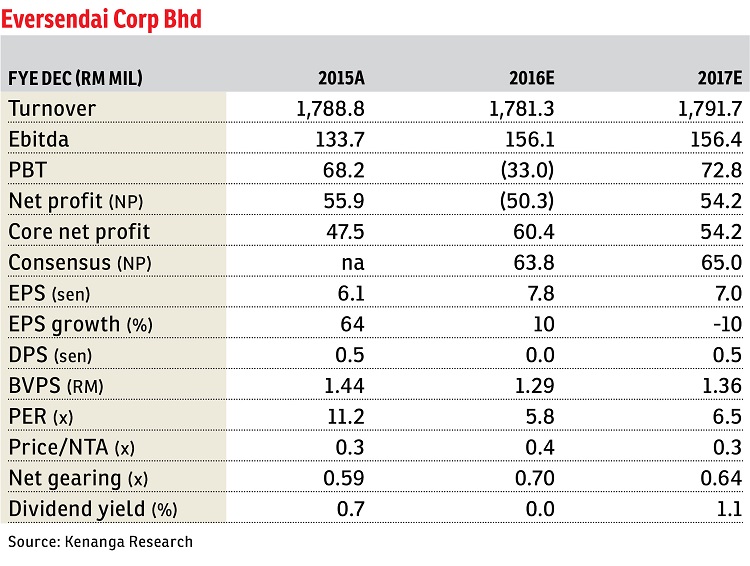

Eversendai Corp Bhd (Sept 6, 47 sen)

Maintain outperform call with a lower target price of 63 sen: We attended Eversendai Corp Bhd’s briefing and came away feeling “neutral” on its outlook.

As of Aug 31, 2016, Eversendai had secured RM1.53 billion worth of contracts in line with our expectations, accounting for 77% of our financial year 2016 estimate (FY16E) targeted RM2 billion replenishment.

We believe our replenishment target is highly achievable underpinned by RM20 billion worth of tender book (structural steel and construction worth RM9 billion; oil and gas worth RM11 billion).

Year to date, its outstanding order book stands at RM2.5 billion, providing earnings visibility for the next 1.5 years.

Management reiterated that its RM130 million investment in Technics Oil and Gas Ltd (TOGL) had been fully impaired and will no longer suffer fair value losses moving forward.

To recap, Eversendai has impaired a cumulative amount of RM101.7 million in the first half of 2016 (1H16) for TOGL due to the slump in share price and is currently placed under judicial management.

We are positive on this, as we believe the full impairment on TOGL would enable Eversendai to move on and focus on its core businesses. We understand that Eversendai’s RM246 million Worli Mixed Development project is partially placed on hold as the clients are in the midst of obtaining approval to have the building built taller.

Hence, Eversendai has been incurring idle costs while provisioning for variation order claims, which bog down its construction margins in India.

However, management remains hopeful that this ongoing issue should be resolved by 1H17.

While Middle East margins have shown improvement underpinned by the new contracts secured at a gross profit margin level of 13% to 15%, we remain concerned about margin sustainability considering Eversendai displayed volatile margins in the financial year ended Dec 31, 2014 (FY14) to FY15 despite securing jobs with good margins then.

For FY17, management expects to have its two lift boats (valued at US$180 million [RM734.4 million]) delivered and this could potentially reduce its current net gearing level of 0.67 times (as of the second quarter of FY16) to 0.40 times due to its payment structure of a 20% down payment and the remaining 80% upon completion.

Nonetheless, we keep our gearing levels unchanged for now due to potential payment risks. We keep our conservative earnings estimates unchanged as we maintain our estimated FY16 replenishment target of RM2 billion.

Post-briefing, we revise our valuations lower to nine times FY17E price-earnings ratio (PER) (from 70 sen based on 10 times FY17E PER) which is in line with the valuation ascribed to its mid-cap peers like Kimlun Corp Bhd as we rebase our valuation methodology for Eversendai. We are keeping an “outperform” call premised on its improving outlook without more negative surprises coupled with Eversendai’s current weak share price. — Kenanga Research, Sept 6

This article first appeared in The Edge Financial Daily, on Sept 7, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Queens Residences @ Queens Waterfront

Sungai Nibong, Penang

Queens Residences @ Queens Waterfront

Sungai Nibong, Penang

Queens Residences @ Queens Waterfront

Sungai Nibong, Penang

Tate Dalton @ Eco Botanic 2

Iskandar Puteri, Johor

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Taman Perindustrian Subang USJ 1

Subang, Selangor