Hua Yang Bhd (Oct 24, RM1.24)

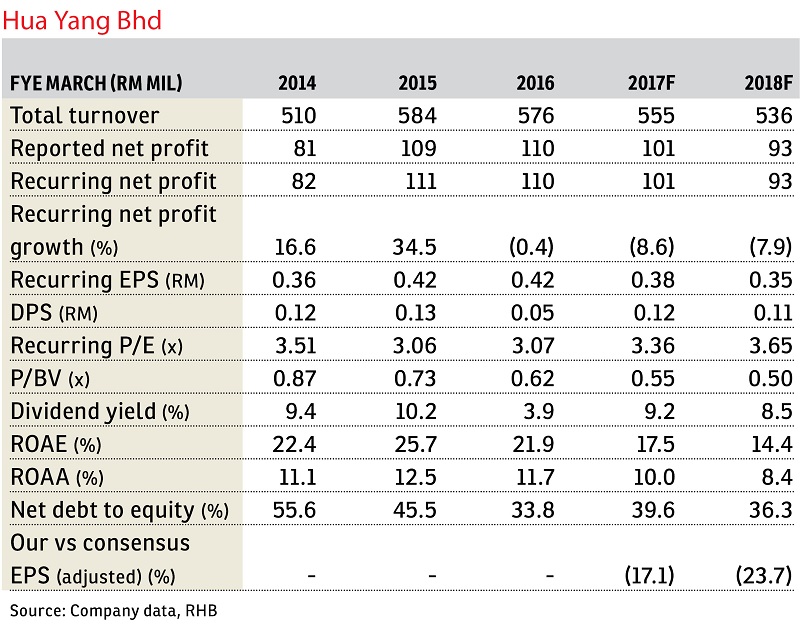

Maintain neutral with a lower target price (TP) of RM1.36: We believe township projects are the key sales driver for Hua Yang Bhd in the financial year ending March 31, 2017 (FY17) in the face of a property sector slowdown. The company registered new sales of RM101 million in the first half ended Sept 30, 2016 (1HFY17), substantially below its RM500 million sales target for FY17.

Nonetheless, we maintain our earnings forecast pending its analysts’ briefing, which was scheduled for yesterday. We adjust our revalued net asset valuation (RNAV)-based TP to RM1.36 (from RM1.81), taking into account its recent bonus issue.

We believe Hua Yang’s focus and experience in the affordable segment will serve it well in this challenging operating environment. We expect its township projects to perform better than the other segments. In 1HFY17, its township projects Bandar Universiti Seri Iskandar in Perak and Taman Pulai Hijauan in Johor contributed 25% and 19% to total new sales of RM101 million.

Hua Yang’s 88 million new shares from its one-for-three bonus issue were listed on Oct 13, 2016. We view this proposal as a way to reward existing shareholders while conserving its cash. It would also improve the trading liquidity of the stock.

We make no changes to our FY17 to FY19 earnings per share forecasts, pending the analysts’ briefing. We adjust our RNAV-based TP to RM1.36, taking into account the larger share base from its bonus issue and attaching a 45% discount to RNAV.

Hua Yang’s 1HFY17 core net profit of RM40.9 million (-30.2% year-on-year) came in below expectations. The below-par performance was due mainly to slower new launches in FY16, and several ongoing projects being at the tail end of construction. No dividend was declared, as expected. — RHB Research, Oct 24

This article first appeared in The Edge Financial Daily, on Oct 25, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Plenitube Harp @ Taman Desa Tebrau

Johor Bahru, Johor

Pangsapuri Sri Ilham, Bandar Baru Seri Alam

Masai, Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor