THE property market continues to be sluggish overall but this could also be a good time to look for deals in certain property hotspots. Looking at Selangor, in particular, one may be surprised that there are several unassuming areas that may offer investors some good returns.

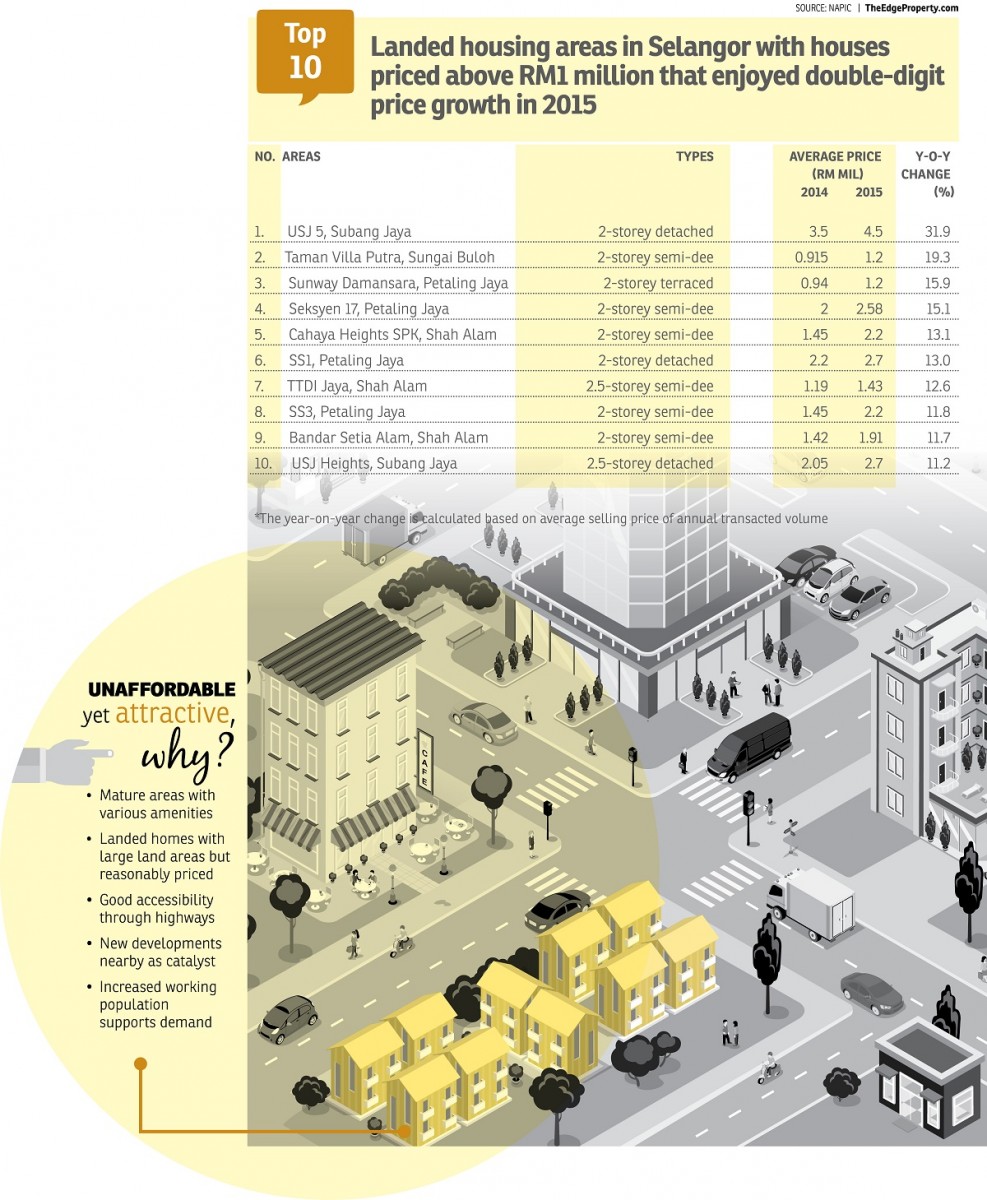

Data collated by the National Property Information Centre (Napic) showed that in 2015 there were 22 areas in Selangor that had landed homes with average selling prices of above RM1 million but enjoyed a year-on-year capital appreciation of over 10%.

From Napic’s list, TheEdgeProperty.com shortlisted the top 10 areas with the highest capital appreciation recorded. The appreciation rate ranged from 11.2% to as high as 31.9%.

The top three locations were: USJ 5 near Subang Jaya, Taman Villa Putra in Sungai Buloh and Sunway Damansara in Petaling Jaya.

The other areas that made up the top 10 were Seksyen 17 in Petaling Jaya, Cahaya Heights SPK in Shah Alam, SS1 and SS3 in Petaling Jaya, Taman TTDI Jaya in Shah Alam, Bandar Setia Alam in Shah Alam and USJ Heights.

