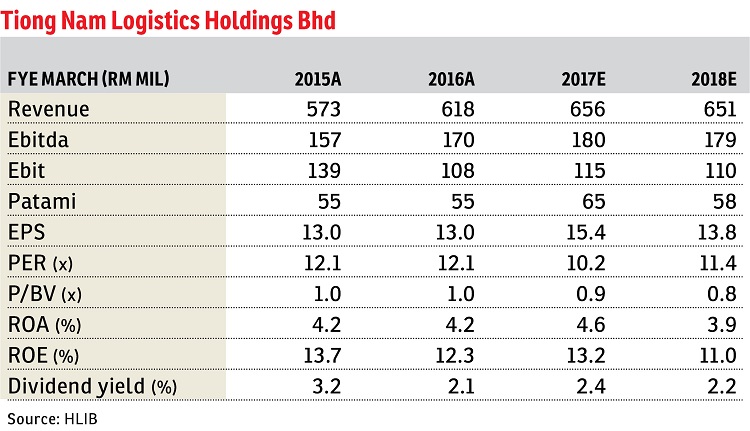

Tiong Nam Logistics Holdings Bhd (Sept 2, RM1.60)

Maintain buy with an unchanged target price of RM2.07. The upcoming real estate investment trust (REIT) listing announcement is expected to be made by end-October as the valuers have just completed their visits to their warehouses with proper valuation on the to-be-listed warehousing assets expected to be finalised by this month.

This indicates that the application to the Securities Commission Malaysia could be somewhere in October, providing further catalyst to its share price.

Recent slight weakness in its logistics service revenue is a result of cessation of part of its haulage business which fetched low margins.

The group, on the other hand, has secured two major clients from Japan (car manufacturer) and China (major smartphone manufacturer). As these contracts involve more specialised services, better margins are expected to be gained from the work done.

This would help to bring back growth for its logistics business from the second quarter of 2017 onwards.

With regard to the e-commerce secular trend, the group is still exploring several major online platforms both locally and foreign-based.

As new players put market share as their main objective, instead of profitability, rates quoted from the e-commerce space for logistics services are very competitive. As such, the group opts to carefully review its pricing before committing to the business to avoid significant deterioration in margins.

In the group’s property division, it has new property development project in the cards. The project is worth RM170 million involving mix development (both commercial and residential) with a target launch expected to be in financial year 2018.

This would help to bring continuity to its property earnings base amid overall property market slowdown. Current unbilled sales stood at RM246.6 million, providing further cover for its property revenue in the next two years.

Risks are overexpansion of warehousing space and surge in fuel pricing. — Hong Leong Investment Bank Research, Sept 2

This article first appeared in The Edge Financial Daily, on Sept 5, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Bandar Puteri Puchong

Bandar Puteri Puchong, Selangor

Akira @ 16 Sierra (Sierra 9)

Puchong South, Selangor

Akira @ 16 Sierra (Sierra 9)

Puchong South, Selangor

Akira @ 16 Sierra (Sierra 9)

Puchong South, Selangor

Shaftsbury Serviced Apartments

Cyberjaya, Selangor

Shaftsbury Serviced Apartments

Cyberjaya, Selangor

Akira @ 16 Sierra (Sierra 9)

Puchong South, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)