Recommend buy with a target price of 48.5 sen: Pesona Metro Holdings Bhd is a small cap contractor that has little market attention until recently as it goes through a winning streak, securing RM1.8 billion worth of construction jobs year to date. Pesona yesterday secured its single-largest contract win worth RM488 million for the construction of Central Plaza I-City Mall in Shah Alam. Consequently, this has beefed up its outstanding order book to a record high of RM2.3 billion, which comfortably provides strong earnings visibility to the group for the next three to 3½ years.

Apart from its construction business, Pesona is striving to build up a recurring income stream that would help mitigate the cyclical risks in the construction sector. Hence, it is currently venturing into its first concession business, which entails the development and maintenance of student hostels in Universiti Malaysia Perlis (Unimap) through the acquisition of SEP Resources Sdn Bhd for RM29.2 million. The acquisition of SEP would take place in two tranches by acquiring 70% of SEP in the first tranche in the financial year ending Dec 31, 2016 (FY16), while the remaining 30% would be completed in FY17 should it be able to get approval for the waiver on the bumiputera ownership requirement. The concession is expected to generate average yearly profit after tax of around RM10 million for the next 20 years from FY17. SEP aside, Pesona is still eyeing two other potential concessions.

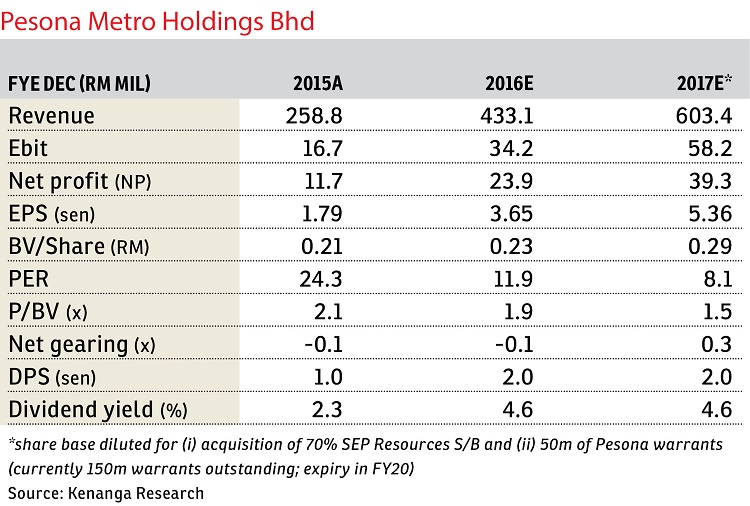

With about RM1 billion tender book in hand, we target a replenishment of RM1.9 billion for FY16 and a lower replenishment of RM400 million for FY17 as we expect Pesona to focus on project execution moving forward. By only factoring in 70% of Unimap earnings from FY17, we expect Pesona to generate FY16-FY17 earnings of RM23.9 million to RM39.3 million. Note that we have chosen to omit the remainder 30% earnings contribution from SEP should Pesona fail to acquire due to bumiputera ownership requirement, and its contract win of RM488 million has been factored into our estimates. — Kenanga Research, Nov 3

This article first appeared in The Edge Financial Daily, on Nov 4, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Setiawangsa Business Suite

Taman Setiawangsa, Kuala Lumpur

Bungalow Lot at Jalan Gasing, Unparalleled Kuala Lumpur View For Sale

Petaling Jaya, Selangor

Pangsapuri Damai, Subang Bestari

Subang Bestari, Selangor

Laman Haris @ Eco Grandeur

Bandar Puncak Alam, Selangor

Iris @ Bandar Hillpark

Bandar Puncak Alam, Selangor