Mature but sexy

“It surprised me to see the older areas, such as SS1, SS3, TTDI Jaya and Cahaya Heights SPK, making the list as these places are not the property investment hotspots which we read in the news,” Kim Realty Sdn Bhd CEO Vincent Ng tells TheEdgeProperty.com.

He notes that these areas have similarities. For one, they are mostly mature and old areas with established amenities and good accessibility to highways. Some areas also offer good rental investment opportunities.

He cites SS3, which is located opposite the Sungai Way Free Trade Industrial Zone, as an area which offers good opportunities to owners to turn their homes into rental accommodation for factory workers.

There are several technology and electrical manufacturing factories located in the zone, including Western Digital (M) Sdn Bhd, Omron Malaysia Sdn Bhd, Tamura Electronics (M) Sdn Bhd and Freescale Semiconductor Malaysia Sdn Bhd.

“Houses close to the Sungai Way Free Trade Zone have monthly rentals ranging from RM3,000 to RM4,000. If the owner renovates the house to increase the rooms and if they come with better facilities — such as en-suite bathrooms and kitchen, the property could fetch a monthly rental of up to RM6,000,” adds Ng.

Huttons One World Real Estate Group negotiator Daneal Eoon concurs that properties in mature areas like Seksyen 17 and SS3 in Petaling Jaya are sound investments as these areas offer various amenities and good accessibility.

“Besides Petaling Jaya, these are also the main reasons property buyers look at Subang Jaya as well.

“Besides, compared with similar landed properties in new townships, prices in these areas are still considered reasonable especially for those who are already comfortable or familiar with Petaling Jaya or Subang Jaya,” he adds.

He notes that new commercial developments near these mature housing areas also spur property demand as investors anticipate prices to continue climbing.

For instance, Mah Sing Group’s Icon City mixed development in Kelana Jaya is near to SS1 and SS3 while Seksyen 17 is located between the Phileo Damansara commercial centre and Damansara Intan as well as near to Seksyen 13 and 14’s commercial and industrial areas.

“Being surrounded by many commercial developments with a growing working population helped to maintain demand,” says Eoon.

Areas with more affordable choices

CBD Properties real estate negotiator Shermine Lim says residential property prices in Petaling Jaya have reached exorbitant levels, forcing homebuyers to search for houses in other mature areas with more reasonable pricing, such as Shah Alam.

Hence, some areas in Shah Alam or Sungai Buloh which are not too far from Petaling Jaya have attracted the attention of homebuyers and investors. Among the popular areas are Bukit Jelutong, Bandar Setia Alam, TTDI Jaya and Taman Villa Putra.

“Bandar Setia Alam has attracted buyers who are looking for a new development with a good design concept as well as gated-and-guarded elements,” she explains.

She notes that Cahaya Heights SPK has not seen much movement in recent years in terms of sales, but it is nevertheless “a nice place to live”.

“The leasehold title may deter older investors but this is not a concern for most young buyers,” she adds.

On TTDI Jaya, Lim says its proximity to the Hicom-Glenmarie Industrial Park (about 5km to 6km) benefits TTDI Jaya as the working population could support the demand for houses and accommodation there.

“According to my observation, over 90% of property buyers in Shah Alam are looking for own stay or for their children, not so much for investment as the price growth is slower than other places such as Petaling Jaya and Subang Jaya,” she explains.

New developments benefit older areas

For investors, Lim from CBD Properties sees good potential in Subang Jaya’s properties as the large population there could support price growth in the long term.

She says there are some investors who are looking for houses in USJ and Subang Jaya for rental yield as there is strong demand from students as well as hospital staff.

“USJ 5 is one of the most in-demand areas in the Subang Jaya and USJ areas as it is located near guarded developments as well as bungalow projects, where the more affluent reside,” she adds.

Lim notes that USJ Heights, which is located adjacent to industrial areas, may not be as attractive as USJ 5 situated about 5km away although it still offers a nice living environment within the project.

“USJ Heights’ surrounding environment has an impact on demand, but USJ Heights will see more growth potential after Tropicana Metropark’s development comes up,” she adds.

The 88-acre Tropicana Metropark is an integrated township developed by Tropicana Corp Bhd. The developer has launched three phases including Pandora serviced residences, Paloma serviced residences and Courtyard Villas as well as the commercial development, Metroplex.

Meanwhile, another housing area in the Top 10 list, Taman Villa Putra in Bukit Rahman Putra, Sungai Buloh is also gaining growth momentum due to its proximity to many Petaling Jaya hotspots with about a 15-minute drive to Bandar Utama, Mutiara Damansara and Taman Tun Dr Ismail (TTDI).

This gated-and-guarded township’s demand could be supported by the nearby working population as it is located near to Hospital Sungai Buloh as well as SB Jaya and Putra Industrial areas, says Lim.

