KUALA LUMPUR (Nov 10): Shares in IOI Properties Group Bhd slumped the most in a month yesterday, after the property developer was reported to have place a record bid of S$2.57 billion (RM7.77 billion) for a plot of land in Singapore’s financial district.

KUALA LUMPUR (Nov 10): Shares in IOI Properties Group Bhd slumped the most in a month yesterday, after the property developer was reported to have place a record bid of S$2.57 billion (RM7.77 billion) for a plot of land in Singapore’s financial district.

In a filing with Bursa Malaysia yesterday, IOI Properties said it, via its wholly-owned subsidiary Wealthy Link Pte Ltd, had submitted the bid for a 1.09ha piece of leasehold land in Central Boulevard to the republic’s Urban Redevelopment Authority.

“The decision on the award of the tender will be made after all bids have been evaluated. The company will make the relevant announcements once such decision has been made,” it added.

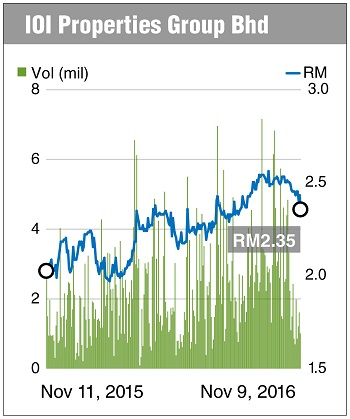

The market did not react favourably to the news as the stock slid as much as eight sen or 3.29% to end the day at RM2.35, the lowest level since Aug 15 this year. On Tuesday, the stock closed at RM2.43.

A total of 1.01 million shares were traded between RM2.34 and RM2.43 yesterday, valuing it at RM10.37 billion.

When contacted, RHB Research analyst Loong Kok Wen told The Edge Financial Daily the bid reflected the group’s optimism over the office market in Singapore in the longer term, although the price tag is “quite aggressive”.

“I understand their South Beach office has been fully leased out. If you look at the bid, location-wise, it is very strategic,” she said, noting that the land had attracted seven bidders, including big names like MapleTree Trustee and OUE Ltd, Guangzhou R&F Properties and Tang City Properties.

“So the land [seems to be] a must-have parcel for developers,” she added.

Loong noted that IOI Properties had also made clear that it wants to grow sustainable recurring income from the office segment and the acquisition is just part of its strategy.

According to its Annual Report 2016, IOI Properties had cash of RM2.1 billion, while borrowings amounted to RM4.2 billion as at June 30, 2016 (financial year 2016 [FY16]). Its net gearing stood at 14% as at FY16.

IOI Properties has five developments in Singapore, namely Cape Royale and Seascape at Sentosa Cove, Cityscape @ Farrer Park, South Beach and The Trilinq.

IOI Properties also stated in the annual report that its South Beach project, a joint-venture development with City Developments Ltd, had managed to lease out more than 90% of total retail space.

“The completion of the mass rapid transit (MRT) link in July 2016, which provided the vital link to the Esplanade and City Hall MRT stations, will not only provide convenience to the development, but also enhance the vibrancy and footfall of the retail area,” it added.

Despite this, IOI Properties expects sales in the private residential market in Singapore to continue to be challenging as a result of continuing global economic uncertainty and the cooling measures being in force.

“However, price affordability and established locations will be key determinants for prospective homebuyers, and this is evident with the continued sales recorded in our Trilinq project during the financial year under review,” the group added.

This article first appeared in The Edge Financial Daily, on Nov 10, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Andana Condominium @ D'Alpinia

Puchong South, Selangor

Pangsapuri Angsana, Bandar Mahkota Cheras

Cheras, Selangor

South Brooks @ Desa ParkCity

Desa ParkCity, Kuala Lumpur

Paloma @ Tropicana Metropark

Subang Jaya, Selangor