KUALA LUMPUR (Nov 18): GuocoLand (Malaysia) Bhd, which is controlled by tycoon Tan Sri Quek Leng Chan, saw net profit for the first quarter ended Sept 30, 2016 (1QFY17) fall near 99% year-on-year (y-o-y) to RM265,000 or 0.04 sen per share versus RM21.33 million or 3.18 sen per share, largely because the previous year had recorded a fair value gain of some RM16.7 million.

The fair value gain arose from the valuation of investment properties.

Its income statement filed with Bursa Malaysia yesterday showed it recorded higher selling and marketing expenses (up 9.4% to RM4.1 million), administrative expenses (up 10.3% to RM12.6 million) as well as finance costs (up 145.5% to RM8.8 million) during the period, with lower other net operating income (down 74% to RM5.4 million).

Revenue, meanwhile, weakened 24.4% y-o-y to RM53.53 million from RM70.81 million, on lower contribution from its residential projects in Damansara City, namely the Oval and Amandarii.

But the decline was partially offset by higher contribution from its commercial projects in Old Klang Road and Petaling Jaya.

Going forward, GuocoLand expects the property market outlook and sentiment to remain cautious amid an uncertain economic environment.

Hence, it foresees a challenging year ahead and will continue to focus on the timely completion of its development projects and to monetise its inventories.

GuocoLand’s share price was flat at RM1.18 yesterday, valuing it at RM819.54 million.

This article first appeared in The Edge Financial Daily, on Nov 18, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Baypoint @ Country Garden Danga Bay

Johor Bahru, Johor

Menara Bintang Goldhill

Bukit Bintang, Kuala Lumpur

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

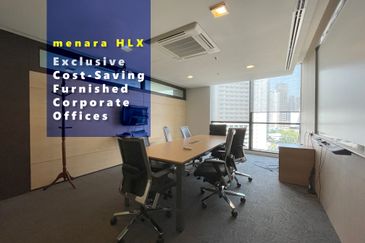

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur