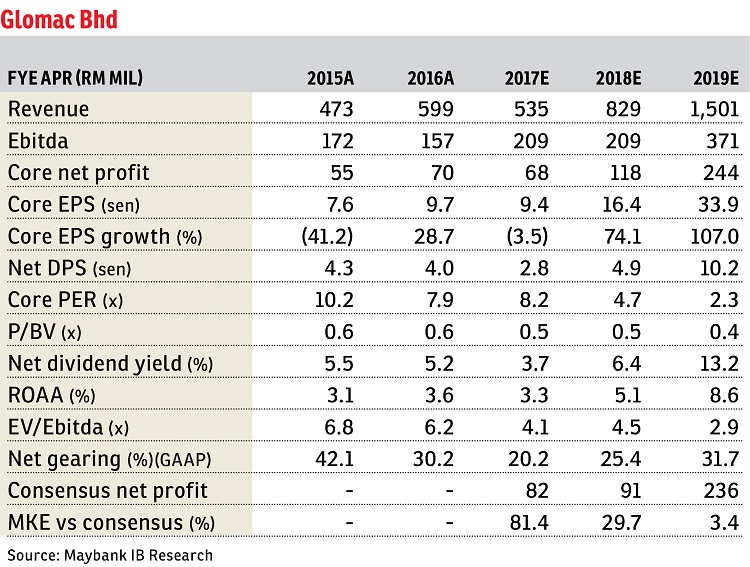

Glomac Bhd (Sept 13, 76 sen)

Maintain hold with a higher target price (TP) of 82 sen: Glomac Bhd’s upcoming first quarter ended July 31, 2016 (1QFY17) results could come in below expectations, with weaker core net profit quarter-on-quarter (q-o-q) and year-on-year (y-o-y). Glomac’s internal sales target of RM600 million to RM650 million for financial year 2017 (FY17) also seems challenging. We adjust our earnings forecasts by -21% to +3.4% but raise revised net asset value (RNAV)-TP by +8% to 82 sen (on unchanged 60% discount to RNAV) after factoring the Plaza Kelana Jaya phase 4 (PKJ4) project.

Glomac’s 1QFY17 results, to be released on Sept 21 or 22, are likely to come in below expectations. Excluding a disposal gain of RM80 million to RM84 million, owing to the land sale in Cheras (announced in October 2015), 1QFY17 core net profit could come in at RM5 million to RM10 million (-53% to -76% y-o-y, -54% to -77% q-o-q) accounting for just 7% to 15% of our full-year estimate. The weaker earnings performance could be due to weaker sales (-40% y-o-y in FY16), slower progress billing and higher marketing expenses.

Sales may have fallen short in 1QFY17 on the lack of new launches. So far, Glomac has only soft-launched 56 units of landed properties (phase 6) at Lakeside Residences worth RM50.2 million in gross development value (GDV). Management is, however, keeping its RM600 million to RM650 million sales target for FY17 (Maybank Kim Eng: RM480 million) and will intensify the launches from 2QFY17 onwards. It has lined up RM982 million worth of new property launches from 2Q to 4Q, of which 35% is derived from PKJ4.

We adjust our financial year ending April 30, 2017 (FY17)/FY18/FY19 core earnings forecasts by -21%/-4%/+3.4% to factor in higher marketing expenses for FY17, change in progress billing assumptions and Plaza Kelana Jaya phase 4 (RM344 million in GDV; mixed development; the land was previously up for sale). All in, we raise our RNAV/share estimate to RM2.05 (+8%). Consequently, our TP is raised to 82 sen based on an unchanged 60% discount to RNAV. — Maybank IB Research, Sept 13

This article first appeared in The Edge Financial Daily, on Sept 14, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Seksyen 5, Petaling Jaya

Petaling Jaya, Selangor

Seksyen 4, Petaling Jaya

Petaling Jaya, Selangor

Section 22, Petaling Jaya

Petaling Jaya, Selangor

Trillium, Perdana Lakeview East

Cyberjaya, Selangor