KUALA LUMPUR (Sept 13): The recent positive US housing data is good news for exports-oriented furniture manufacturer Poh Huat Resources Holdings Bhd, which derives at least 60% of its sales from the US market.

US housing starts, the leading indicator for the country’s housing market, has risen 2.1% to a seasonally adjusted annual rate of RM1.21 million in July — a five-month high and above market expectations.

Poh Huat’s co-founder and managing director Tay Kim Huat said outlook for the furniture industry remains bright, especially in the US, as the economy recovers.

“Every year, we target a 20% sales growth. Usually our sales grow between 15% and 20% [thanks to] the number of residential and office buildings that have been increasing in tandem with population growth and urbanisation,” Tay told The Edge Financial Daily at his Muar office.

Tay said US families, on average, change their home furniture every seven years — more frequently compared to the average Malaysian family’s 10 years — and such a buying pattern lends support to the furniture market. Reports have estimated that the US furniture market was worth US$96.4 billion (RM396.20 billion) in 2014, and expected to grow at a compound annual growth rate of 2.9% through 2019.

Going forward, Tay said the company’s focus will remain with the US market, though Poh Huat plans to expand its distribution channels elsewhere too. “We plan to set up a trading house in Australia. We are looking at Europe too,” he said, without giving a specific timeline.

Poh Huat has a 51%-owned trading house in South Africa now, Poh Huat International Furniture SA Pte Ltd. It also has manufacturing facilities in Muar, Malaysia, and two others in Binh Duong and Dong Nai, Vietnam — which are operating at around 75% of their capacity.

Its Malaysian operation makes office furniture, which it mostly exports to Canada and North America, while the Vietnamese operations mainly produce the more labour-intensive home furniture.

Tay said Poh Huat is exploring opportunities to set up another manufacturing facility in a neighbouring country, to “ensure we stay cost-competitive”, but declined to reveal more, saying only that Poh Huat has the financial muscle to expand. As at April 30, its net cash was RM27.7 million.

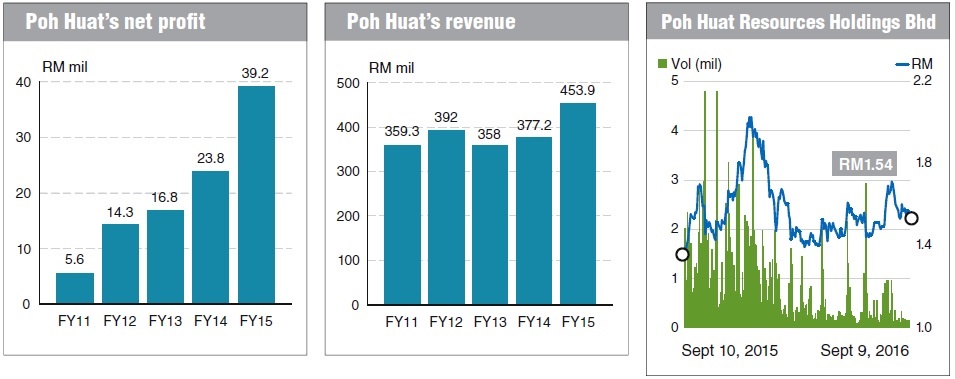

Poh Huat’s net profit for the second quarter ended Apr 30, 2016 (2QFY16) fell 14% to RM3.88 million, from RM4.53 million a year ago, despite a 10.71% growth in revenue, primarily due to a stronger ringgit, which resulted in forex losses.

Nevertheless, it saw more export sales from its Vietnam operations, as demand for furniture continued to stay strong, in line with sustained employment and strengthening housing market data in the US.

For the six months ended April 30, 2016 (1HFY16), Poh Huat’s net profit climbed 42% to RM18.01 million from RM12.71 million, while revenue grew 28% to RM257.52 million.

Poh Huat’s group financial controller Lee Ing Tiong said profit before tax (PBT) margin for the second half ending Oct 31, 2016 (2HFY16) is expected to be higher than 1HFY16 on anticipation of orders of products with higher margin for the Christmas season. For the full FY16, however, PBT margin is expected to stay at 10%, he added.

While price competition is an issue in every business, the furniture manufacturer does enjoy some stickiness from its long-term clients. “We do face price competition from China and they are still the world’s largest furniture exporter. But when it comes to bulky items like furniture, trust and relationship built between us and our long-term clients over the years matter,” Tay said.

The original equipment manufacturing business accounts for 90% of Poh Huat’s exports to the US. Poh Huat’s notable clients include Canada-based Performance, US-based Ashley Furniture Industries Inc and Aspen Home.

Meanwhile, Tay, who has a direct interest of 24.11% and an indirect interest of 5.52% in the company, said the company intends to continue paying out 30% to 40% of its profit as dividends although Poh Huat doesn’t have a dividend policy.

TA Securities senior analyst Ooi Beng Hooi, who tracks the counter, said Poh Huat’s earnings prospect is positive as demand from the US market has been healthy. “We are forecasting a dividend of 8 sen this year. This would translate to a dividend yield of more than 5%,” he told The Edge Financial Daily when contacted.

Ooi also opined that Poh Huat’s 20% sales growth target should be achievable for FY17. “The labour cost in Vietnam is lower and its Malaysian operation is very much automated,” noted Ooi, who has a “buy” call and a target price of RM2.05 on Poh Huat.

Meanwhile, Gan Kong Yik, chief investment officer of KAF Investment Funds Bhd, opined the counter is a good buy especially in the current tepid stock market environment.

“The company is expected to benefit from positive US housing data. There is usually a six-month lag for the strong data to translate into orders and sales. The dividend yield is about 4.8%, [previous] earnings growth is about 10% to 15%. PER is about 7 times, which is attractive. The company is in a net cash position too,” he said via telephone. He added that Poh Huat will also benefit if the ringgit weakens further against the US dollars.

Shares of Poh Huat closed 3 sen lower at RM1.54 last Friday, valuing it at RM328.8 million. Year to date, the counter has declined 22.06%.

Want to know the price trends of a development? Click here.

This article first appeared in The Edge Financial Daily, on Sept 13, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Sentrio Suites (Sentrio Pandan)

Desa Pandan, Kuala Lumpur

Mayfair Residences @ Pavilion Embassy

Keramat, Kuala Lumpur