Titijaya Land Bhd (Nov 15, RM1.77)

Unrated with a target price of RM1.79: Titijaya Land Bhd recently stole the limelight by entering into a joint-venture (70:30) agreement with China Railway Engineering Corp (CREC) to develop a piece of land in Jalan Ampang for an estimated gross development value (GDV) of RM2.1 billion. If successfully launched, we estimate this project alone to add RM120 million to its revalued net asset valuation (RNAV) or 21 sen (fully diluted per share). Given the increasing presence of China’s investment in Malaysia, we do not rule out more similar collaborations between Titijaya and CREC in the future.

On Sept 30, 2016, Titijaya proposed to acquire NPO Builders Sdn Bhd for a total consideration of RM115.6 million via issuance of 79.7 million new shares at RM1.45 per share. Post-acquisition, NPO will own approximately a 17% stake in Titijaya. NPO owned two pieces of freehold land with an estimated GDV of RM2.4 billion. Land cost is only 5% of total GDV, which is attractive. We understand that the development will comprise 6,000 to 7,000 affordable homes at the price range of RM300,000 to RM450,000 per unit.

One of the key strengths of Titijaya is its ability to expand its landbank through: i) joint ventures; and ii) land swaps with strategic partners such as government agencies and synergistic partners. This will also help minimise capital outlay without land holding cost.

Titijaya’s land banks are mainly located in the Klang Valley and Penang. Including the recent joint-venture deal with CREC, total GDV of future launches has increased by 21% to RM12 billion.

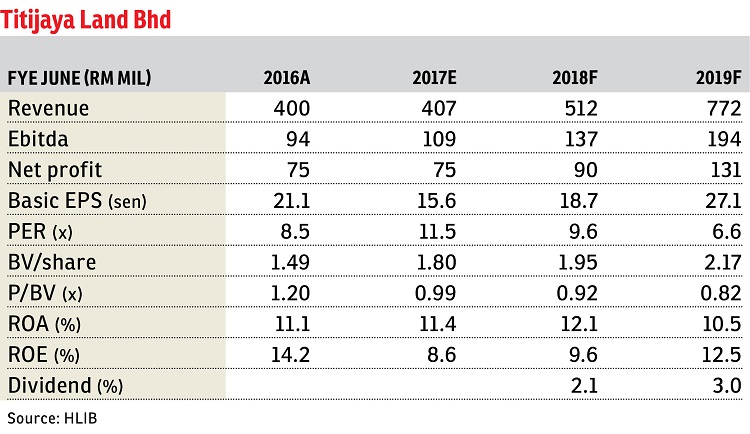

We estimate earnings to be relatively flat in financial year 2017 (FY17), and grow by a two-year compound annual growth rate of 32% to RM131 million in FY19 (price-earnings ratio will drop to 6.6 times). This will mainly be contributed by the launching of Riveria Central (GDV: RM1.4 billion) and 3rdNvenue (GDV: RM2.1 billion).

The company also proposed a share split for every one share into two new shares and a free warrant for every two subdivided shares.

Its partnership with CREC could be just a beginning.

We derive the fully diluted RNAV of the company at RM3.17 per share. If we factor in both Bukit Bintang and KLCC land with a conservative estimated GDV of RM3 billion, our RNAV will be further boosted by 10% to RM3.47 per share.

At the current share price, the company is trading at a 44% discount to RNAV or 48% if both pieces of land are factored into our RNAV. — Hong Leong Investment Bank, Nov 14

This article first appeared in The Edge Financial Daily, on Nov 16, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Residensi Xtreme Meridian (Astoria Ampang)

Ampang, Kuala Lumpur

Aira Residence

Damansara Heights, Kuala Lumpur