Sunway Construction Group Bhd (Nov 23, RM1.62)

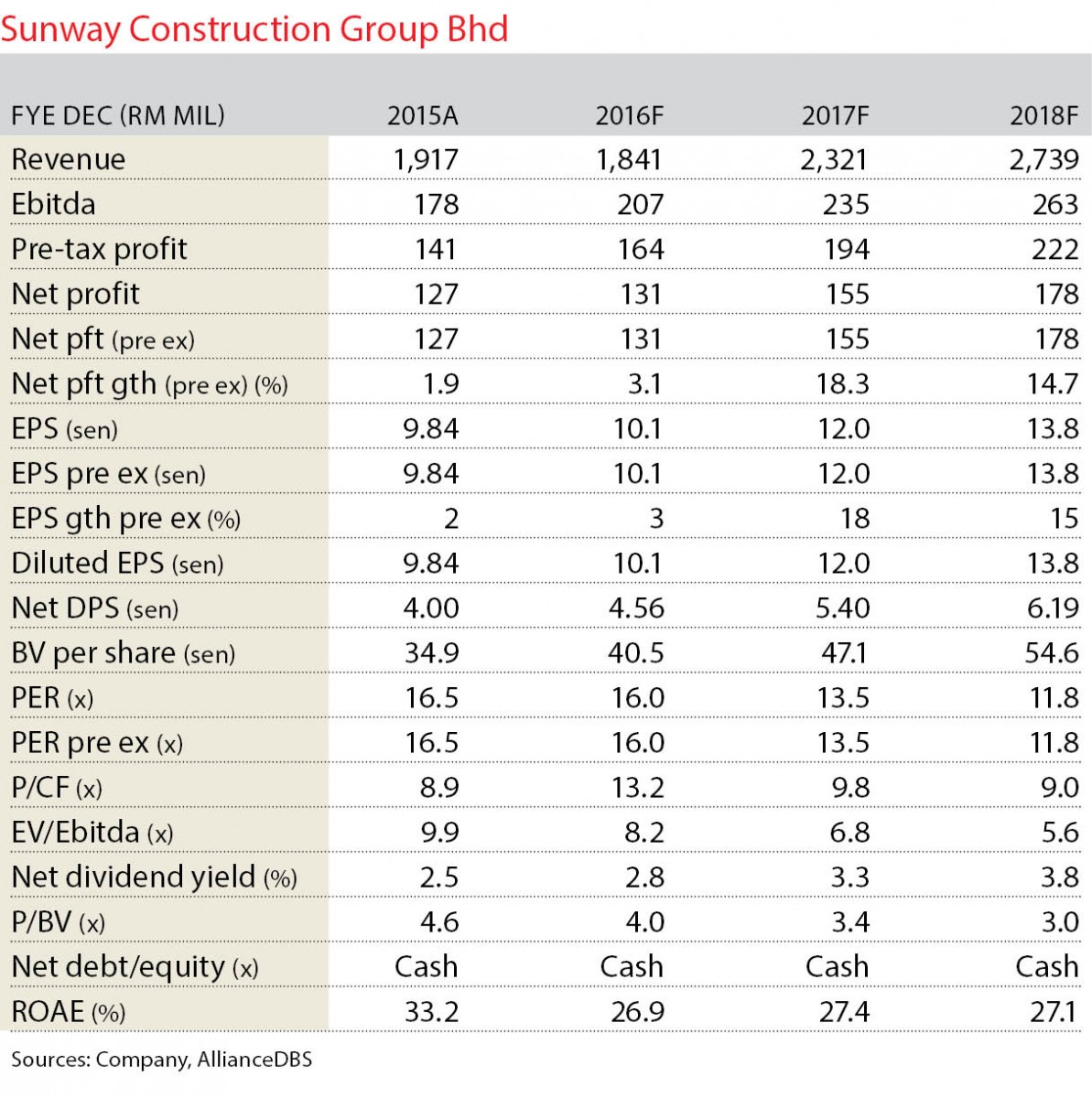

Maintain buy with an unchanged target price (TP) of RM1.92: Sunway Construction Group Bhd (SunCon) is the largest listed pure play construction company in Malaysia. Given its strong track record with mass rapid transit (MRT), light rail transit (LRT) and bus rapid transit (BRT) jobs previously, we are of the view that SunCon is on a strong footing to bag several key infrastructure packages such as the LRT3 and BRT as well as other infrastructure-related and building projects. SunCon has also established itself as the only construction specialist to be involved in all three Rapid Line infra projects (MRT, LRT and BRT). This makes the group one of the strongest contenders to win the pipeline of the 11th Malaysia Plan projects.

Its precast division is a strong proxy to the growing demand for Housing & Development Board residences in Singapore, where the government is targeting to build an additional 88,000 units of public housing from 2016 to 2019. With premium earnings before interest and tax margins recorded over the past few years, the business is return on equity-enhancing and also synergistic to its construction business. The completion of its third precast plant in Iskandar should give it ample capacity to cater for more orders, while also compensating for the eventual return of the Tampines plant.

Not one to rest on its laurels, SunCon will be bidding for LRT 3 (already pre-qualified), private and public sector building jobs, and the internal projects from the property arm of its holding company. With year-to-date wins reaching RM2.6 billion (including precast), it has exceeded its RM2.5 billion forecast this year where the more recent wins have been for internal jobs and MRT 2 advanced works.

Our TP is based on sum-of-parts (SoP) valuation to reflect the growing contribution from its high-margin precast business. While our SoP value is RM2.77 billion or RM2.14 per share, we have ascribed a 10% discount to arrive at our TP price of RM1.92.

The timely execution of its peak order book of RM5 billion is crucial to minimise the risk of any earnings cuts. With its strong execution track record and experience, we believe the group is able to execute the projects in a timely manner. — AllianceDBS Research, Nov 23

This article first appeared in The Edge Financial Daily, on Nov 24, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

ARA SENDAYAN @ BANDAR SRI SENDAYAN

Seremban, Negeri Sembilan

RIMBUN KIARA @ SEREMBAN 2

Seremban, Negeri Sembilan

Green Street Homes @ Seremban 2

Seremban, Negeri Sembilan

Suriaman 2, Bandar Sri Sendayan

Seremban, Negeri Sembilan

Semenyih Integrated Industrial Park

Semenyih, Selangor

Taman Senawang Perdana

Seremban, Negeri Sembilan

Desa Idaman, Taman Puchong Prima

Puchong, Selangor