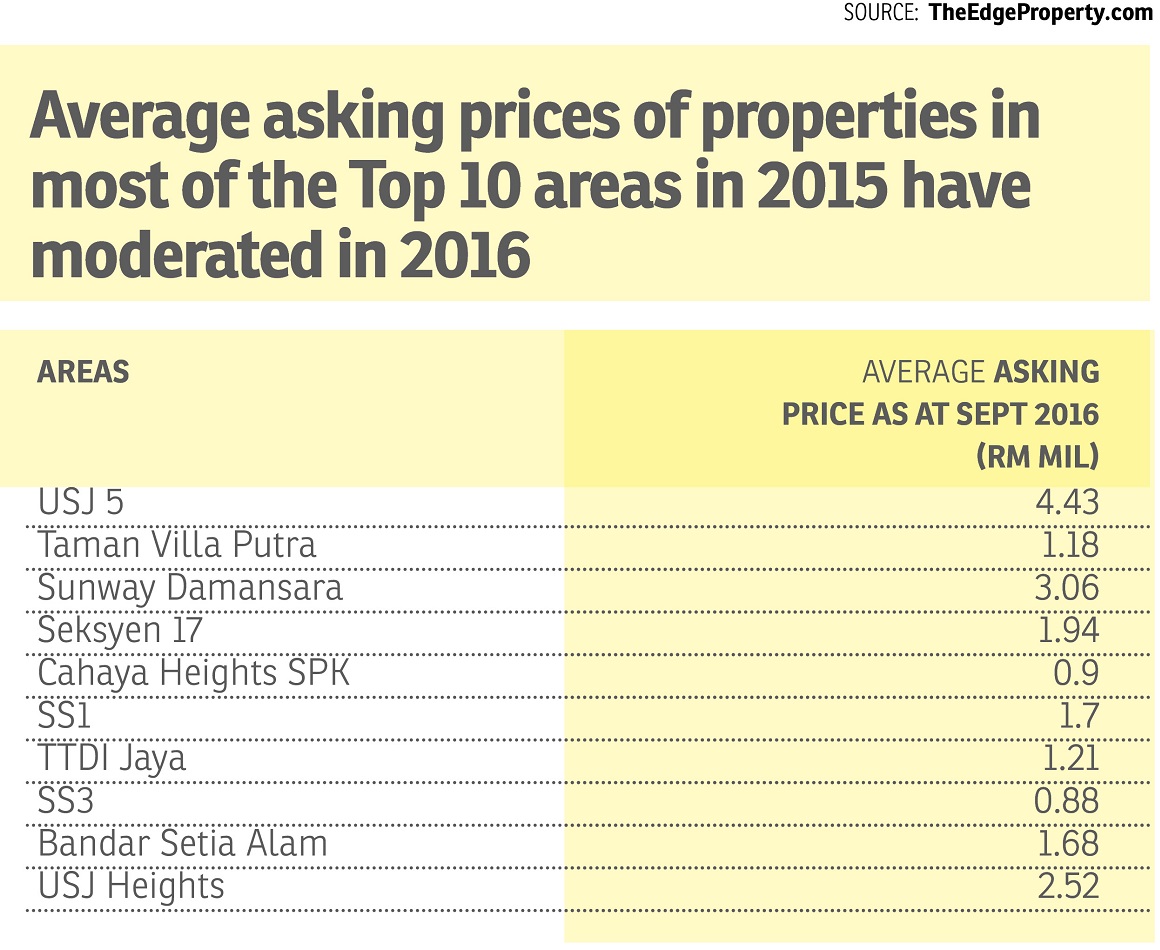

Weakening price growth in 1Q2016

Although the houses in these 10 areas have achieved high capital appreciation over 2015, their current performance may be hampered by the current poor market sentiment over the sluggish economy.

Some properties in the Top 10 areas have seen selling prices dipping in 1Q2016. For instance,

TheEdgeProperty.com data showed that the average selling price of double-storey detached homes in USJ 5 (based on two transacted deals) was down at RM2.5 million in 1Q2016.

Other areas that have seen price dips in 1Q2016 include Sunway Damansara, Seksyen 17, SS3, Bandar Setia Alam and USJ Heights.

Acrehill Properties real estate negotiator Michelle Lee says owners of landed homes are becoming more realistic in line with current market conditions and sellers have lowered their asking prices.

For instance, double-storey terraced houses in Sunway Damansara that have seen their average selling price exceed RM1 million will find it hard to sustain their price uptrend as asking prices have dropped back to around RM900,000.

“Nevertheless, owners will still make a profit as most of them had purchased their properties more than 10 years ago at a lower price of about RM300,000 to RM400,000,” she explains.

Similarly, in other areas such as USJ 5 and USJ Heights, owners are willing to lower their asking prices.

“Now is the best time for first-time owners to purchase a house or existing property owners to upgrade their house. But for investment purposes, I would be a bit more cautious,” Lee says.

This story first appeared in TheEdgeProperty.com pullout on Oct 7, 2016, which comes with The Edge Financial Daily every Friday. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

D'Cerrum Apartment @ Setia EcoHill

Semenyih, Selangor

D'Cassia Apartment @ Setia EcoHill

Semenyih, Selangor

Harmoni Apartment @ Eco Majestic

Semenyih, Selangor

Residensi Bintang Shamelin ( Shamelin Star )

Cheras, Kuala Lumpur

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)