After a series of acquisitions over the past two months, privately held Pembinaan Maju Wangi Sdn Bhd has accumulated almost 12.16 million shares, or an 11.36% stake, in Toyo Ink Group Bhd.

This makes it the second largest shareholder after Bangsar-based property group Eng Lian Enterprise Sdn Bhd, which has 15.4% equity interest.

The latest changes in shareholding have raised questions as to whether the new stakeholder will help to expedite the company’s power-generation project in Vietnam.

“There is little or no information about Pembinaan Maju Wangi or the individuals behind it, what their plans are, whether they are politically connected and whether they have the requisite funds to support Toyo Ink’s plans,” says one market watcher.

Pembinaan Maju Wangi is entering Toyo Ink at a time when it is likely to need fresh capital to embark on the power project, which is estimated to cost US$3.5 billion.

Toyo Ink had secured a deal in 2008 with Power Engineering Consulting Joint Stock Company 2, under the Ministry of Industry of Vietnam, to build a 2,000mw coal-fired power plant in Hau Giang in South Vietnam.

The plan is to supply energy to Vietnam’s southern region under a 25-year concession, and diversify Toyo Ink’s revenue base from manufacturing printing ink.

The plan is to supply energy to Vietnam’s southern region under a 25-year concession, and diversify Toyo Ink’s revenue base from manufacturing printing ink.

The company is slated to handle ancillary infrastructure systems, including coal handling, as well as cooling and fresh water systems, pollutant and waste control, removal and treatment systems, a coal yard and a coal jetty, among others.

However, Toyo Ink has yet to commence the project after eight years. Managing director Song Kok Cheong had been quoted in the media last month as saying the company was in the final stages of eight years’ of discussion with the Vietnamese authorities.

Song is also a substantial shareholder of Toyo Ink with an 11.1% stake.

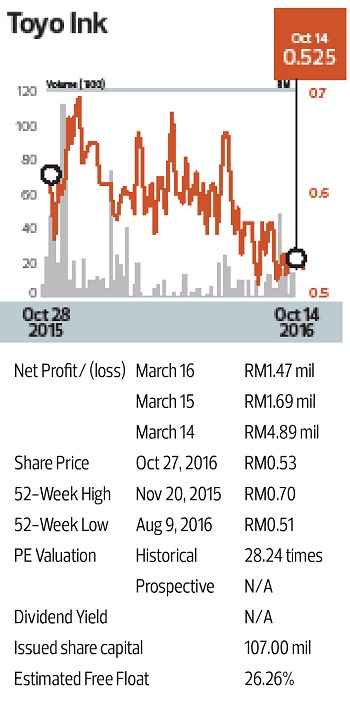

Toyo Ink’s earnings, generated from its core ink manufacturing business, have not been exciting over the past two years.

For the three months ended June 30, it posted a net profit of RM768,000 on revenue of RM19.93 million. In the corresponding period a year ago, it only recorded a net profit of RM66,000 from RM18.11 million in sales.

For the financial year ended June 30, 2016 (FY2016), its profit of RM1.47 million was lower than the RM1.69 million the year before. Revenue was flat at RM81.74 million in FY2016.

Back to the new shareholders. According to Toyo Ink’s annual report, Pembinaan Maju Wangi only held 2.04% equity interest or 2.19 million shares as at June 30. The latter possibly acquired shares from Cheah Yoke Han, who ceased to be a substantial shareholder on Sept 14 after she sold 1.5 million shares.

It is noteworthy that she had been a substantial shareholder since mid-August 2012.

Pembinaan Maju Wangi paid RM5.11 million for 9.97 million shares in Toyo Ink, at prices ranging from 49 sen to 55 sen, between Aug 18 and Oct 24.

So just who is behind Pembinaan Maju Wangi?

A check with the Companies Commission of Malaysia (CCM) shows that the company was incorporated and registered in September 1981.Its nature of business is stated as property investment, general contractors and commission agents.

The directors and shareholders are Lam Peng Kee and Fong Siew Ching, who are possibly husband and wife as they have the same address in the CCM filings. Lam controls 80% of the company while Fong has a 20% stake. Both have been directors since December 2009.

Pembinaan Maju Wangi only has a RM2 million charge from CIMB Bank Bhd that remains unsatisfied, but its financials, assets and debt obligations are not available as it has exempt private company status.

What seems clear is that both Lam and Fong are low key and are not known corporate personalities.

Another question is why Pembinaan Maju Wangi has not sought board representation although it has an 11.36% stake in Toyo Ink.

Besides Pembinaan Maju Wangi and Cheah, other shareholding changes have taken place as a result of Ng Chong You passing away. The 7.97 million shares, or 7.45% stake, held by Chong You and his wife Ling Ha Kee has passed to their son, Ng Tze Woei.

Tze Woei is also not on the board of Toyo Ink, despite being a substantial shareholder. Other substantial shareholders that do not have board representation are Eng Lian, which is controlled by the Ng family, Fong Po Yin (11.09%) and Kok Sau Lan @ Kwok Sow Lan (close to 7%).

Non-independent non-executive director Lim Guan Lee holds 10.81%.

Toyo Ink’s net asset value per share as at June 30 stood at RM1.17, with cash balances of RM2.20 million, short-term debt commitments of RM16.93 million and long-term borrowings of RM8.24 million.

Much of the assets are in the form of buildings, including a three-storey office and factory on a 2.73-acre plot in Selangor with a net book value of RM10.59 million and a 1½-storey freehold semi-detached light industrial building in Puchong with a net book value of RM2.42 million.

In the notes accompanying its financials, Toyo Ink says of its prospects: “In view of the ongoing market penetration strategy and continuous cost control management, the board of directors is confident of achieving encouraging performance for the financial year ending March 31, 2017.”

The power plant project will be a game changer for Toyo Ink, as is the case for a few other Malaysian firms, such as JAKS Resources Bhd and Mega First Corp Bhd.

Nonetheless, power generation projects abroad are not necessarily a secure recurring income source, with one example being Mudajaya Group Bhd’s project in India.

This article first appeared in The Edge Malaysia on Oct 31, 2016. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

Residensi Zamrud (Zamrud Residensi)

Kajang, Selangor

Semenyih Lake Country Club

Semenyih, Selangor

Pangsapuri Seroja

Setia Alam/Alam Nusantara, Selangor

Kawasan Perindustrian Balakong

Balakong, Selangor

Sendayan Tech Valley Industrial Park

Siliau, Negeri Sembilan

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)