KLANG Valley’s non-landed residential properties located in established areas, at the fringes of Kuala Lumpur city centre and priced below RM400 psf are enjoying the highest appreciation in prices.

KLANG Valley’s non-landed residential properties located in established areas, at the fringes of Kuala Lumpur city centre and priced below RM400 psf are enjoying the highest appreciation in prices.

TheEdgeProperty.com product and business development director Alvin Ong revealed these findings during his presentation titled “Riding the HSR wave: Opportunities on the subsale market” at TheEdgeProperty.com’s “Symposium on Kuala Lumpur-Singapore High Speed Rail 2016” on Aug 27.

Organised by TheEdgeProperty.com, the symposium titled “Where to invest — Don’t miss the boat” was supported by The Edge Malaysia with Bukit Bintang City Centre as the presenting sponsor.

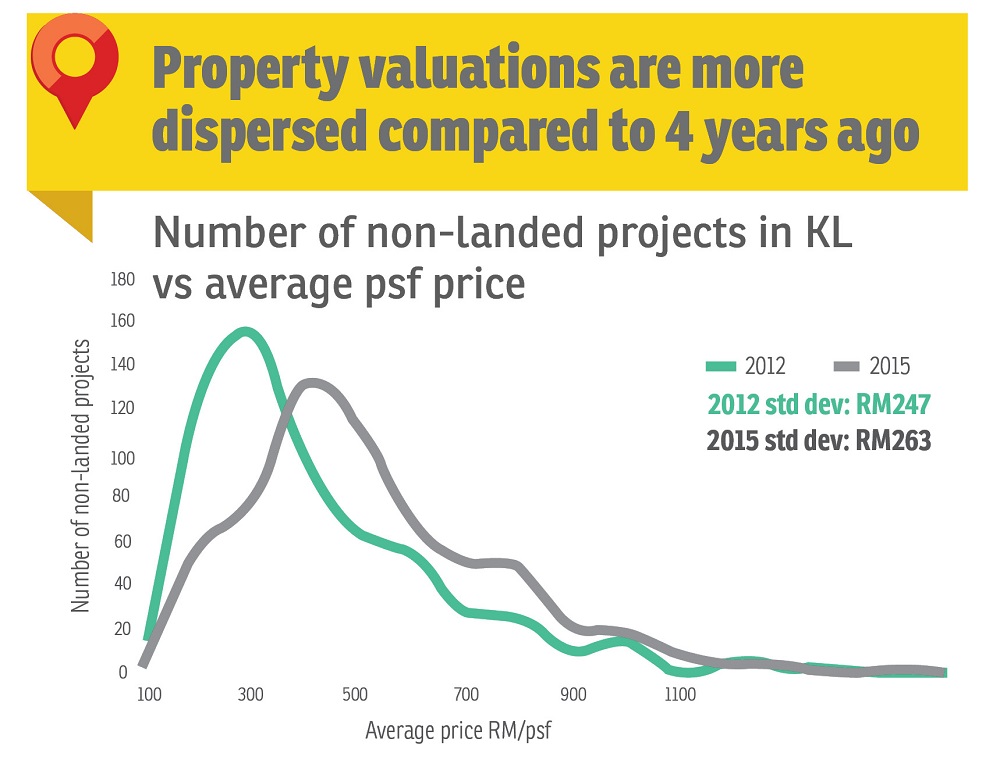

Ong said TheEdgeProperty.com’s analysis found that non-landed residences that were going for RM400 psf and below had better growth potential compared with the more expensive ones, especially those in the RM1,000 psf and above category.

“According to data from TheEdgeProperty.com, from 2012 to 2015, non-landed residential properties under RM400 psf saw the largest price increase. For properties sold at RM1,000 psf and above during the same period, there were hardly any movement in prices,” said Ong, adding that the non-landed homes segment makes up around 80% of secondary market transactions a year.

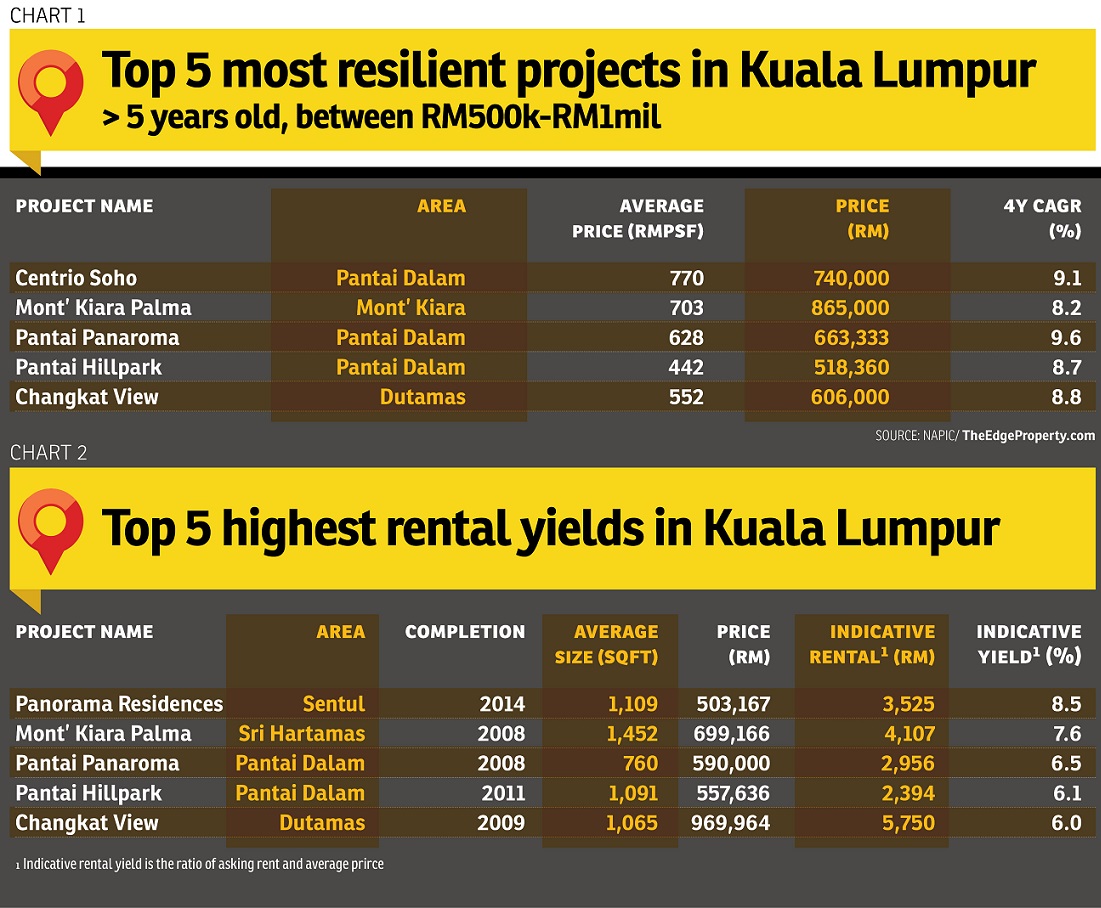

Citing findings by TheEdgeProperty.com, Ong also shared with the audience the top five non-landed homes in Kuala Lumpur with the highest compound annual growth rate (CAGR) over four years (2012-2015). They were Centrio SOHO (9.1%), Mont’Kiara Palma (8.2%), Pantai Panorama (9.6%), Pantai Hillpark (8.7%) and Changkat View (8.8%) (see Chart 1).

He noted that properties which are located in more developed, “self-catering areas” also enjoy better capital appreciation and rental yields.

On rental yields, TheEdgeProperty.com’s data showed that the top five non-landed residential properties in Kuala Lumpur with the highest rental yields in 2015 were Panorama Residences in Sentul (8.5%), Waldorf Tower in Sri Hartamas (7.6%), 231 TR Serviced Suites in Kuala Lumpur City Centre (6.5%), Endah Promenade in Sri Petaling (6.1%) and Solaris Dutamas in Dutamas (6%) (see Chart 2).

“If you are familiar with these projects, you will realise that they are part of integrated developments or located next to a shopping mall, or close to public transport and other amenities,” he said.

Similarly, the KL-Singapore High Speed Rail (HSR) will not have a positive impact, including on values of property surrounding a station, if the station is not well embedded.

“You will need connectivity and some retail. The stations must be easy to reach and convenient,” he added.

He also pointed out that residential properties on the fringes of Kuala Lumpur city centre such as Kepong, Bukit Jalil, Cheras and Old Klang Road are showing resilience as property prices continue to grow despite the current market slowdown.

Moving forward, it seems the young are more bullish about the property market outlook for the next one year. In an online survey by

TheEdgeProperty.com among 1,095 respondents from different locations, races and ages, it was found that 35% of respondents aged 20 to 30 years old were more bullish about the property market than the older 31 to 40-year-olds (31%), 41 to 60-year-olds (27%) and those aged 60 years old and above (22%). It also found that 40% of respondents believed that property prices will go down in the next 12 months while 31% said property prices will go up and another 29% said prices will remain flat. Ong also told the audience that TheEdgeProperty.com offers free analytics, including price trends and rental yields. “During such uncertain times, the website can be a referral point before you make your purchase,” he said.

TheEdgeProperty.com is a portal that offers a host of features, including property news, timely market data and research. These are complemented by equally comprehensive property listings. Other highlights include notable done deals, events and launches, legal and feng shui tips and advice, as well as featured projects.

Try out one of our super tools, the rental yield calculator, here.

This story first appeared in TheEdgeProperty.com pullout on Sept 2, 2016, which comes with The Edge Financial Daily every Friday. Download TheEdgeProperty.com pullout here for free.

HSR270816

TOP PICKS BY EDGEPROP

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Dalia Residences @ Tropicana Aman

Telok Panglima Garang, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)