently capped its DPR to a maximum of 40% instead.

KUALA LUMPUR (Aug 8): Matrix Concepts Holdings Bhd, which was one of the small- to mid-capitalisation property developers that have been offering a decent dividend payout ratio (DPR) — at least 40% of its net profit — recently capped its DPR to a maximum of 40% instead.

This has raised concerns over the Seremban-based builder’s future earnings prospects.

The move came after its peer Hua Yang Bhd cut back on its dividend payout, though the latter still rewarded shareholders via a bonus issue amid the softening property market.

In an interview with The Edge Financial Daily, Matrix Concepts managing director and chief executive officer Datuk Lee Tian Hock (pictured) said the adjustment of its dividend policy is due to the need to conserve cash for “bargain hunting” next year as he anticipates some competitively priced land parcels will be put up for sale in the next couple of years, potentially in Seremban or Port Dickson, Negeri Sembilan.

“The property market has been facing a tough time in the last two years. We want to conserve some liquidity as we foresee some good picks in the next two years,” said Lee, who does not rule out the possibility of further DPR cuts, if necessary.

However, he said the company’s board will consider giving higher dividends if it is more comfortable with its cash position in future.

Due to its generous dividend payout previously, Matrix Concepts has been among the top picks in the property market for analysts. Interestingly, though the new DPR ceiling is no good news to yield-seeking investors, analysts by and large believe Matrix Concepts remains an attractive pick — providing it sustains its earnings growth momentum going forward.

“In terms of yield, it is still considered attractive [by] the sector, given the uncertain market and the recent OPR (overnight policy rate) cut. I think when the global market is entering a negative yield environment, this is still a yield stock that investors can [consider],” RHB Research’s analyst Loong Kok Wen said when contacted.

Loong said Matrix Concepts is still seeing resilient sales as its land cost is cheap and it can afford to sell lower-priced products.

“It is still reasonable and deserves a buy call (target price of RM3.20) from us, as long as the group is able to maintain its earnings growth,” said Alliance DBS Research’s Quah He Wei.

Quah also believes the group will outperform its peers in the next two years, underpinned by its unbilled sales — which stood at RM600 million as at March 31 — besides its healthy 30% margin.

Meanwhile, Matrix Concepts chief is confident the group can achieve its sales target of RM950 million to RM1 billion for the financial year ended March 31, 2017 (FY17), about 10% higher than its FY16 sales, due to the affordability of its properties.

Lee also said the group’s landed properties in Seremban, priced

between RM500,000 and RM600,000, are affordable for Klang Valley folk, who accounted for over half of the group’s customers last year.

“The idea of ‘work in Klang Valley, live in Seremban’ has become a reality. We are shifting our target to Klang Valley purchasers as the distance, for them, is still manageable,” he added.

The group has planned RM1.3 billion worth of launches, in terms of gross development value, for FY17. They comprise different phases of three developments, namely its flagship township Bandar Sri Sendayan, the residential NS Residensi SIGC, both in Seremban, and its Bandar Seri Impian project in Kluang, Johor.

The group’s land bank stands at 2,350 acres (951ha), which can last it for the next nine years.

“Over 70% of our property developments are in the affordable segment. We are confident the take-up rate will be good,” said Lee, adding its project take-up rates are normally between 70% and 80%.

Lee said the group’s RM600 million unbilled sales should also sustain the group’s cash flow for the next two years. Further, to maintain the group’s affordable housing margin at 30% amid the softening property market, Lee said the group is keeping to their selling prices while offering smaller units.

On expectations of higher sales and a sustainable margin, Lee is positive the group will be able to maintain its earnings performance in the current downturn.

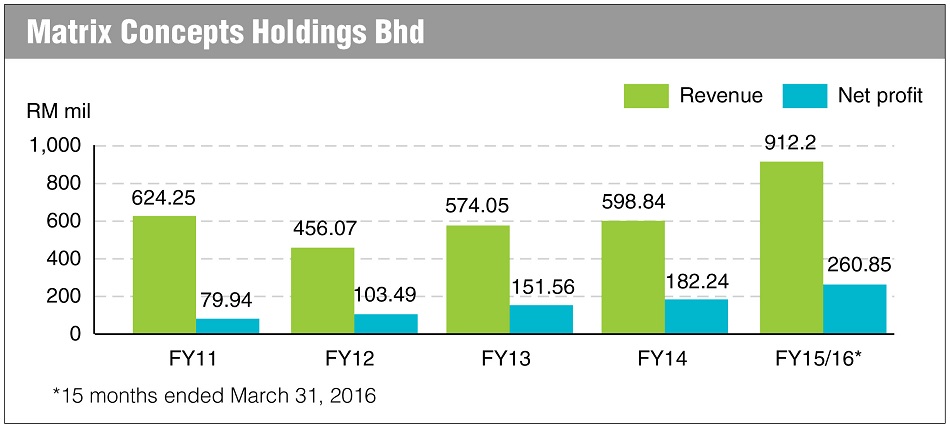

The group charted a net profit of RM260.9 million for the 15-month ended March 31, 2016 (FY16), growing 43.2% from RM182.2 million in FY14. It changed its FY16 financial year end to March 31, 2016, from Dec 31, 2015. On a 12-month versus 12-month basis, its net profit gained 17% year-on-year in the cumulative period ended Dec 31, 2015, to RM213.2 million.

FY18 may be an even better year for the group, as it expects to see an income of about A$30 million (RM92 million) from its development project in Melbourne, while its new but loss-making international school and clubhouse business is expected to turn a profit.

“The construction of the M Carnegie Boutique Apartment project in Melbourne will start in September as all funding are already in place. It should be completed by November next year,” said Lee.

He said annual revenue contribution from its international school and clubhouse businesses will gradually rise to 15% from 7% currently, as it is a strategic business that is insulated from cyclical risks.

Matrix Concept rose two sen to RM2.52 last Friday, for a gross dividend yield of 6%. The counter hit its all-time high of RM2.65 on May 22 last year after it was listed at RM2.20 a share in 2013.

Analysts, however, think the stock will likely be rangebound in the near term due to macro risks in the property sector.

This article first appeared in The Edge Financial Daily, on Aug 8, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Woodbury Residences @ Mahkota Hills

Lenggeng, Negeri Sembilan

Kawasan Perindustrian Mount Austin

Johor Bahru, Johor

Lake Vista Residence (Tasik Vista Residen)

Cheras, Selangor

Lake Vista Residence (Tasik Vista Residen)

Cheras, Selangor