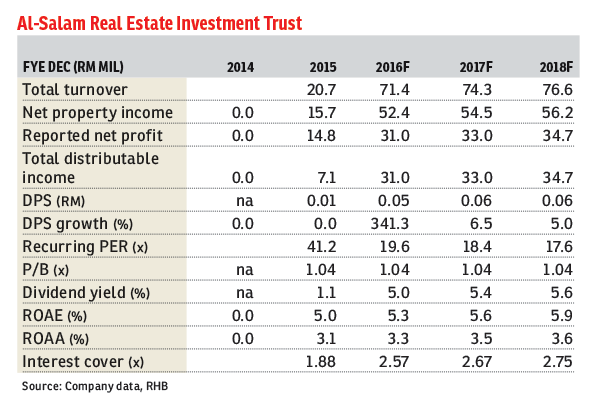

Al-Salam Real Estate Investment Trust Sept 30 (RM1.04)

Initiate coverage with a buy call: Attaching a dividend discount model-based target price (TP) of RM1.18 (12.7% upside): Possessing the crown jewel of Johor Bahru, Komtar JBCC in its stable, Al-Salam Real Estate Investment Trust (REIT) is a well-diversified syariah-compliant REIT that is set to reap the benefits of the massive redevelopments in Johor Baru and its surrounding area. Managed by the highly experienced Damansara REIT Managers Sdn Bhd, the portfolio is also well-defended by the long-term leases of its QSR Brands (M) Holdings Sdn Bhd properties, KFCH International College and Menara Komtar, which provides long-term stability.

We believe the REIT is set for further rerating due to its mixture of stability and growth from its diversified asset base. We expect substantial future growth potential supported by both organic (leveraging on its sponsor JCorp) and future potential acquisitions.

Al-Salam REIT is a medium-sized diversified Malaysian REIT with a total portfolio asset value of RM911.5 million. Its investment properties’ gross floor area totals 1.9 million sq ft with 1.5 million sq ft of total net lettable area. Its properties are well diversified into retail, office, and industrial segments. Al-Salam REIT’s manager is Damansara REIT Managers Sdn Bhd (DRMSB), who also manages Al-Aqar Healthcare REIT, the only listed healthcare-focused REIT in Malaysia. As such, we believe DRMSB has the experience and capability to ensure Al-Salam REIT is managed prudently and efficiently, leading to stable future growth.

Al-Salam REIT is one of only four syariah-compliant REITs listed on Bursa Malaysia. The major advantage of being syariah-compliant is that it gives the REIT an exposure to a bigger pool of potential investors, as syariah-compliant funds can only invest in syariah-compliant securities. With the scarcity of syariah-compliant REITs in the market, we expect Al-Salam REIT to continue to garner investors’ interest, due to its diversified asset base and stable growth outlook.

We believe Komtar JBCC, which contributes more than 50% of the REIT’s revenue, has strong growth potential. The mall has only commenced operations in 2014, and we expect its occupancy rate to grow higher and its rental rate reversion to be strong, due to its positioning which targets the middle to upper class in Johor Bahru, being relatively lower rental rates compared with its peers’, and scarcity of premium shopping malls in Johor Baru’s city centre.

Key risks that can affect our call and TP are significant increase in interest rates, weaker-than-expected consumer sentiment, and competition from new properties. — RHB Research Institute Sdn Bhd, Sept 30

Want to know the price trends of a development? Click here.

This article first appeared in The Edge Financial Daily, on Oct 4, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

Broadleaf Residences, Hometree

Kota Kemuning, Selangor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

Halya @ Daunan Worldwide

Bandar Puncak Alam, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Pulau Indah Industrial Area

Pulau Indah (Pulau Lumut), Selangor

Damansara Heights

Damansara Heights, Kuala Lumpur

Kinrara Residence

Bandar Kinrara Puchong, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)