WCT Holdings Bhd (Nov 14, RM1.93)

Maintain buy with a target price (TP) of RM2.12: WCT Holdings Bhd announced that its 70%-owned subsidiary Jelas Puri Sdn Bhd will be selling The Ascent in Paradigm Petaling Jaya with a leaseback agreement to the Employees Provident Fund (EPF) for RM347 million. The EPF is also a 30% shareholder of Jelas Puri. We are not surprised by this as The Ascent sale was one of the proposed de-gearing exercises set forth by management. The office block currently houses WCT’s headquarters which will be leased back following the sale to the EPF.

The Ascent sale will reduce WCT’s net gearing from 81% to 68% on a pro forma basis. Previously, management guided that its other de-gearing plans included the sale of Paradigm Service Apartments (RM150 million) and REIT (real estate investment trust)-ing its investment properties (RM1.2 billion). Following the recent entrance of Tan Sri Desmond Lim as the largest shareholder (20%) of WCT, we reckon that the potential monetisation of its investment properties could involve injecting them into Pavilion REIT (“buy”; TP: RM1.95). The latter is also held by Lim with a 28% stake.

A significant change in WCT’s strategic direction (if any) as brought forth by its new major shareholder would be a potential risk to watch out for. Proceeds from The Ascent sale will largely be used to pare down debts, we reckon. This will help reduce WCT’s finance cost. Nonetheless, our earnings forecast is unchanged for now, pending clarity on the timeline of disposal.

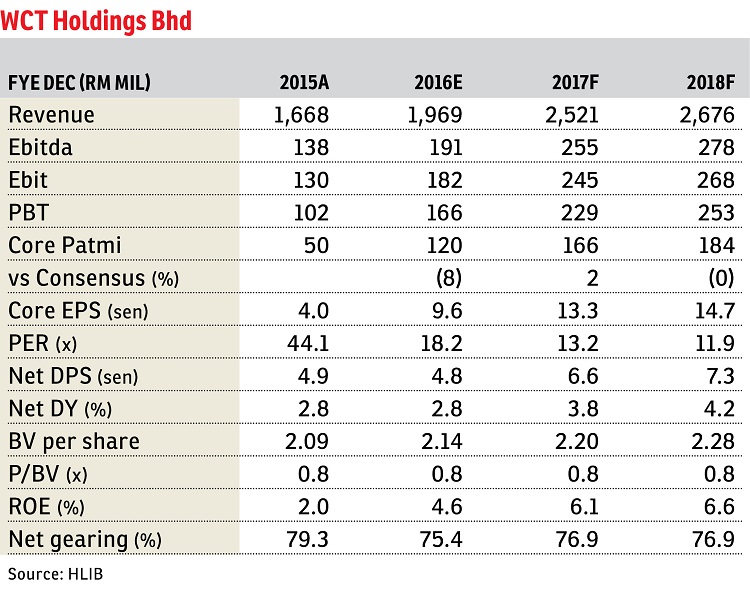

An earnings rebound and sizeable order book aside, the recent deal involving a new major shareholder, which was done at RM2.50 per share, could provide some upside excitement. Our sum-of-parts-based TP of RM2.12 implies financial year 2016 (FY16) price-earnings ratio of 22 times, but this reduces to 16 times in FY17 once earnings kick in. — Hong Leong Investment Bank Research, Nov 14

This article first appeared in The Edge Financial Daily, on Nov 15, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Harmoni Apartment @ Eco Majestic

Semenyih, Selangor

Harmoni Apartment @ Eco Majestic

Semenyih, Selangor

D'Cassia Apartment @ Setia EcoHill

Semenyih, Selangor

D'Cerrum Apartment @ Setia EcoHill

Semenyih, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)