Sunway Bhd (Oct 10, RM3.09)

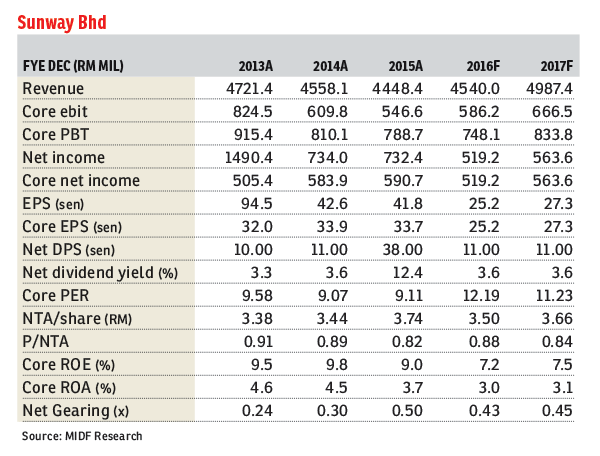

Maintain neutral with a higher target price of RM3.25 from RM3.07 previously: We met up with Sunway Bhd’s management to seek updates and discuss prospects for the group.

Sunway is having high exposure in Johor whereby remaining gross development value (GDV) of RM30 billion from Johor land makes up 61% of Sunway’s total remaining GDV.

Despite the current property supply glut in Johor, management remains confident about the prospect for Iskandar Malaysia. Management believes that high speed rail (HSR) linking Kuala Lumpur to Singapore to be a game changer for Iskandar Malaysia as one of the HSR stations will be located in Iskandar Malaysia.

Moreover, there will be a shuttle service between Iskandar Puteri and Singapore under the HSR’s master plan, where the customs, immigration and quarantine facilities will be located at the stations to reduce the hassle for passengers and also shorten their travelling time.

While we concur that the HSR can be a positive long-term catalyst for Sunway Iskandar, we think that immediate outlook for the property market in Johor is to remain subdued.

Management is maintaining a sales target of RM1.4 billion for financial year 2016 (FY16).

Recall that Sunway registered sales of RM613 million in first half of FY16, which met 44% of management’s full-year sales target.

Looking ahead, management is planning to launch properties with total GDV of RM1.1 billion in the fourth quarter of 2016. The properties are namely Sunway Geo Residence 3 (GDV: RM400 million), Velocity offices (GDV: RM200 million), Sunway Iskandar landed residences (GDV: RM400 million) and others (GDV: RM100 million).

On a side note, Sunway Mont residences @ Mont’Kiara (GDV: RM300 million) was launched in May 2016 and the booking rate was commendable at 80%.

Sunway remains committed to increasing its property exposure in Singapore with the recent land banking exercise in Achorvale Lane. The project would contribute a GDV of S$520 million (RM1.57 billion), on top of three ongoing projects in Singapore with a total GDV of S$1.6 billion.

The selling price for the project in Anchorvale Lane would be at an average of S$850 per sq ft (psf) against the land purchase price of S$355 psf. We expect a healthy take-up rate for the project as the selling price is deemed affordable.

On the China project front, phase one of the Tianjin project (GDV: RM300 million) is fully sold while the second phase is expected to be launched soon.

We are maintaining a “neutral” stance on Sunway as a subdued property market may weigh on its property sales outlook. Nevertheless, we reckon that the project’s kick-off of the HSR can be a long-term catalyst for Sunway. — MIDF Research, Oct 10

This article first appeared in The Edge Financial Daily, on Oct 11, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Trillium, Perdana Lakeview East

Cyberjaya, Selangor

Long Branch Residences

Kota Kemuning, Selangor

SS 21, Damansara Utama

Petaling Jaya, Selangor