WCT Holdings Bhd (Aug 24, RM1.60)

Maintain hold with an unchanged fair value (FV) of RM1.66: WCT Holdings Bhd explained during an analysts’ briefing yesterday morning that the first half ended June 30, 2016 (1HFY16) results released yesterday were not strong as construction profits had yet to pick up significantly. It expects a better showing from the unit from its third quarter ending Sept 30, 2016 (3QFY16), driven by stronger profit recognition from newly secured infrastructure jobs. Construction profits in 1HFY16 came largely from low-margin building jobs, which were not helped by the front-loading of certain mechanical and electrical costs associated with those jobs too.

WCT reiterated its guidance for RM2 billion job wins in financial year 2016 (FY16). Year to date, it has secured RM523 million (including a 30% share of a RM1.4 billion Pan Borneo Highway package). The company appeared confident to win Package V204 (viaduct guideway from Bandar Malaysia South Portal to Kampung Muhibbah) of mass rapid transit Line 2, which we believe is worth about RM1 billion. If it does not succeed, alternatively, it will pursue Package V207 (viaduct guideway from Universiti Putra Malaysia to Taman Pinggiran Putra).

In addition, WCT has submitted bids for two local building jobs worth a total of RM1.5 billion. For local highway projects, having lost out on the Sungai Besi-Ulu Kelang Elevated Expressway and Damansara-Shah Alam Elevated Expressway projects, it is now putting its hope on additional packages from the West Coast Expressway. On the overseas front, WCT expects more tenders for infrastructure projects to be called in Qatar (ahead of the 2022 Fifa World Cup) after the summer months. WCT is keen to bid for the highway projects.

WCT said that a private placement of new shares is no longer a priority in its ongoing degearing exercise. It felt that the less than significant amount of proceeds raised did not justify the earnings dilution, given the current depressed share price. Instead, WCT hopes to raise about RM500 million from the disposal of The Ascent, a 32-storey Class-A office tower worth RM380 million within the Paradigm development in Petaling Jaya, as well as an adjacent service apartment block within the same development, and a commercial building in Pandan Indah. The disposal would reduce its net debt and gearing of RM2.15 billion and 0.8 times as at June 2016 to RM1.65 billion and 0.6 times. It is still pursuing the listing of Paradigm Mall, Petaling Jaya, and Bandar Bukit Tinggi shopping mall, Klang, under a RM1.2 billion real estate investment trust (REIT) by 2Q17. It will only embark on the initial public offering of its construction unit after the REIT’s listing.

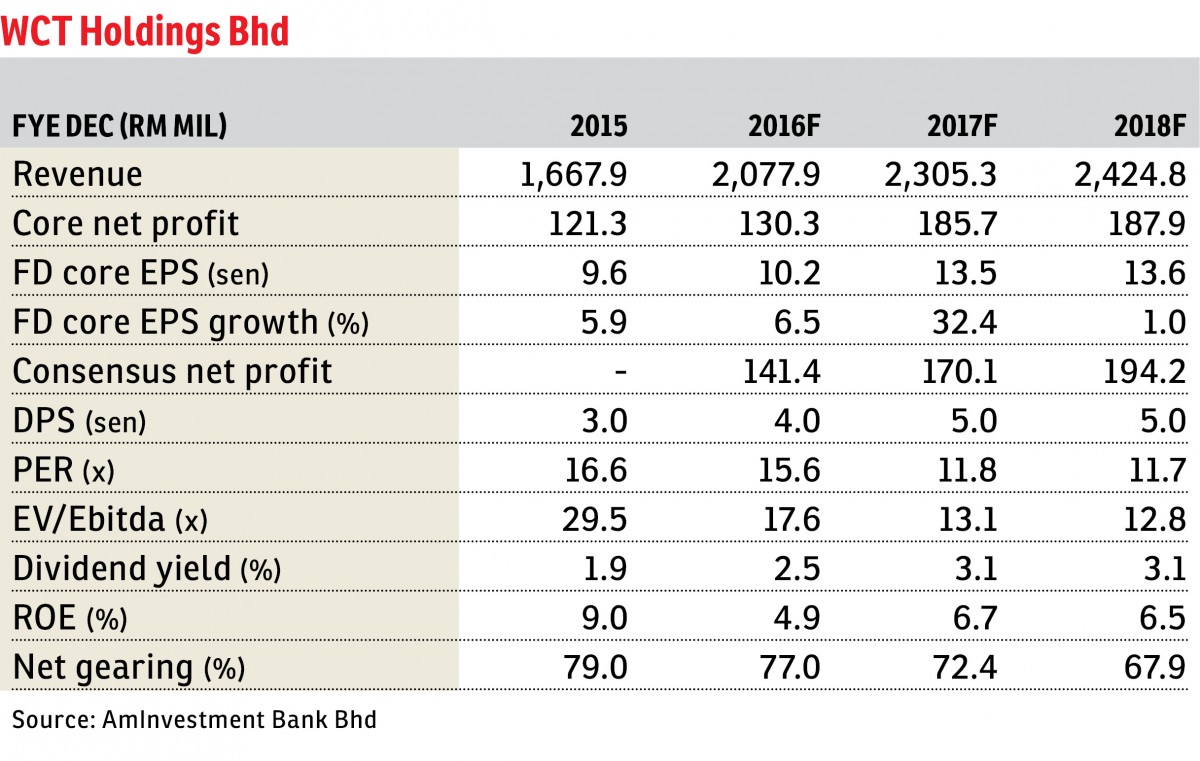

We maintain our forecasts and FV of RM1.66 which is based on a 35% discount to its sum-of-parts, in line with our benchmark of 30% to 40% for property stocks. We value WCT’s construction business at 13 times forward earnings, in line with our benchmark forward target price-earnings ratio of 13 times to 15 times for mid-cap construction stocks. We maintain “hold”. — AmInvestment Bank, Aug 24

Want to know the price trends of a development? Click here.

This article first appeared in The Edge Financial Daily, on Aug 25, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Perdana Exclusive Condo

Damansara Perdana, Selangor

Setia Taipan 1, Setia Alam

Shah Alam, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor