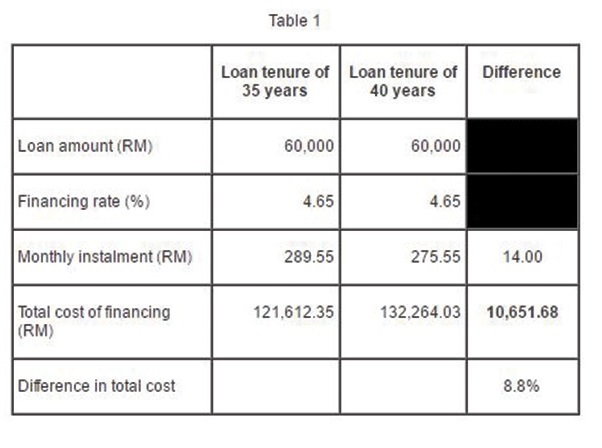

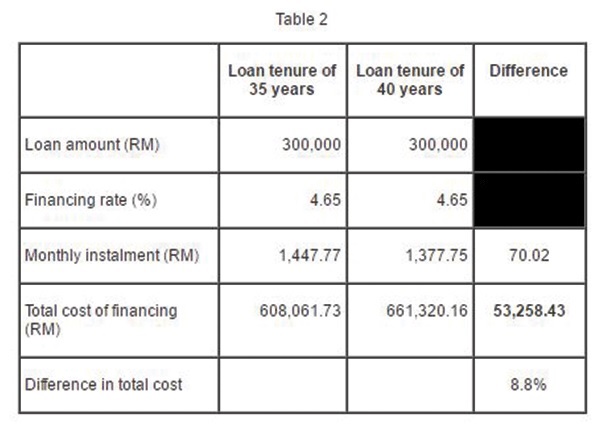

Source: Bank Negara Malaysia

KUALA LUMPUR (Sept 20): Bank Negara Malaysia (BNM) said today that the maximum housing loan tenure of 35 years is more than sufficient for borrowers to settle their housing loans by their retirement age.

It cited a housing loan that is offered when the borrower is 25 years old, where a financing tenure of 35 years would extend to the retirement age of 60 years old.

Increasing the loan tenure to 40 years will only serve to add to the total cost of financing, without significant improvements in the affordability of one's monthly instalment, the central bank said in a statement today.

Assuming a loan of RM300,000 at an interest rate of 4.65% per year, repayable in 35 years, BNM estimated the total cost of financing to be RM608,061.73. However, the total cost of financing will increase by 8.8% or RM53,258.43 to RM661,320.16, if the loan tenure is extended to 40 years.

BNM also dismissed the suggestion that access to financing is the main problem confronting potential buyers of affordable houses.

"Access to financing is not the main problem... The fundamental issues that require resolution are affordability and the shortage of supply of reasonably priced houses," it said.

It added that the implementation of its responsible financing guidelines serves to protect individuals' interests, so that they borrow within their capacity to repay the loans throughout its tenure.

"This is to prevent borrowers from falling into financial hardship due to excessive debt burden, that may lead to foreclosures which will undermine the objective of house ownership," it said.

"BNM wishes to state that financial institutions will continue to lend to individuals who can afford to take on a housing loan, including for the purchases of their first homes.

"In July this year, outstanding housing loans extended by financial institutions continue to grow at 10.1% year-on-year to total RM460.2 billion," it noted.

It also pointed out that about 75% of borrowers or approximately 1.5 million borrowers with housing loans, are first-time house buyers.

The central bank pointed to financial institutions, saying they are responsible to establish that the borrower's income after statutory deductions, expenditure on necessities and all other obligations, are able to meet debt repayments.

"This is to ensure that borrowers can continue to service the loan and have sufficient financial buffers for living expenses and deal with any future increase in financing rates and rising costs," BNM added.

The central bank was responding to news reports on requests for BNM to review the lending guidelines in relation to the extension of the loan repayment period, from 35 to 40 years.— theedgemarkets.com

TOP PICKS BY EDGEPROP

Flat PKNS, Seri Kembangan

Seri Kembangan, Selangor

Bandar Baru Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur