YTL Corp Bhd (Nov 18, RM1.52)

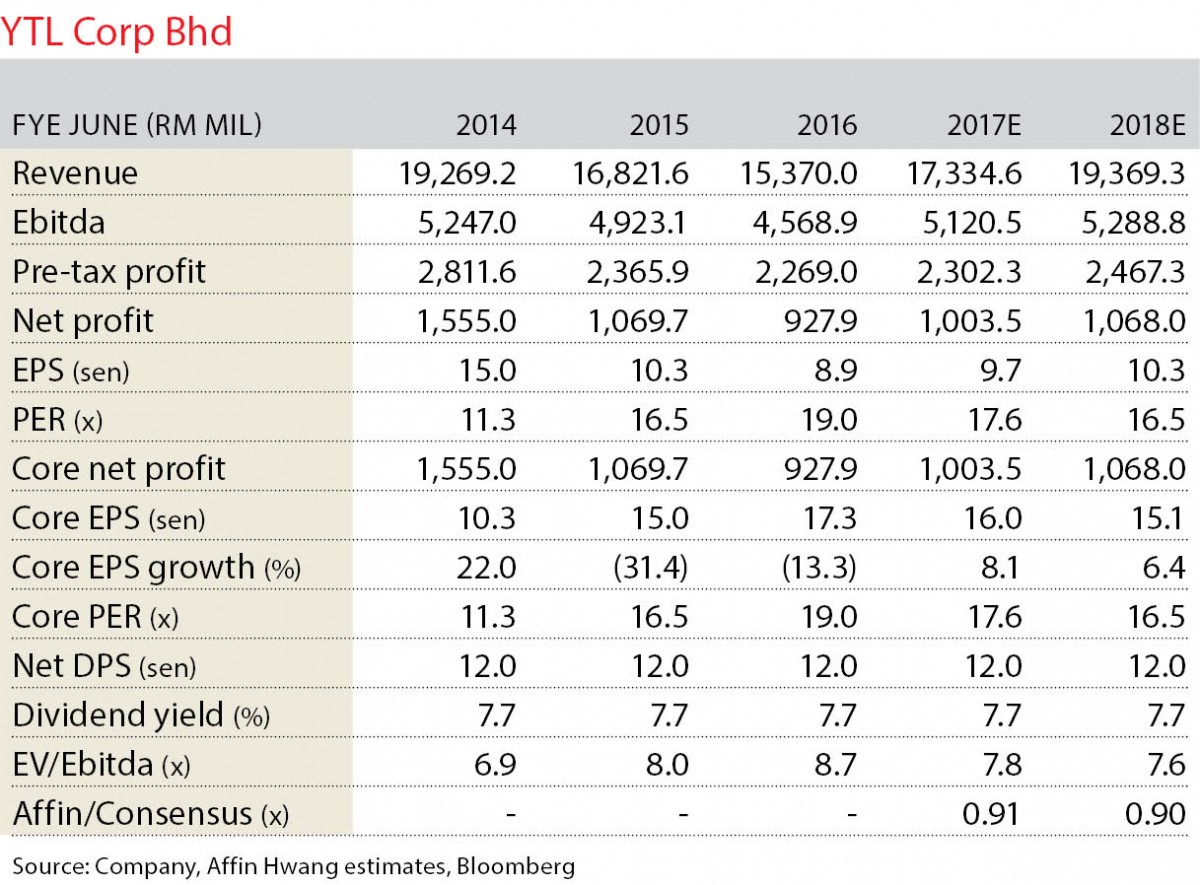

Maintain hold with an unchanged target price (TP) of RM1.70: YTL Corp Bhd 1QFY17 results is below our expectation, mainly due to weaker contribution from the cement segment. Despite the weaker-than-expected results, we still think that management is committed to pay out a 12 sen dividend per share (DPS) for FY17 estimates (FY17E), hence we are maintaining our “hold” call with an unchanged TP at RM1.70.

YTL Corp 1QFY17 results were below our and consensus expectations as net profit of RM150 million (-26% year-on-year [y-o-y]) accounted for only 15% and 14% of full-year estimates respectively. We believe the biggest disappointment is from the cement business, which its profit before tax is down 33% quarter-on-quarter and 36% y-o-y. The overall DPS at 12 sen for FY17E is achievable, in our view, as we expect an increase in dividend payout going forward.

The fall in contribution from the utilities segment is within expectation, given the expiry of its Malaysia power purchase agreement in FY16. However, the decline in the cement business is worse than our expectation, as it was attributed to competitive pricing and lower sales volume. We don’t think the worst is over, as our recent channel check suggests that the current overcapacity is expected to continue into the first half of 2017, hence any delay to any big infrastructure projects will be a risk to YTL Corp earnings.

We maintain our “hold” rating on YTL Corp with an unchanged 12-month TP of RM1.70 based on the same 10% holding company discount to our revalued net asset valuation of RM1.89. We still expect YTL Corp to deliver on the 12 sen dividend given that the capital expenditure cycle for the cement business has likely peaked, while the group should continue to receive fairly steady earnings from its utilities division. — Affin Hwang Capital Research, Nov 18

This article first appeared in The Edge Financial Daily, on Nov 21, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Jalan Taman Bukit Kinrara 1/8

Bandar Kinrara Puchong, Selangor

Savanna Executive Suites @ Southville City

Bangi, Selangor